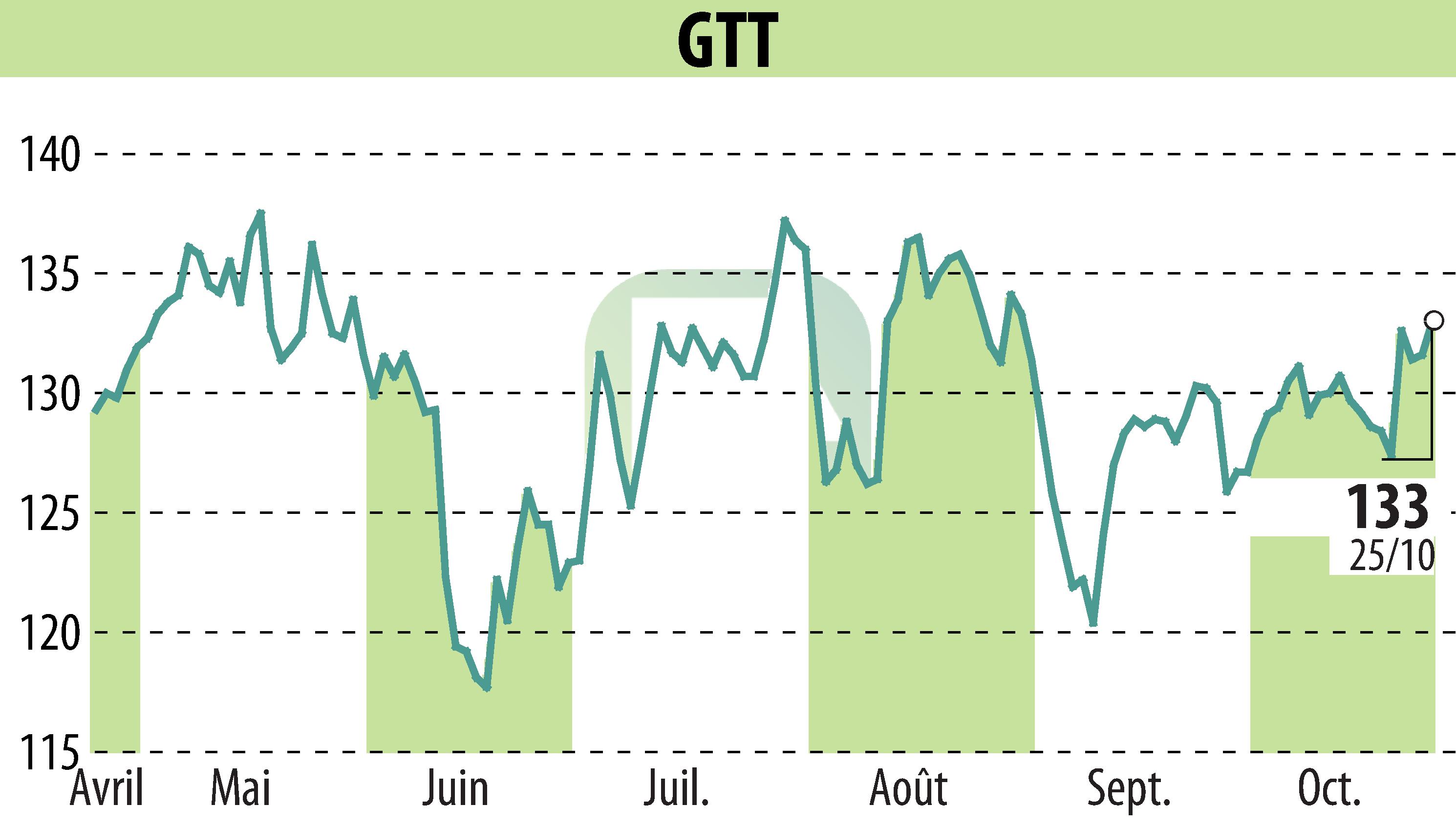

on GTT (EPA:GTT)

GTT's financial performance continues to grow in 2024

GTT reported revenues of €464.7 million for the first nine months of 2024, marking a 54.9% increase compared to the same period in 2023. This increase is mainly attributed to strong demand for LNG carriers, with 68 new orders. The company also received orders for 12 ethane carriers, 1 FSRU and 1 FLNG.

Innovation remains at the heart of GTT’s strategy, with several approvals for new technologies. Notably, developments in the liquid hydrogen and alternative fuels sectors have been approved.

The turnover of the Elogen subsidiary, specializing in electrolysers, remains stable despite a difficult market. GTT has also expanded its digital services and solutions for the smart maritime sector.

The company expects to end 2024 at the top end of its financial guidance despite increased competition, primarily from Chinese containment technologies.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GTT news