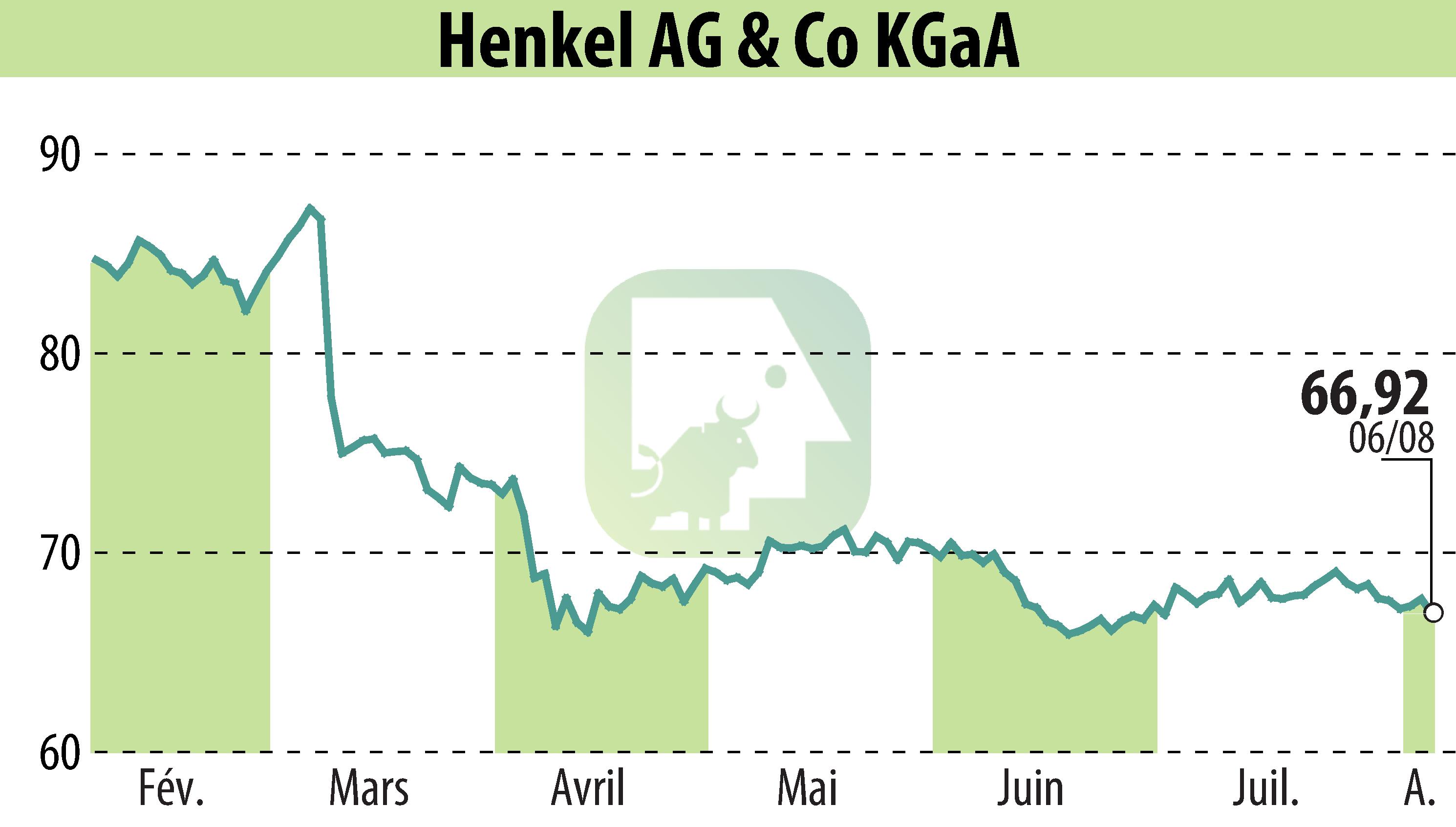

on Henkel KGaA (ETR:HEN3)

Henkel Foresees Profitable Growth Amidst Challenging Conditions

Henkel KGaA anticipates continued profitable growth for fiscal 2025, with an accelerated sales expansion in the first half of the year. The company reported organic sales at a steady 10.4 billion euros, with a positive quarterly growth of 0.9%. Operating profit rose marginally by 0.2%, reaching 1,614 million euros, and the EBIT margin improved to 15.5%.

The company revised its fiscal 2025 outlook, forecasting organic sales growth between 1.0% and 2.0%, adjusting expectations in response to macroeconomic challenges. Henkel remains optimistic about strengthening its gross margins and the cumulative benefits of portfolio enhancements.

Henkel's business units saw mixed results. Adhesive Technologies experienced a 1.2% organic growth with notable expansion in the Mobility & Electronics sector. In contrast, Consumer Brands faced a sales decline of 1.6%, primarily in North America and Europe.

Henkel CEO Carsten Knobel emphasized improved profitability and ongoing investments in innovation. The company continues to push its Purposeful Growth Agenda, focusing on resilience amid prevailing market conditions.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Henkel KGaA news