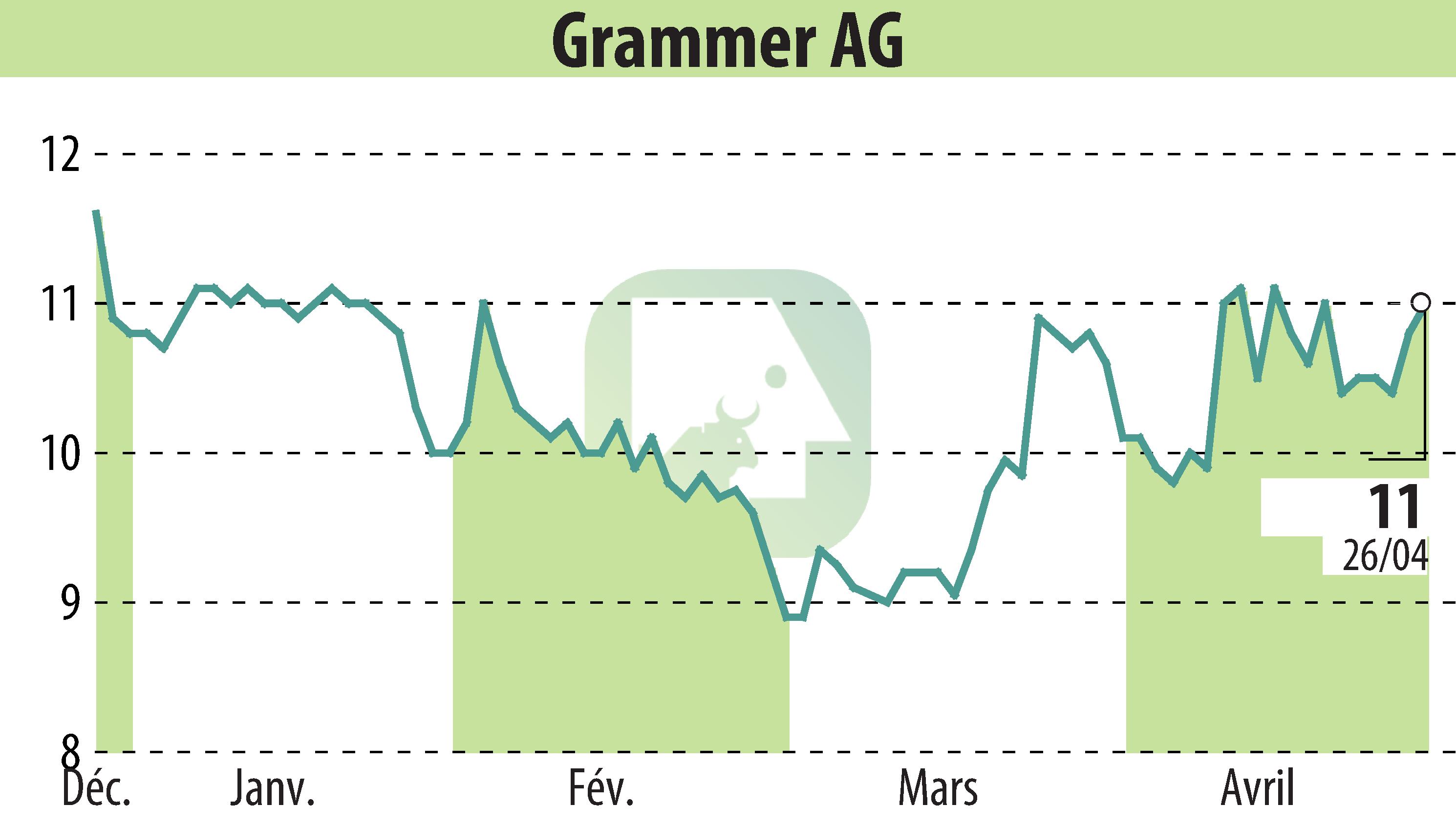

on Grammer AG (isin : DE0005895403)

GRAMMER AG Reports Decline in Q1 2024 Results

GRAMMER AG announced a 5.5% decrease in group revenue for Q1 2024, reaching EUR 556.6 million. The dip from EUR 589.1 million in Q1 2023 reflects weaker economic and industry conditions, particularly in the EMEA and APAC regions. The company also recorded a substantial decline in operating EBIT, from EUR 13.9 million in Q1 2023 to EUR 2.4 million this quarter. Nevertheless, GRAMMER confirmed its revenue forecast for 2024 to remain on par with the previous year, with an anticipated improvement in profitability.

Regional performance varied, with revenue in EMEA and APAC particularly affected by economic uncertainties, leading to significant revenue drops in these markets. Despite these challenges, APAC saw a slight improvement in revenue, attributed to the automotive sector. The AMERICAS region maintained a stable revenue figure of EUR 159.9 million. Additionally, the company's free cash flow improved markedly to EUR 40.2 million, up from EUR 8.7 million in the prior year's same quarter, mainly due to better working capital management.

GRAMMER also highlighted the implementation of its "Top 10 Measures" program aimed at improving profitability and efficiency across its operations. This initiative is critical as the company navigates through the economic cooldown and aims for a stronger performance in the latter half of the year.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grammer AG news