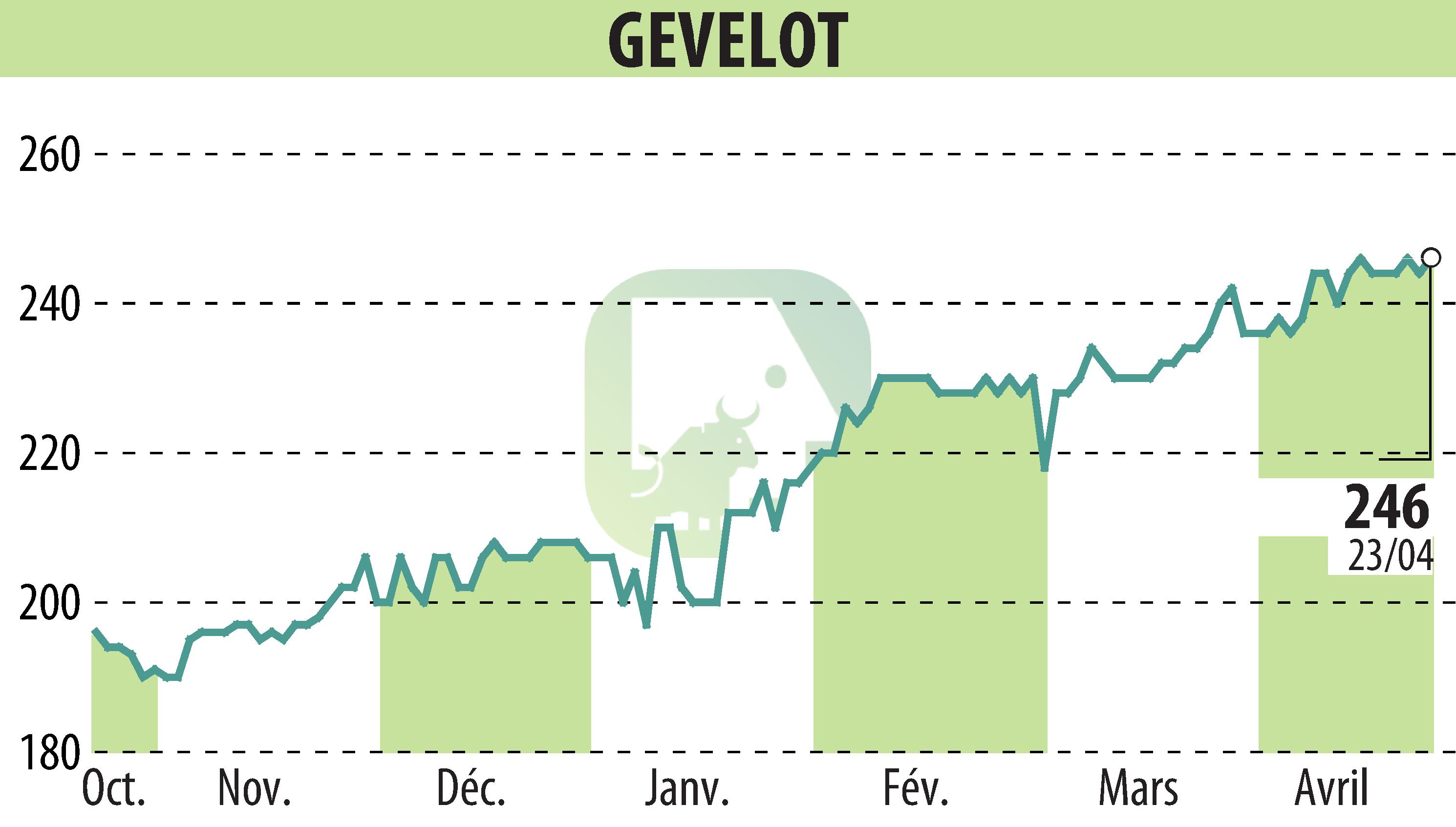

on GEVELOT (EPA:ALGEV)

Gévelot S.A. Reports Robust Financial Performance in 2023

Gévelot S.A. convened its Board of Directors to approve the 2023 financial results according to French and International Accounting Standards. The company posted a strong financial performance with the consolidated turnover growing to €151.2 million from €135.4 million compared to 2022, marking an 11.7% increase.

The company recorded significant growth in the Pumps Sector, contributing €16.0 million to the current operating income. Overall, Gévelot's operating income rose from €12.1 million in 2022 to €14.7 million in 2023. This growth impacts positive financial results, including a notable rise in interest rates contributing to a financial income of €4.0 million, a substantial improvement over the previous year's loss.

The consolidated net income for the company also saw a sharp increase from €8.5 million in 2022 to €13.7 million in 2023, with net profits attributable to the consolidating company reaching €13.3 million. Gévelot's real estate operations, however, reported a loss, reducing the overall operating income gains.

Furthermore, the company announced that its shareholders will be proposed a dividend of 5 euros per share during the upcoming General Meeting on June 6, 2024. This reflects the company's solid financial footing and its confidence in continued robust operations and profitability moving forward.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEVELOT news