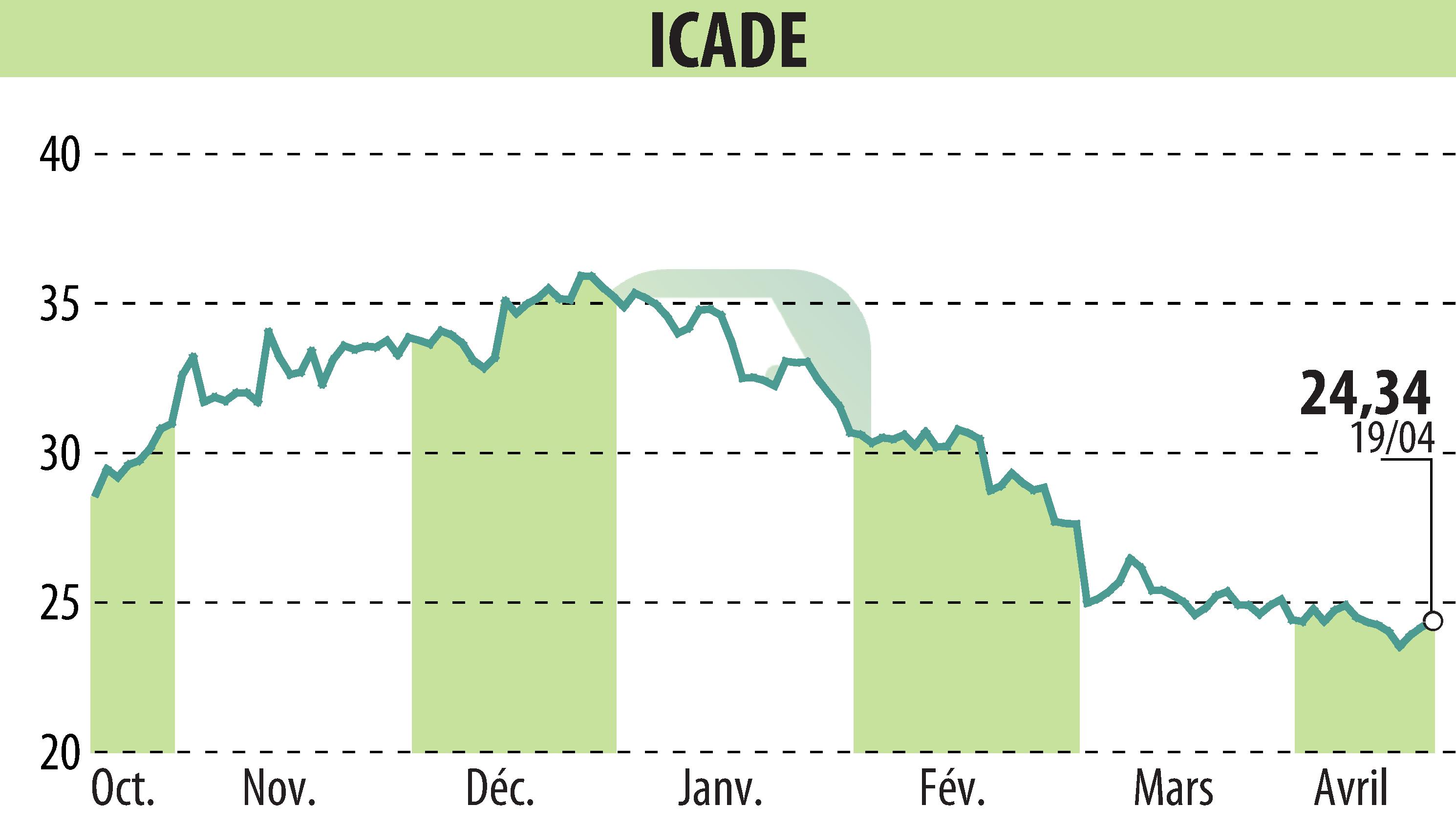

on ICADE (EPA:ICAD)

ICADE Reports Strong Q1 2024 Financial Results and Maintains Future Guidance

ICADE, a notable player in the real estate market, announced positive financial results for Q1 2024, showing a 12.3% increase in IFRS revenue year-over-year. Highlighting robust performance across sectors, the Property Investment division saw a 3.8% rise in gross rental income, mainly due to index-linked rent reviews and the addition of strategically located properties.

Despite challenges in the market, the company's Property Development division witnessed a 14.4% rise in economic revenue, attributed to strong land sales and prior year backlogs. However, relative weaknesses were noted in housing orders, reflecting a broader downturn in the residential market.

ICADE's strategic focus remains steadfast on leveraging its real estate portfolio to navigate market fluctuations, supported by recent shareholder approvals on dividends and executive appointments. With comprehensive plans in place, the company reiterates its 2024 full-year guidance of a net current cash flow per share of between €2.75 and €2.90.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ICADE news