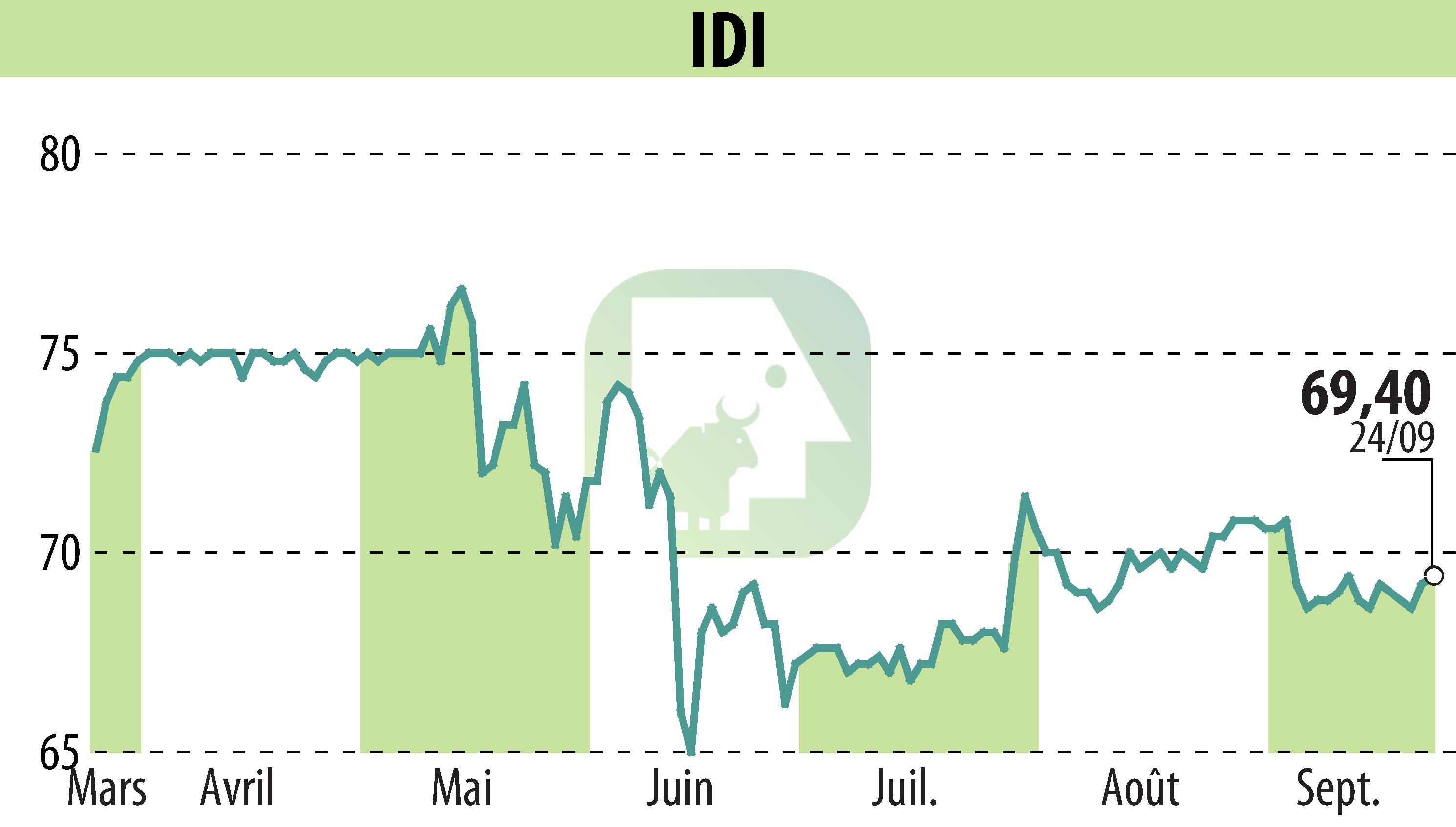

on IDI (EPA:IDIP)

Half-year results 2024: IDI maintains the stability of its NAV and displays consolidated equity of €700 million

Private equity player IDI announces solid half-year results for 2024. NAV per share reached €92.35 as of June 30, 2024, showing slight growth of 0.53% compared to the end of December 2023. This performance highlights the group's resilience in an uncertain economic and political context.

The group has €700 million in consolidated equity and a significant investment capacity of €335.7 million. The strength of its balance sheet allows IDI to seize various opportunities on the market.

During the first half of 2024, the investment team maintained a high level of activity. In particular, IDI took a majority stake in Exsto and the Talis Group acquired the Aston school. These acquisitions illustrate the group's external growth strategy.

IDI remains committed to ESG initiatives, strengthening its positive impact and transparency. The company also continues its efforts to improve the quality of work life of its employees.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all IDI news