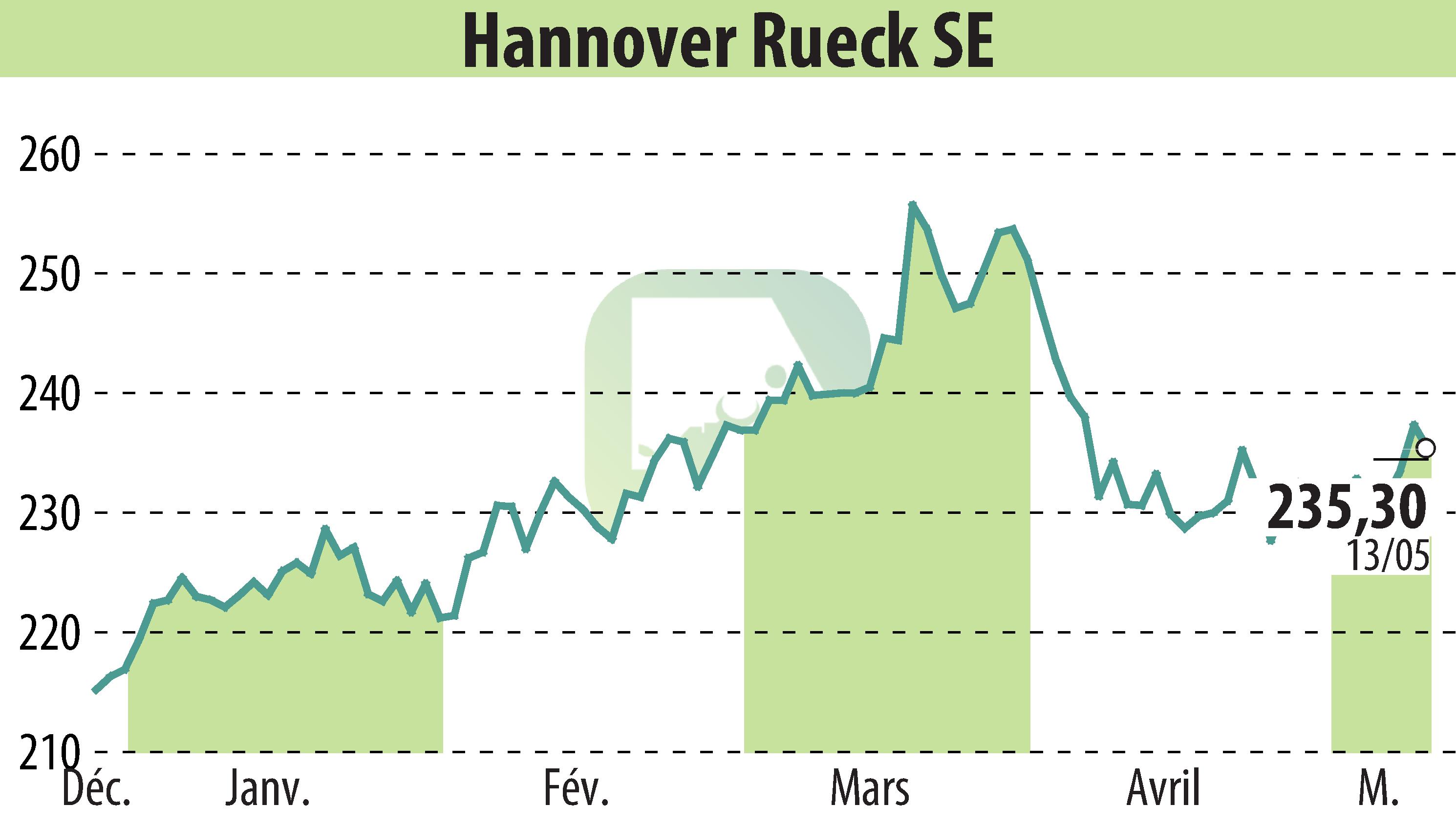

on Hannover Rück SE (isin : DE0008402215)

Hannover Re Reports a 15% Increase in Quarterly Net Income

Hannover Re announced a significant 15% growth in group net income for the first quarter, reaching EUR 558 million. This growth aligns with their 2024 full-year financial guidance. The reinsurance giant has reported a rise in both property and casualty as well as life and health reinsurance revenues, with total reinsurance revenue increasing to EUR 6.7 billion.

Despite the complexities of the global economic landscape, Hannover Re has managed exceptional handling of large losses in property and casualty reinsurance, staying well within budgeted expectations. Life and health reinsurance also performed as anticipated, backed by strong demand in financial solutions and longevity risk protection.

The company's return on equity improved to 21.3%, while their investment portfolio exceeded expectations with a 3.3% return on investment. Hannover Re CEO Jean-Jacques Henchoz expressed optimism about maintaining profitability through ongoing treaty renewals and robust demand for high-quality risk protection.

Hannover Re reaffirmed its 2024 outlook, forecasting over 5% growth in reinsurance revenue, leveraging stable market conditions and robust pricing strategies from recent renewals. The firm remains focused on its core reinsurance services while anticipating modest growth in asset portfolios and a sustained return from investments.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hannover Rück SE news