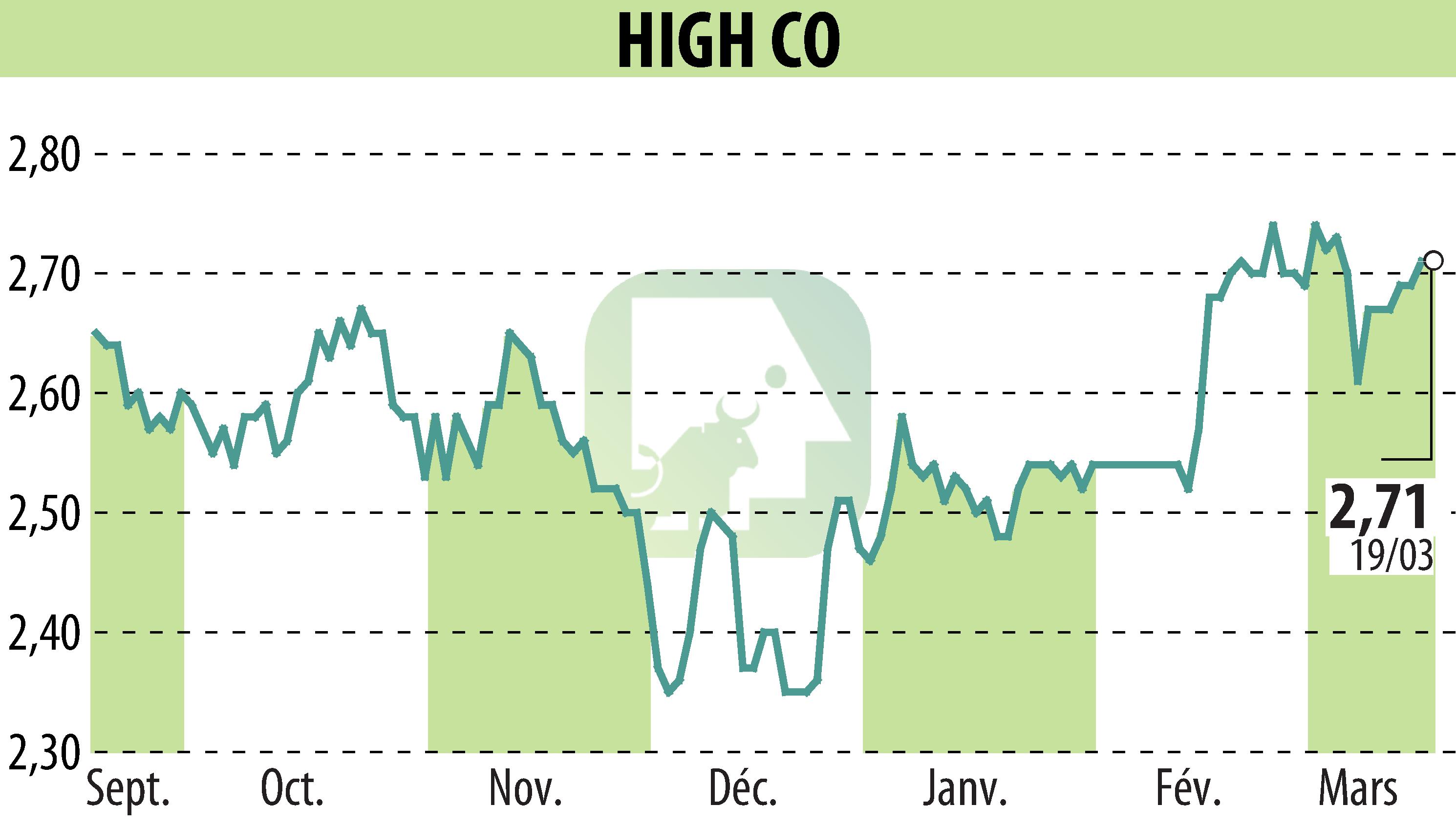

on High Co (EPA:HCO)

HighCo: Sale of High Connexion with a view to a Strategic Reorientation

On March 19, 2025, HighCo announced the signing of a memorandum of understanding for the sale, subject to conditions precedent, of its subsidiary High Connexion. The sale is being made to a group of investors including Albarest Partners and Guillaume Guttin. High Connexion, a specialist in mobile marketing and payment solutions, is 51% owned by HighCo and is located in Oullins.

This sale is part of HighCo's strategy to refocus its activities on its key divisions: Activation and Agencies & Sales. In 2024, High Connexion generated a gross margin of €8.65 million and revenue of €60.18 million, representing 12.5% and 41.1% of HighCo's consolidated totals respectively.

HighCo expects to complete the sale by June 30, 2025. The proceeds from the sale could allow for an exceptional distribution of €1.00 per share. Detailed impacts on financial results will be communicated on March 26, 2025.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all High Co news