on GROUPE CRIT (EPA:CEN)

Groupe CRIT Announces Solid Annual Results for 2023

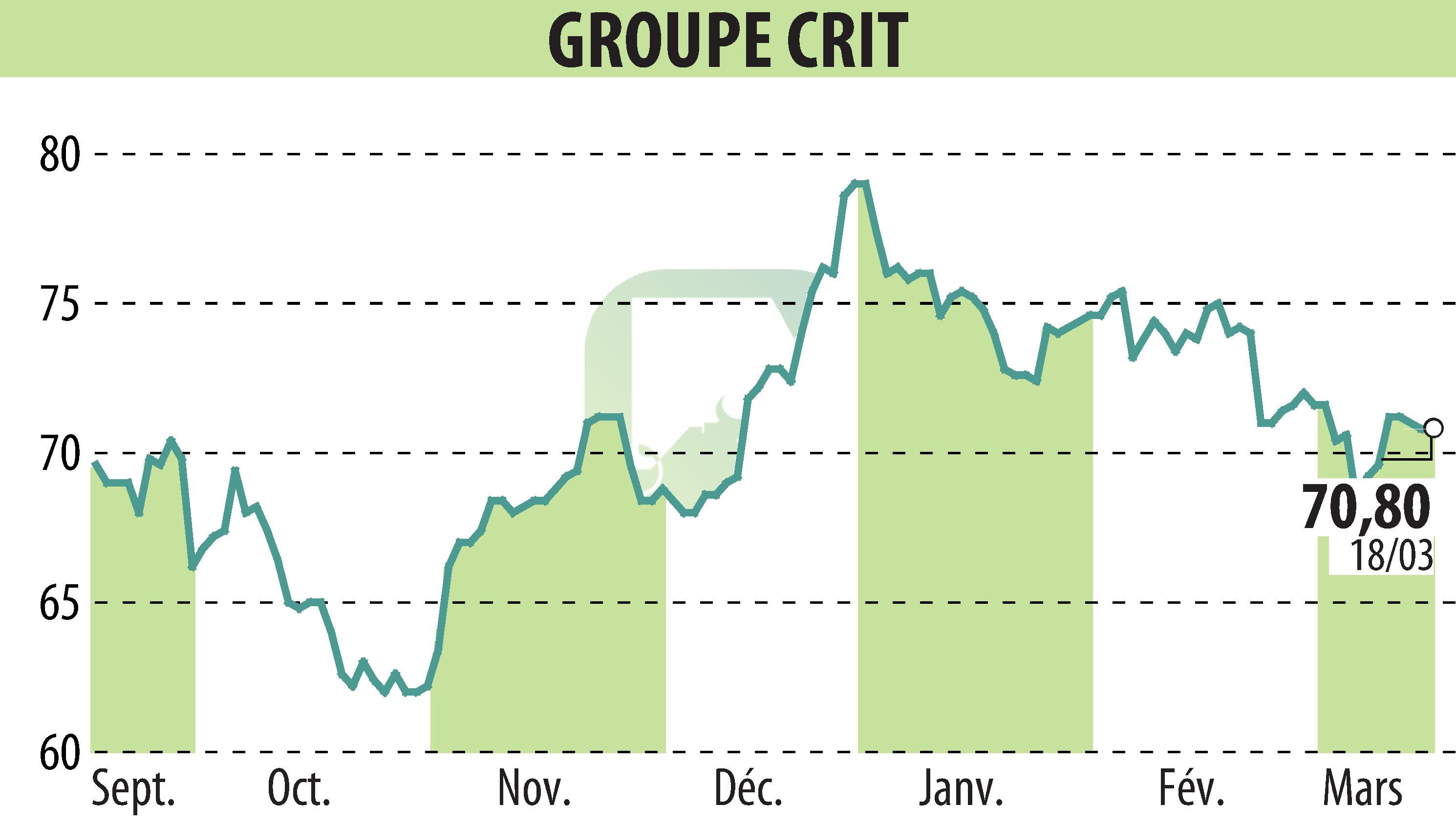

Groupe CRIT, a significant entity in the realms of temporary employment and airport assistance both domestically and internationally, unveiled its financial results for 2023. With a revenue of €2.536.1 billion, the company observed an increase of 8.5% from the previous year. This growth, attributed to all sectors of the group's operations, signals a robust commercial trajectory. Notably, the temp work division, accounting for 81.2% of total activity, experienced a 7% rise in turnover, marking achievements in both domestic and global markets.

Internationally, Groupe CRIT saw remarkable growth of 23.3% in its temporary work turnover, partly due to the acquisition of the Swiss firm OK Job. Meanwhile, the multiservice division reported a 14.6% increase in turnover, with airport activities up 14.9%, indicating a recovery surpassing pre-pandemic levels. The overall financial performance also improved, with net profits up by 6% to €75.2 million, and a fortified financial position evidenced by the net cash of €382 million.

Looking into 2024, despite a slow start in the temporary work sector and optimistic forecasts in airport activities, Groupe CRIT remains positive. Furthermore, the group's international footprint is set to expand through the acquisition of a majority stake in OPENJOBMETIS, aiming to strengthen its position in the global temporary work market and project annual turnover beyond €3.3 billion.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GROUPE CRIT news