on Hawesko Holding AG (ETR:HAW)

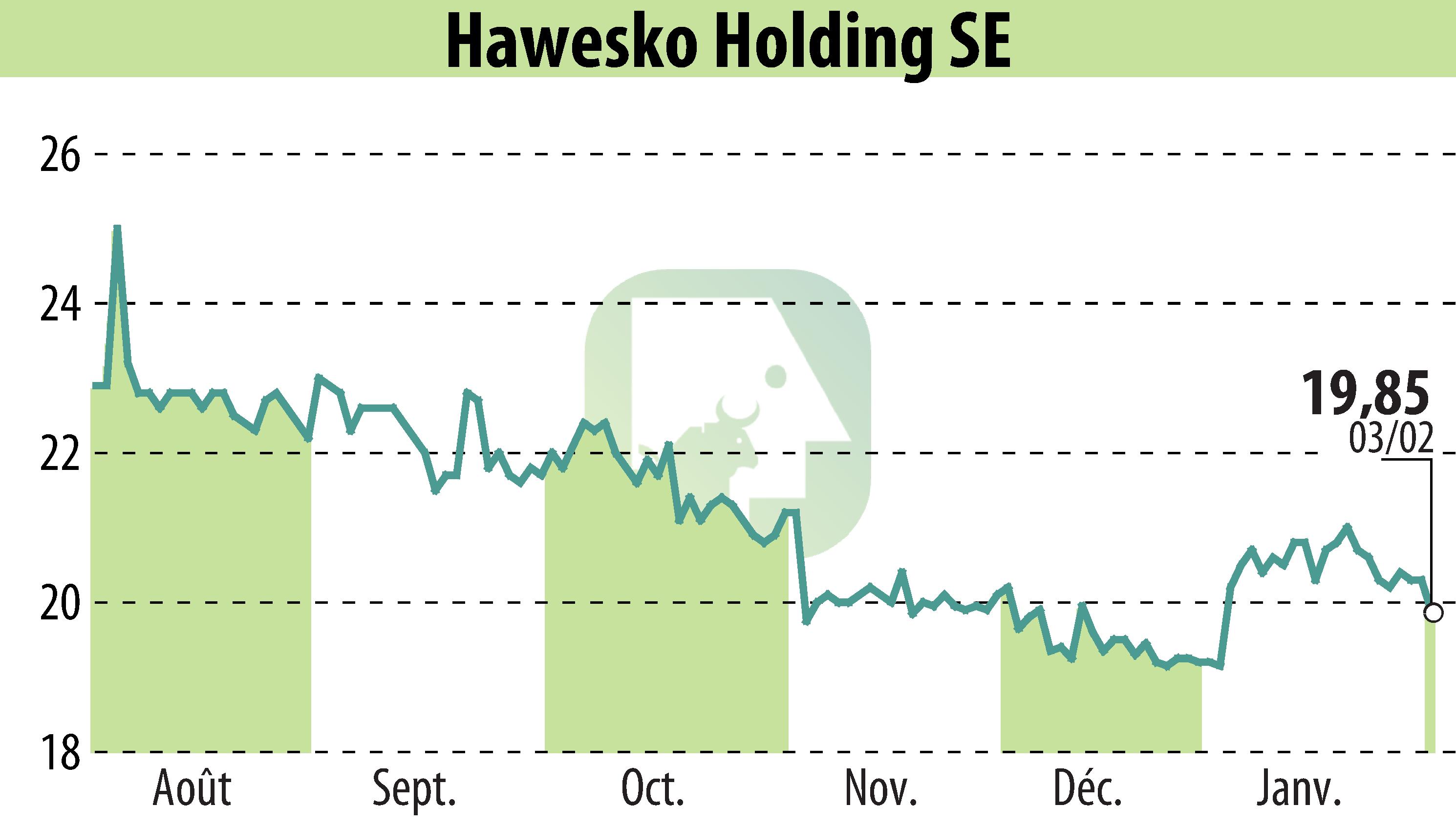

Hawesko Holding SE Demonstrates Resilience in 2025

In 2025, Hawesko Holding SE recorded consolidated sales of €622 million and an EBIT of €26 million. Despite a challenging market, the Hamburg-based wine trading group outperformed the overall industry, with a modest 3% sales decline compared to the market's 6% drop.

The B2B segment saw sales grow to €203 million, marking a slight increase, while the brick-and-mortar and e-commerce segments experienced decreases. The EBIT margin remained close to the previous year's level at 4.1%.

Hawesko attributes this performance to their proactive cost and efficiency program initiated in 2025. The program, featuring innovative marketplace models and AI-driven advertising, is expected to positively impact earnings from 2026 onward.

CEO Thorsten Hermelink expressed confidence in leveraging their strong cash flow and cost structure to take advantage of new opportunities in Germany and Europe.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hawesko Holding AG news