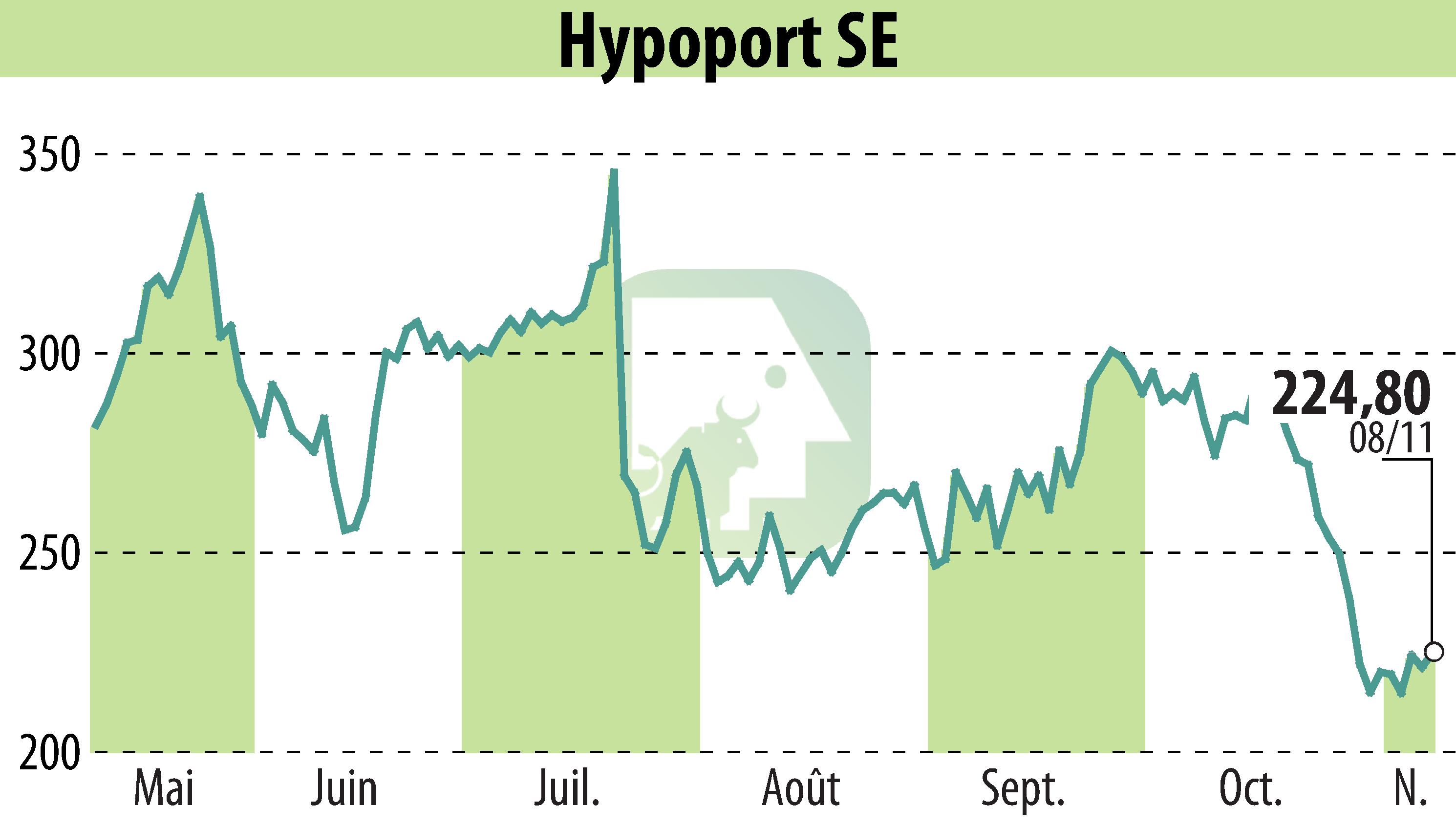

on Hypoport AG (isin : DE0005493365)

Hypoport Achieves Solid Nine-Month Earnings Despite Challenges

Hypoport AG reported a 24% year-on-year revenue increase to €332 million for the first three quarters of 2024, despite difficult market conditions. This was driven by a significant recovery in their mortgage finance business. Gross profit rose by 11% to €170 million, and EBIT returned to nearly €12 million after previous losses. The Real Estate & Mortgage Platforms segment saw a 36% revenue rise, bolstered by increased transaction volumes and consumer confidence in property prices stabilizing.

In the Financing Platforms segment, revenue grew by 6% to €54 million. This growth was modest due to rigid lending policies and slow market movement, although notable gains were seen in the housing industry subsegment. The Insurance Platforms segment reported a 3% revenue increase, continuing steady progress in portfolio migration.

CEO Ronald Slabke highlighted the recovery in mortgage finance as a fundamental element for future growth, stating this aligns with their full-year EBIT forecast of €10-20 million.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hypoport AG news