on GEE Group Inc. (NASDAQ:JOB)

GEE Group Reports Fiscal 2025 First Quarter Results

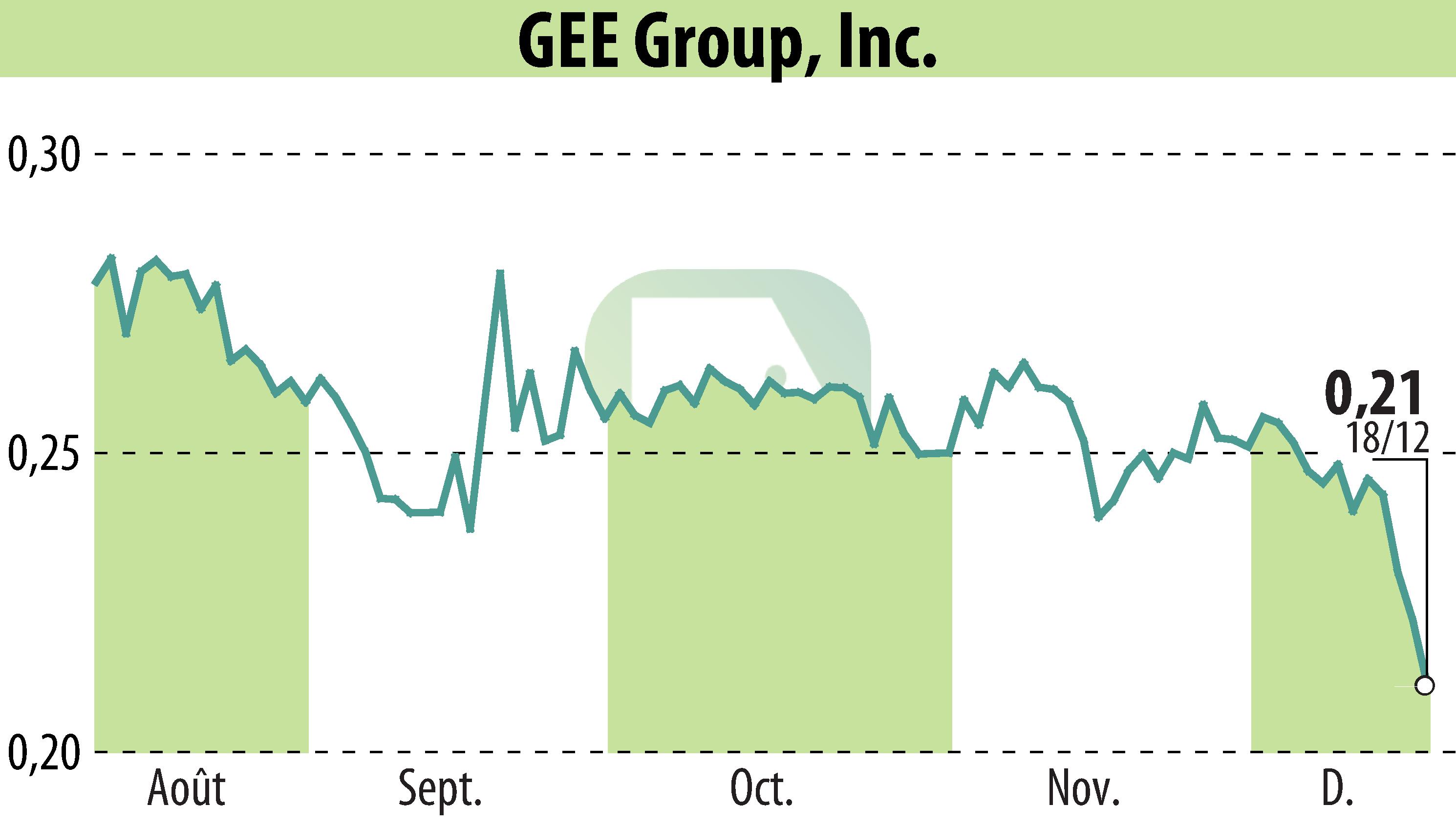

GEE Group Inc. announced its fiscal 2025 first-quarter results, highlighting a 15% decrease in revenues compared to the same period in fiscal 2024. The decline is attributed to reduced job orders amid a challenging macroeconomic environment, ongoing inflation, and uncertainty regarding potential recession risks. Consequently, consolidated revenues stood at $26 million, down from $30.6 million the previous year.

The company encountered a 14% drop in professional contract staffing services revenues and a 20% fall in industrial contract services revenues. Direct hire placement revenues also decreased by 18%. Gross profit decreased to $8.3 million from $9.7 million, while gross margin slightly increased due to changes in business mix.

SG&A expenses fell by 17% due to cost-cutting measures. Despite a net loss of $0.7 million, this reflects an improvement from the $1.6 million loss in the prior year. GEE Group retains a strong financial position with cash balances at $19.7 million and no long-term debt.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEE Group Inc. news