on GEA Group Aktiengesellschaft (ETR:G1A)

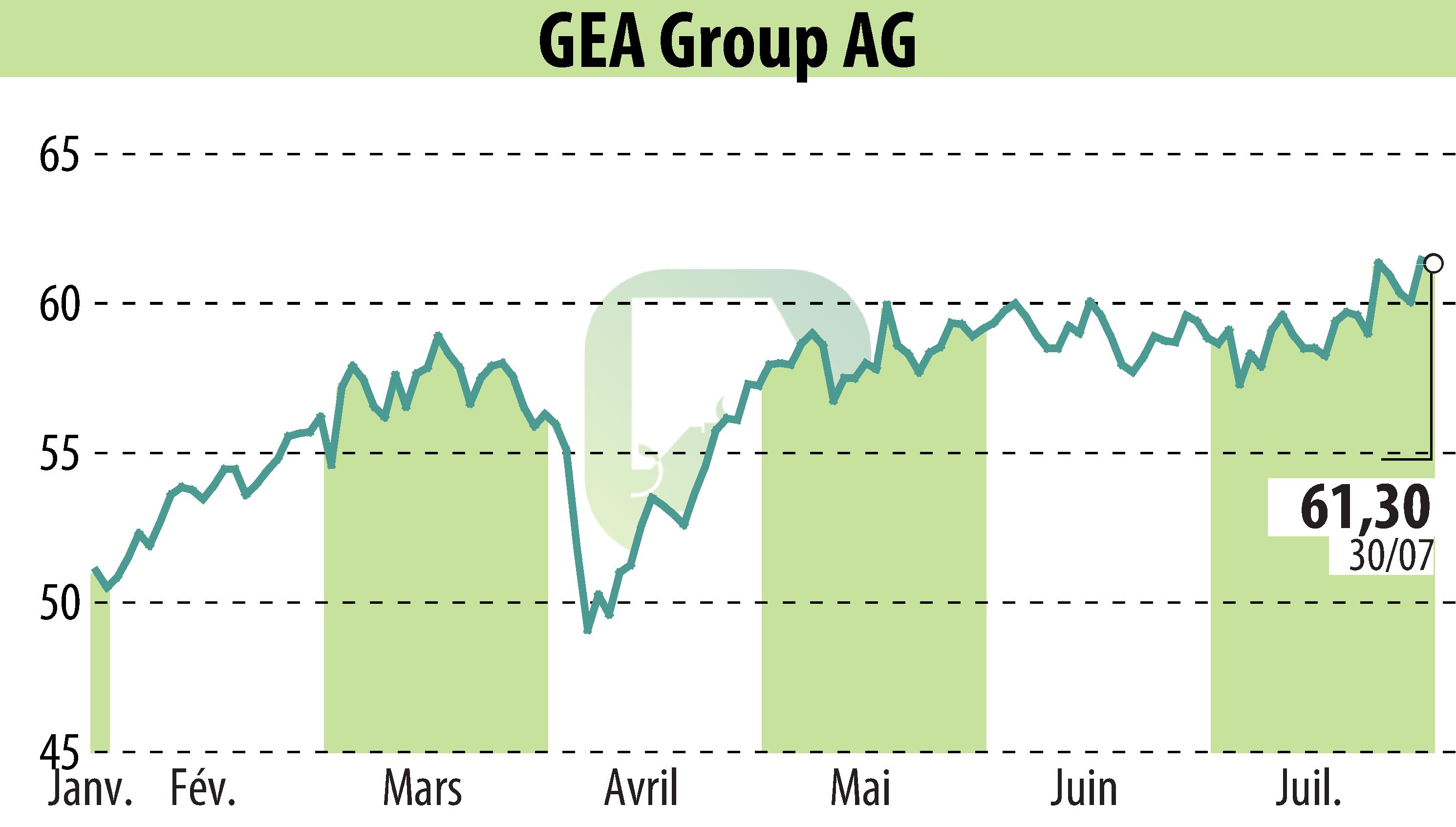

GEA Group Raises 2025 Forecasts Amid Strong Performance

GEA Group Aktiengesellschaft has increased its 2025 forecasts following a robust operational performance in the first half of the year. The Düsseldorf-based company now anticipates organic sales growth between 2% and 4%, up from a previous range of 1% to 4%. The EBITDA margin before restructuring expenses is expected to rise to 16.2%-16.4%, with ROCE projected at 34%-38%, higher than earlier estimates.

CEO Stefan Klebert credits the positive adjustment to a solid order book and efficiency gains across the group. Notably, a large order valued between EUR 140 million and EUR 170 million will be recorded in the second half of 2025. GEA anticipates accelerated revenue growth and enhanced profitability in 2026.

The company's preliminary second-quarter results show organic revenue growth at 1.5% compared to the previous year's 1.2%. EBITDA margin improved to 16.5%, marking a significant rise from 15.2% in Q2 2024.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEA Group Aktiengesellschaft news