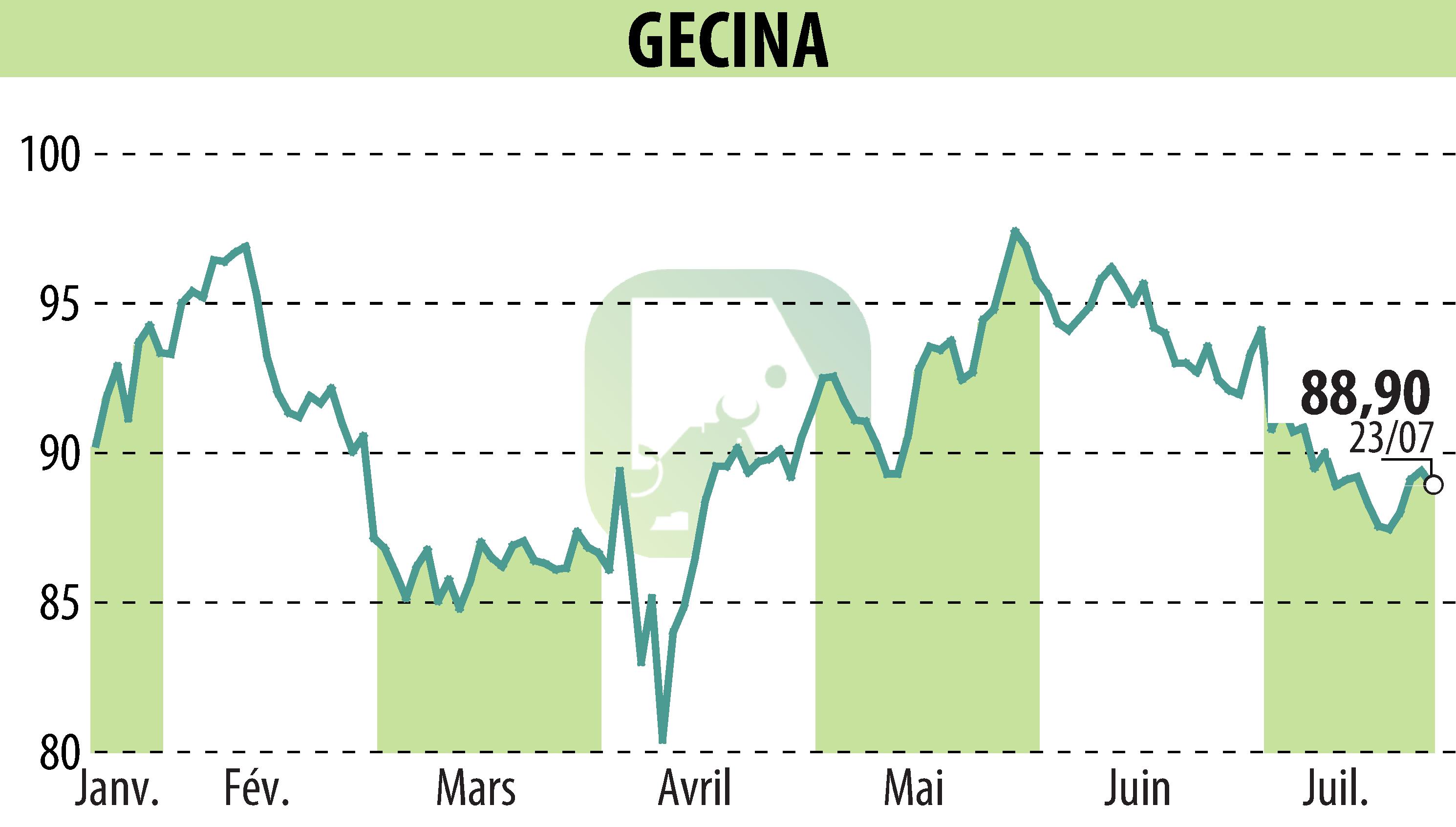

on GECINA (EPA:GFC)

Gecina launches a buyout offer and a new green bond issue

Gecina announced on July 24, 2025, the launch of a repurchase offer on its bonds maturing in 2027 and 2028. Simultaneously, the company plans a €500 million 10-year green bond issue. This transaction aims to optimize the maturity profile of its debt and strengthen its long-term financial visibility.

The existing bonds in question include €700 million maturing in 2027 and €800 million maturing in 2028, both with a coupon of 1.375%. Priority allocation of the new bonds could be granted to existing holders.

Gecina, rated A-, has €3.7 billion in liquidity and continues to proactively manage its financial structure. The success of the green bond issue will determine the tender offer, in accordance with the terms of the Tender Offer Memorandum published on this date.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GECINA news