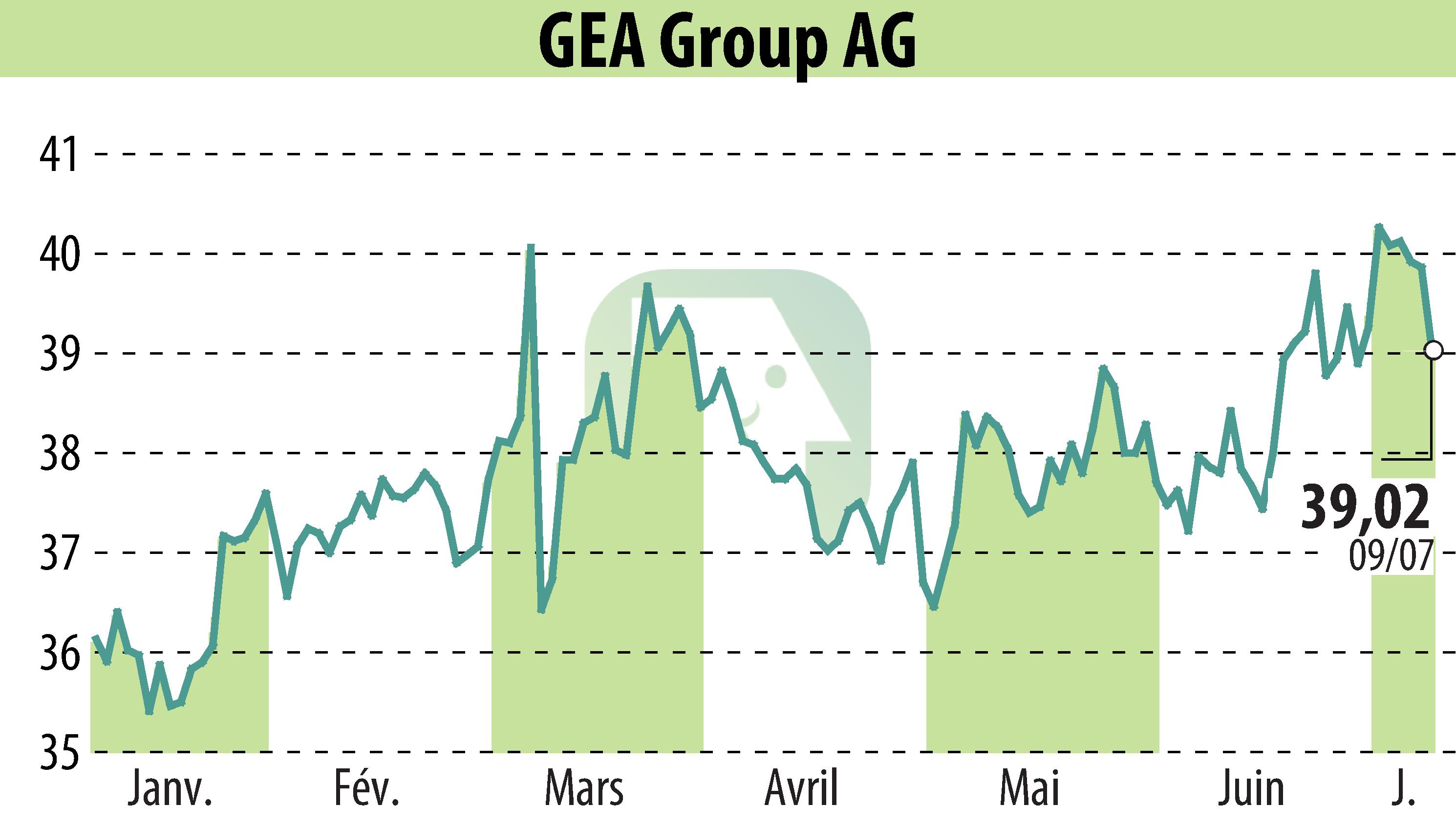

on GEA Group Aktiengesellschaft (isin : DE0006602006)

GEA Raises Forecast for EBITDA Margin and ROCE for Fiscal Year 2024

GEA Group Aktiengesellschaft has updated its forecast for the fiscal year 2024. Due to a strong performance in the first half of the year, GEA now expects an EBITDA margin between 14.9% and 15.2%, up from the previous range of 14.5% to 14.8%. The return on capital employed (ROCE) is also revised upwards to a range of 32.0% to 35.0%, compared to the earlier expectation of 29.0% to 34.0%. The company maintains its projection for organic revenue growth at 2.0% to 4.0%.

CEO Stefan Klebert expressed satisfaction with the positive developments, noting that GEA has already achieved its ambitious Mission 26 financial targets ahead of schedule. The company will outline its strategic goals up to 2030 at the Capital Markets Day on October 2, 2024. The full half-year financial report will be published on August 7, 2024.

Key preliminary financial figures indicate that GEA reported an EBITDA before restructuring expenses of 15.2% in Q2 2024, compared to 14.3% in Q2 2023. The company’s ROCE for the last four quarters stands at 32.2%. Sales have shown slight organic growth, although reported order intake has declined.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEA Group Aktiengesellschaft news