on GEA Group Aktiengesellschaft (ETR:G1A)

GEA Group Sees Growth in Q2 2025, Boosts Annual Forecast

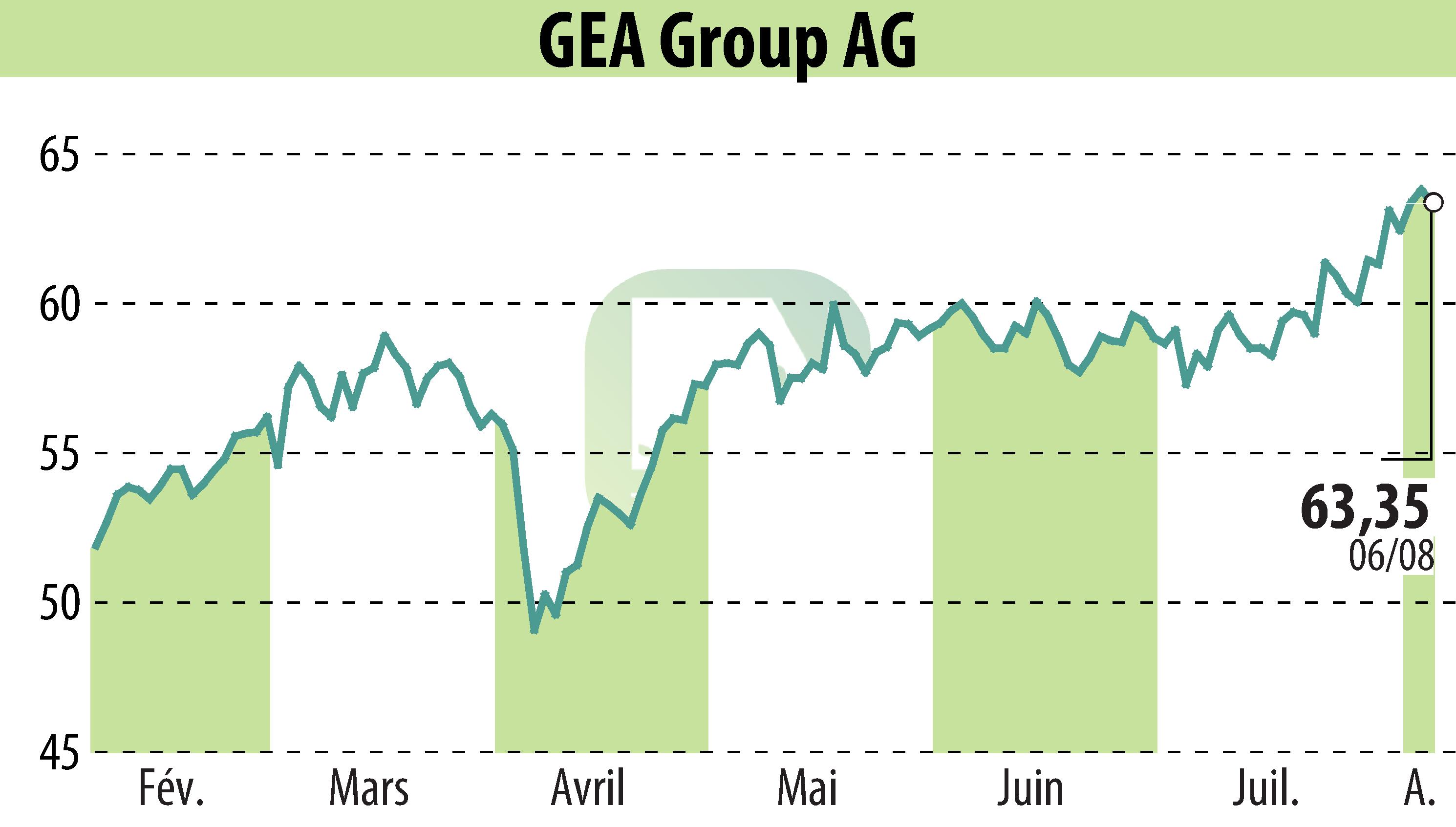

In Q2 2025, GEA Group reported a 1.5% increase in order intake, reaching EUR 1,309 million, underpinned by a 5.0% organic growth. Despite a 0.9% drop in revenue to EUR 1,312 million, organic revenue rose by 1.5%. The EBITDA before restructuring expenses improved by 8.1% to EUR 217 million, pushing the margin to 16.5% from 15.2%. Additionally, ROCE elevated to 35.3%, a notable rise from 32.3% in Q2 2024.

Given the positive outlook, GEA upgraded its 2025 guidance, anticipating organic revenue growth of 2-4%, an EBITDA margin of 16.2-16.4%, and a ROCE of 34-38%. A major order from Qatar’s Baladna Food Industries contributed to this optimism.

The company maintained solid liquidity with net debt at EUR 59.8 million by the end of June 2025. GEA's focus remains on leveraging its established market positions globally while mitigating competitive impacts.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEA Group Aktiengesellschaft news