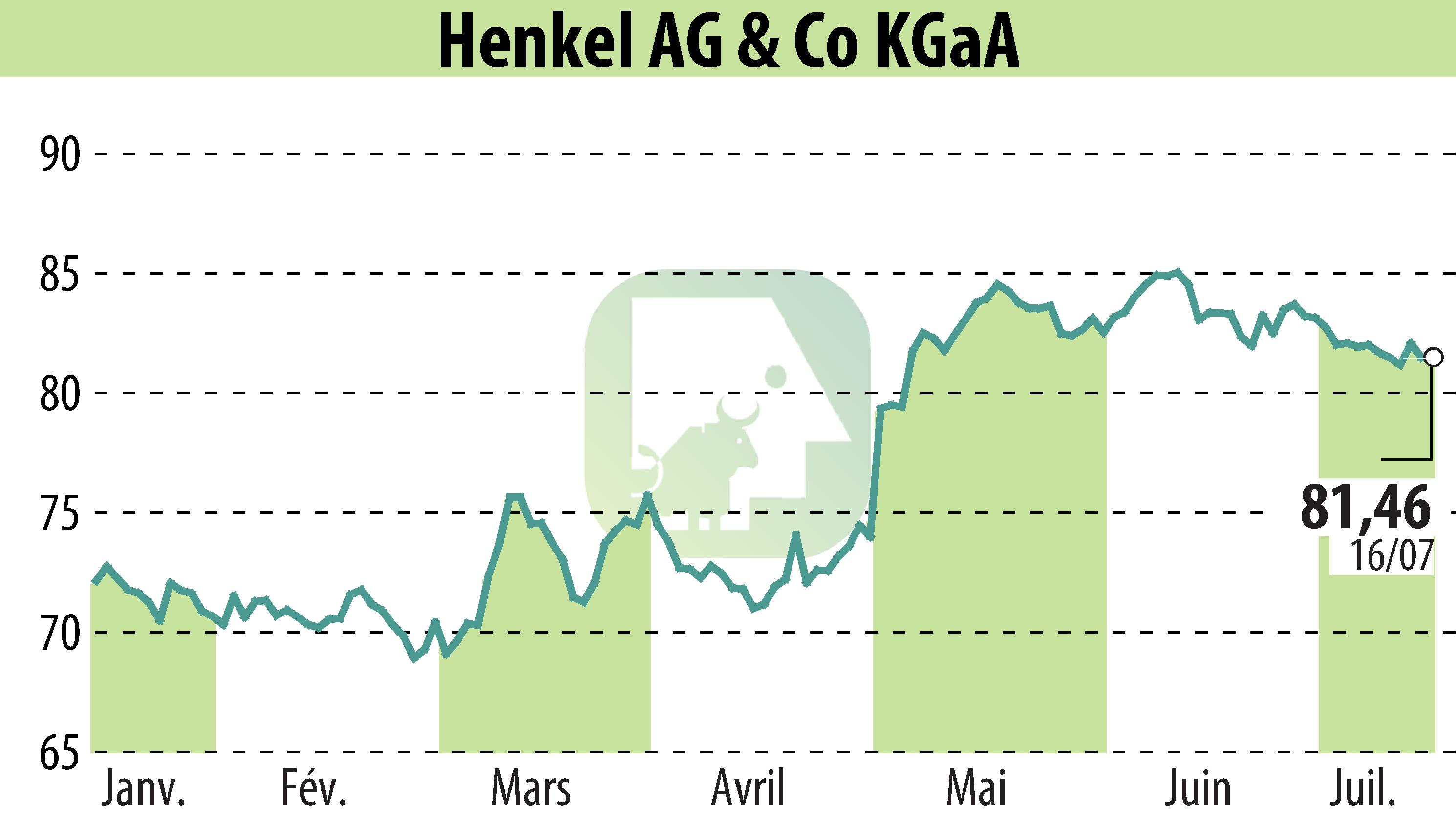

on Henkel KGaA (isin : DE0006048432)

Henkel Reports Strong H1 2024 Performance and Raises Earnings Outlook

Henkel AG & Co. KGaA has reported robust business performance for the first half of 2024, surpassing market expectations. The company also raised its earnings outlook for the full year, driven by better-than-expected performance in its Consumer Brands unit. Key contributing factors include higher adjusted return on sales and adjusted earnings per share.

Preliminary figures indicate that Henkel generated sales of €10,813 million, reflecting an organic sales growth of 2.9%. Adjusted operating profit rose by 28.4% to €1,610 million, while adjusted earnings per preferred share increased by 32.9% to €2.78. The Adhesive Technologies unit showed an organic sales growth of 2.0%, while the Consumer Brands unit saw a 4.3% growth.

The company now forecasts an adjusted return on sales between 13.5% and 14.5%, and an increase in EPS ranging from 20% to 30% at constant exchange rates. This updated outlook accounts for anticipated higher prices for direct materials in the latter half of the year.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Henkel KGaA news