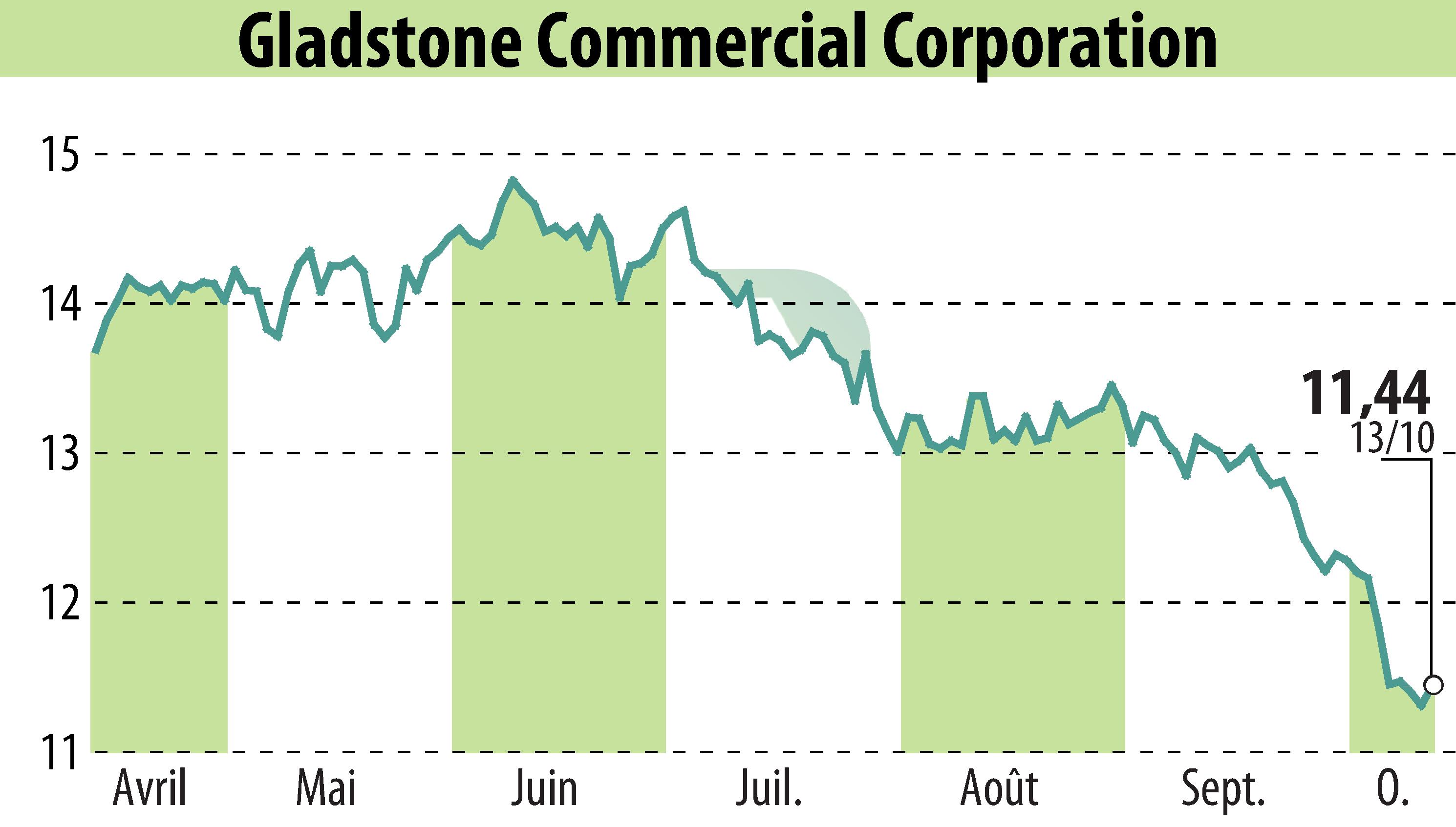

on Gladstone Commercial Corporation (NASDAQ:GOOD)

Gladstone Commercial Expands Credit Facility to $600 Million

Gladstone Commercial Corporation (Nasdaq: GOOD) has announced an amendment, extension, and upsize of its syndicated revolving credit and term loan facility. The total facility now amounts to $600 million, with a potential increase to $850 million. This adjustment includes a $50 million increase in the term loan component and a $75 million boost in the revolving credit facility. The modifications aim to support company growth and provide liquidity for future acquisitions and operations.

The revolving credit facility's maturity extends to October 2029, while Term Loans A and B mature in October 2029 and February 2030, respectively. The amendment also offers an option to extend Term Loan C until February 2029. Key Bank led the transaction as joint lead arranger alongside Bank of America, The Huntington National Bank, and Fifth Third Bank National Association.

The company expressed satisfaction with the support from its banking partners and the addition of new banks, emphasizing the facility's importance for ongoing growth.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gladstone Commercial Corporation news