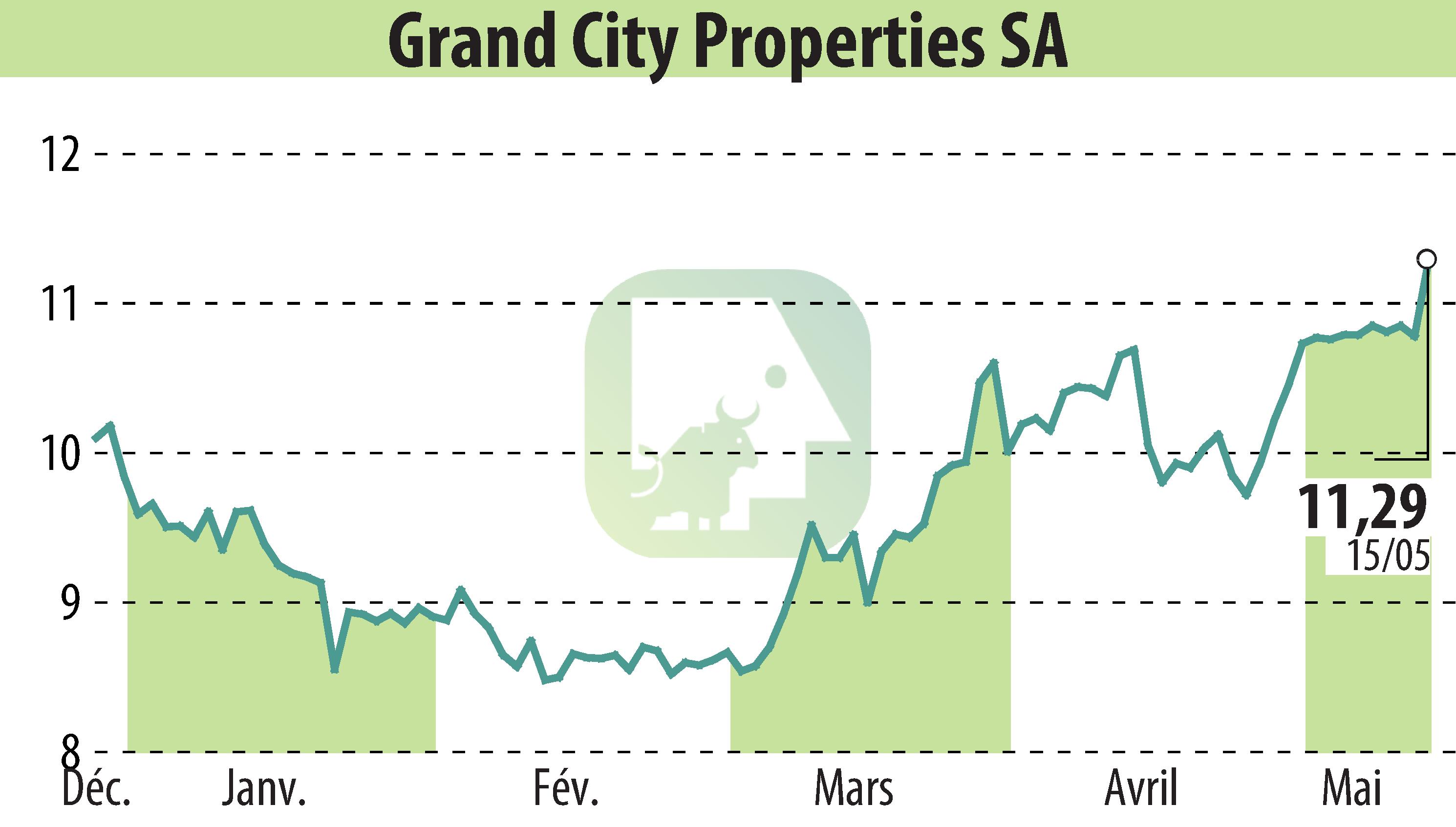

on Grand City Properties S.A., (isin : LU0775917882)

Grand City Properties S.A. Reports Positive Start to 2024 WithIncreased Financial Performance

Grand City Properties S.A. disclosed a successful first quarter in 2024, with net rental income rising by 4% to reach €105 million, compared to €101 million in the same period the previous year. The company attributes the increase to solid like-for-like rental growth. Adjusted EBITDA also saw a growth of 3%, amounting to €82 million. Despite the positive figures, FFO I experienced a slight decline of 4%, primarily due to higher perpetual notes attribution.

The financial stability of the company is underlined by a strong liquidity position, with €1.3 billion in cash and liquid assets, covering debt maturities until the end of 2026. The company's conservative financial approach is reflected in a stable LTV of 36%. Furthermore, in April 2024, Grand City Properties successfully negotiated a perpetual notes exchange, which was met with a high acceptance ratio of 82%.

Overall, the company confirms its full year 2024 financial guidance, suggesting confidence in continued strong performance. These operational successes and strategic financial management practices highlight Grand City Properties’ proactive approach to growth and stability in a fluctuating market.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news