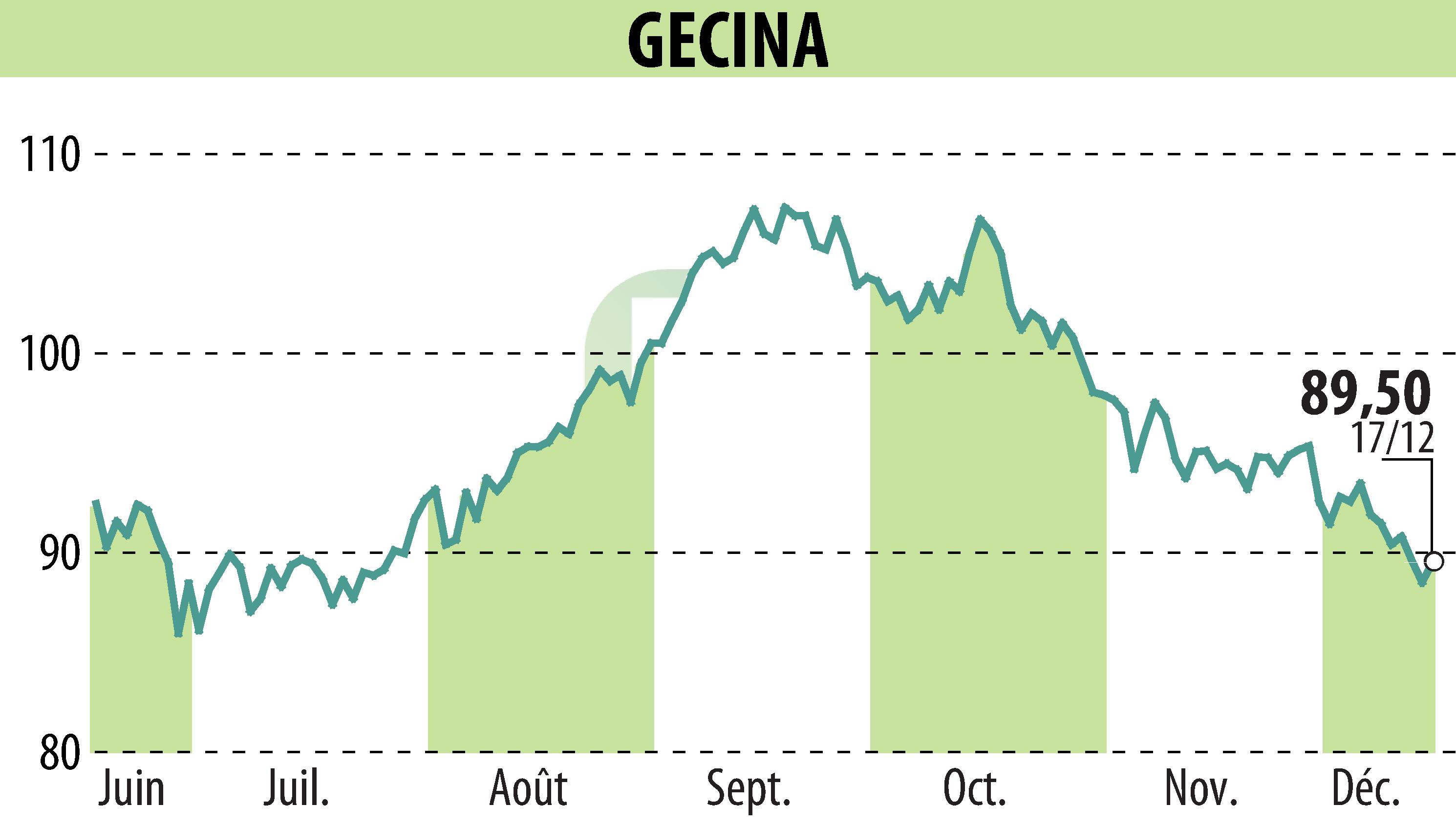

on GECINA (EPA:GFC)

Gecina: Sale of a student residential portfolio to Nuveen and GSA

Gecina has signed a firm commitment to sell its student residence portfolio to Nuveen Real Estate and Global Student Accommodation (GSA). This transaction includes 18 assets in operation, totaling nearly 3,300 beds, and 4 others under development. Valued at approximately €567 million, completion is expected in the first half of 2025.

The sale is the result of a competitive process involving various investors. Nuveen, an American investor, is partnering with GSA to enter the French market. Gecina will continue to support the buyer and Yugo, the operating partner, until the end of 2025.

This transaction will allow Gecina to strengthen its balance sheet and invest in other real estate projects. Gecina's assets, focused on innovation and accessibility, represent a portfolio of 3.5 billion euros.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GECINA news