on Hypoport AG (ETR:HYQ)

Hypoport SE Reports Doubling of EBIT Amid Adjusted Forecast for 2025

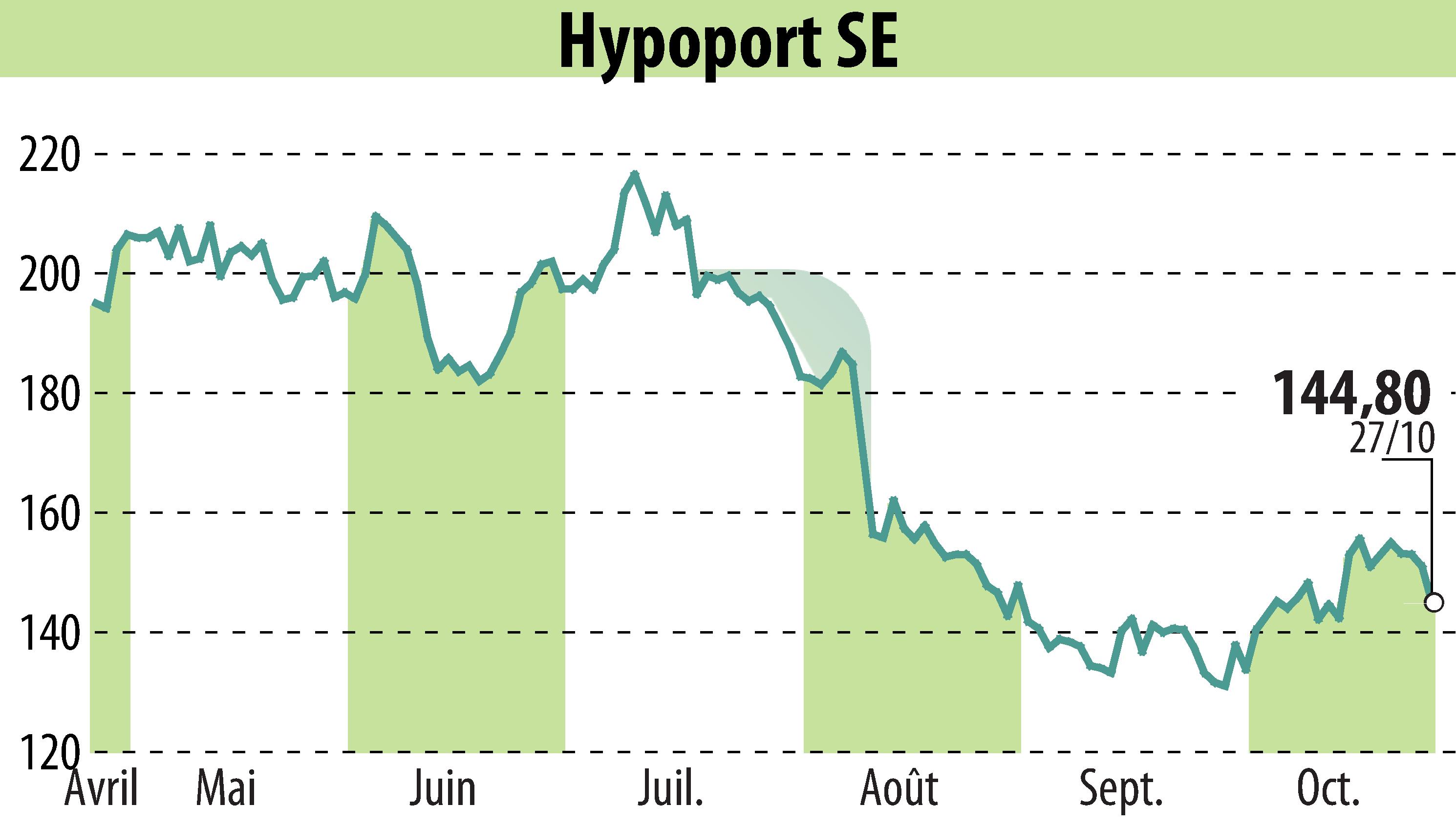

Hypoport SE has announced a significant increase in its earnings before interest and taxes (EBIT) for the first nine months of 2025, doubling the previous year's figures. This growth is attributed to the robust performance of the private mortgage business within its Real Estate & Mortgage Platforms segment.

The company's revenue for Q3 2025 rose by 11% to approximately €154 million, while gross profit increased by 19% to around €67 million. The EBIT for the quarter surged by 120% to approximately €7.6 million.

However, due to weaker performance from Starpool Finanz GmbH, a joint venture with Deutsche Bank, Hypoport adjusted its annual revenue and gross profit forecasts. The company now expects full-year revenue of at least €600 million, down from €640 million, and gross profit of at least €260 million, down from €270 million.

The EBIT forecast remains unchanged, expected between €30 million and €36 million for 2025. Final Q3 results will be published on November 10, 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hypoport AG news