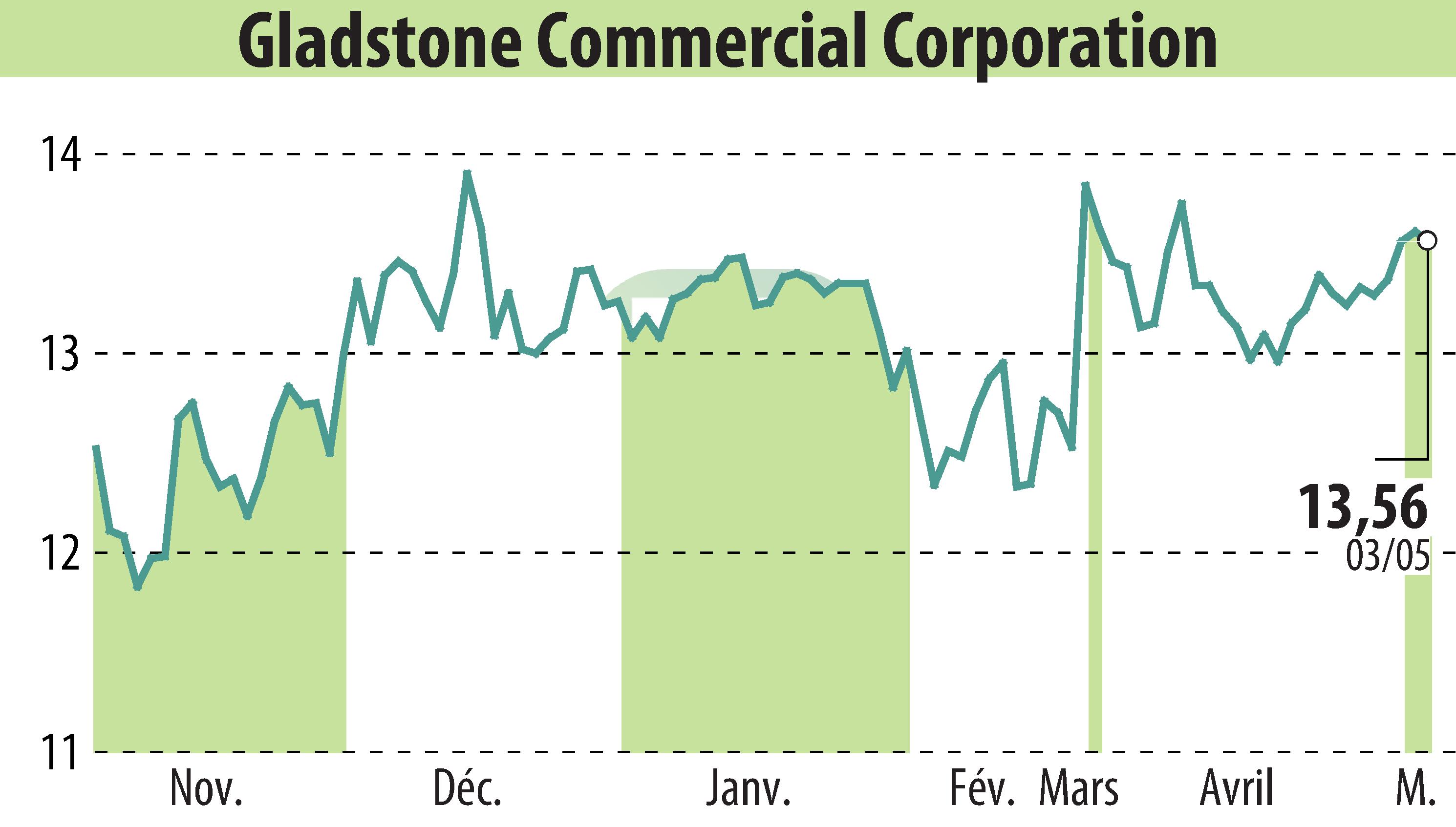

on Gladstone Commercial Corporation (NASDAQ:GOOD)

Gladstone Commercial Corporation Reports First Quarter 2024 Financial Results

Gladstone Commercial Corporation (Nasdaq: GOOD) announced its financial outcomes for the quarter ending March 31, 2024. The company reported a slight decrease in total operating revenue to $35,721 thousand, marking a 0.5% dip compared to the previous quarter. Meanwhile, total operating expenses significantly dropped by 17.1% to $23,315 thousand. Other expenses saw a substantial increase, surging 175.7% to $8,880 thousand.

Net income for the quarter stood at $3,526 thousand, a 22.5% decrease from December 2023. Consequently, net income available to common stockholders and Non-controlling OP Unitholders sharply fell by 77.1% to $306 thousand. Despite these declines, the company maintained a consistent monthly cash distribution per common share at $0.30. Furthermore, the quarter saw a collection of 100% cash rents and the sale of three non-core properties, generating $19.5 million.

Core funds from operations (FFO) also experienced decreases, totaling $13.9 million, down 4.5% from the previous quarter. This resulted mainly from an incentive fee recorded in March 2024 and minor increases in property expenses. Overall, the diluted core FFO per share remained at $0.34, reflecting the economic challenges and operational adjustments during the period.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gladstone Commercial Corporation news