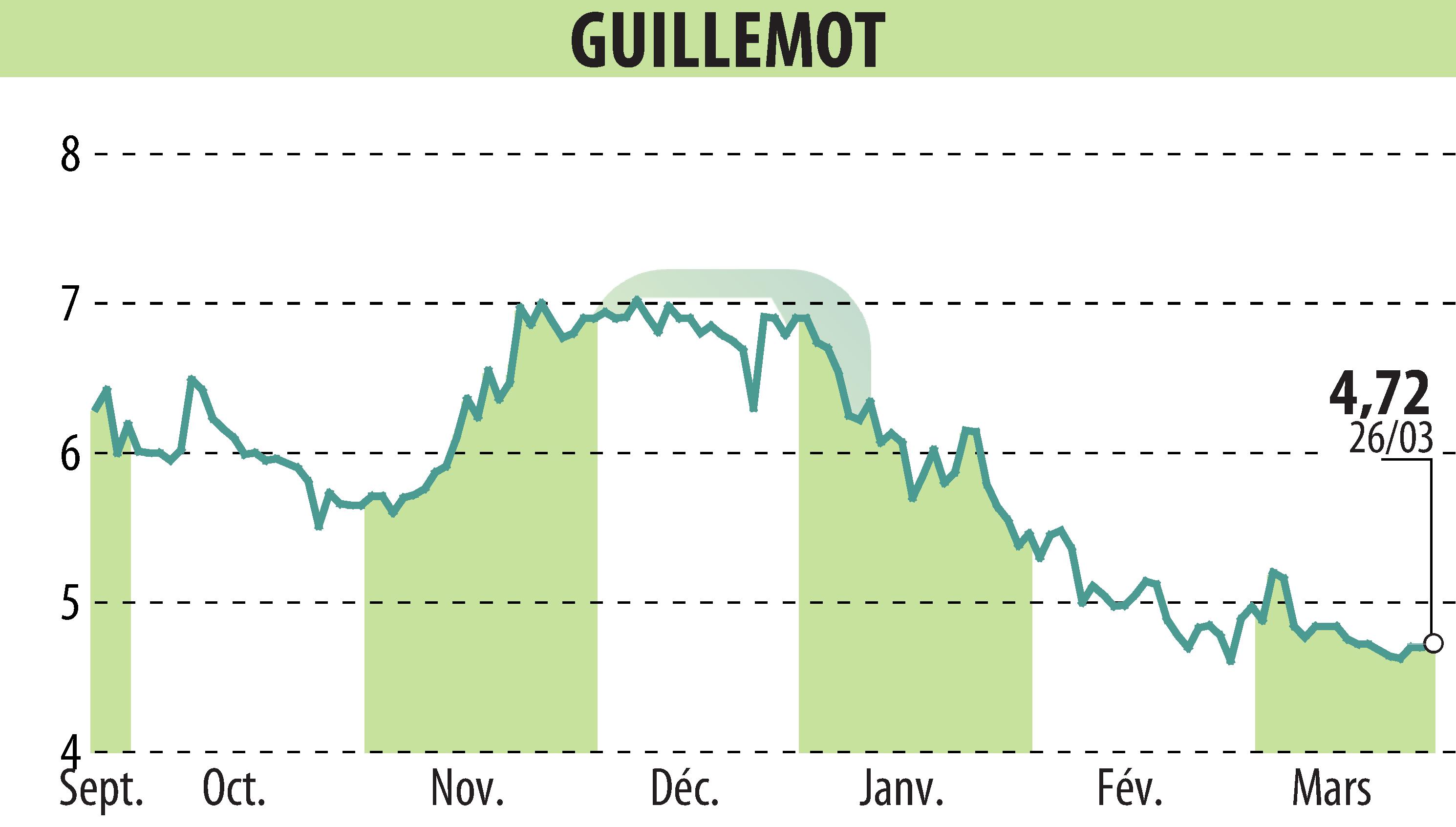

on GUILLEMOT (EPA:GUI)

Guillemot Corporation: a difficult year in 2023 but encouraging prospects for 2024

Decline in turnover and results in 2023, but a return to growth expected in 2024

By Roger HERRMANN - The annual turnover of Guillemot Corporation stands at 119.1 million euros in 2023, a decrease of 37% compared to the previous year. Current operating profit amounts to 2.5 million euros, down 93% compared to 2022. Consolidated net profit is 1 million euros, down 95% compared to 2022.

These results are partly explained by high inventory levels among the group's customers, following excessively high sales expectations. The group has therefore accelerated its promotional actions to reduce its customers' stocks, which are now at balanced levels.

The gross accounting margin rate fell by 5 points compared to last year to stand at 49% for 2023, in an inflationary and very competitive context. However, the group was able to re-establish gross accounting margin rate levels higher than those of the fourth quarter of 2022.

In 2024, the group is focusing its efforts on developing new offers, expanding its ranges in its classic segments and strengthening its commercial strategy in the APAC region and the Middle East. The group expects a return to growth for the 2024 financial year and a positive operating result.