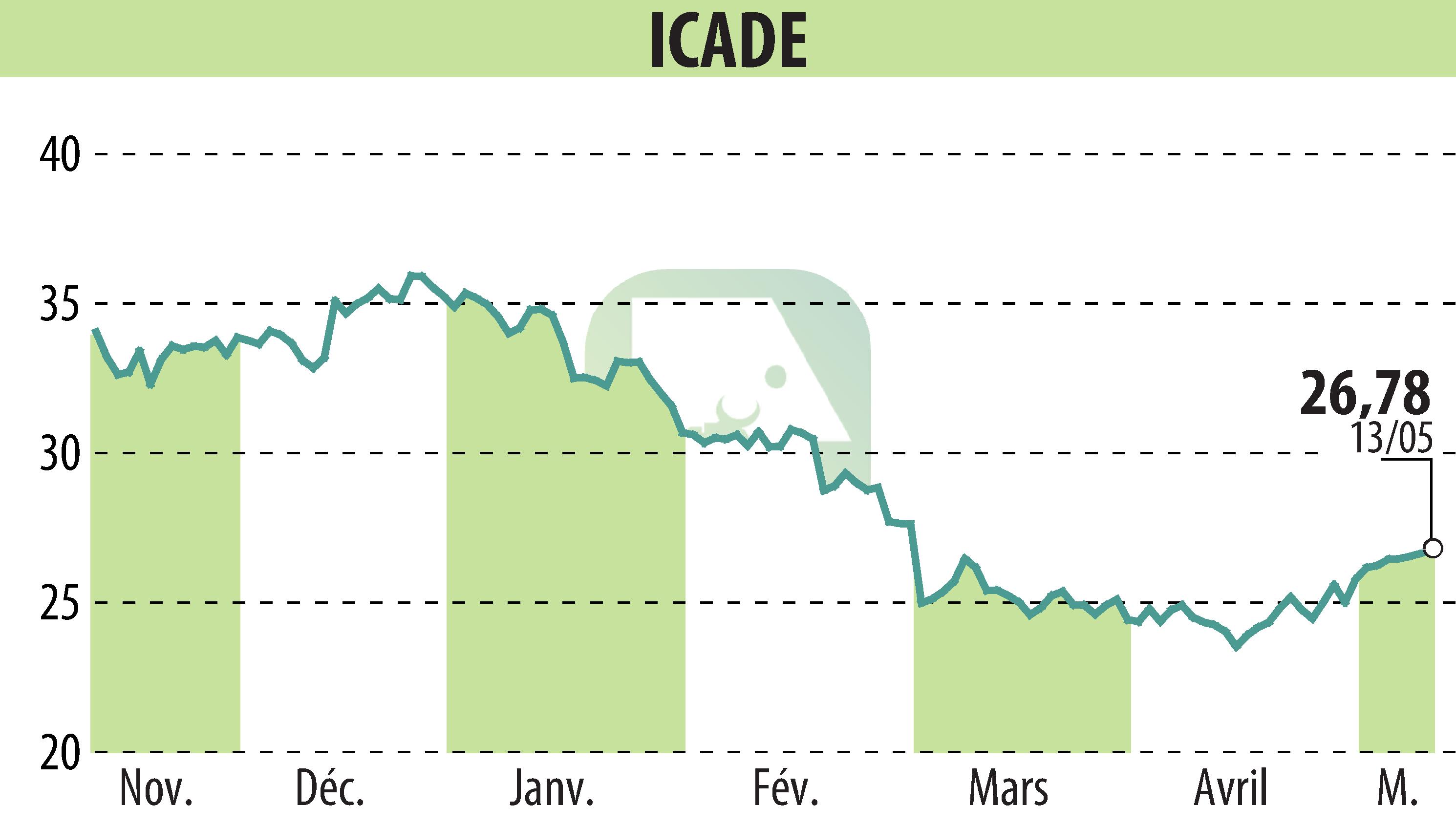

on ICADE (EPA:ICAD)

ICADE Announces Cash Tender Offer for Bonds

Icade, the real estate firm, declared a cash tender offer for three existing series of notes on May 14, 2024. This offer includes a €500 million note due in November 2025 with a 1.125% coupon, a €750 million note due in June 2026 with a 1.75% coupon, and a €600 million note due in September 2027 with a 1.5% coupon, each fully outstanding. The tender aims to buy the 2025 and 2026 series notes as Priority 1, while the 2027 notes are marked as Priority 2. The tender, capped at €350 million, is confirmed to end on May 22, 2024.

HSBC Continental Europe and Société Générale are managing the tender process. This strategic move aligns with Icade's February 2024 ReShapE strategy, where it aims to proactive debt management by utilizing proceeds from its 2023 Healthcare activities divestiture.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ICADE news