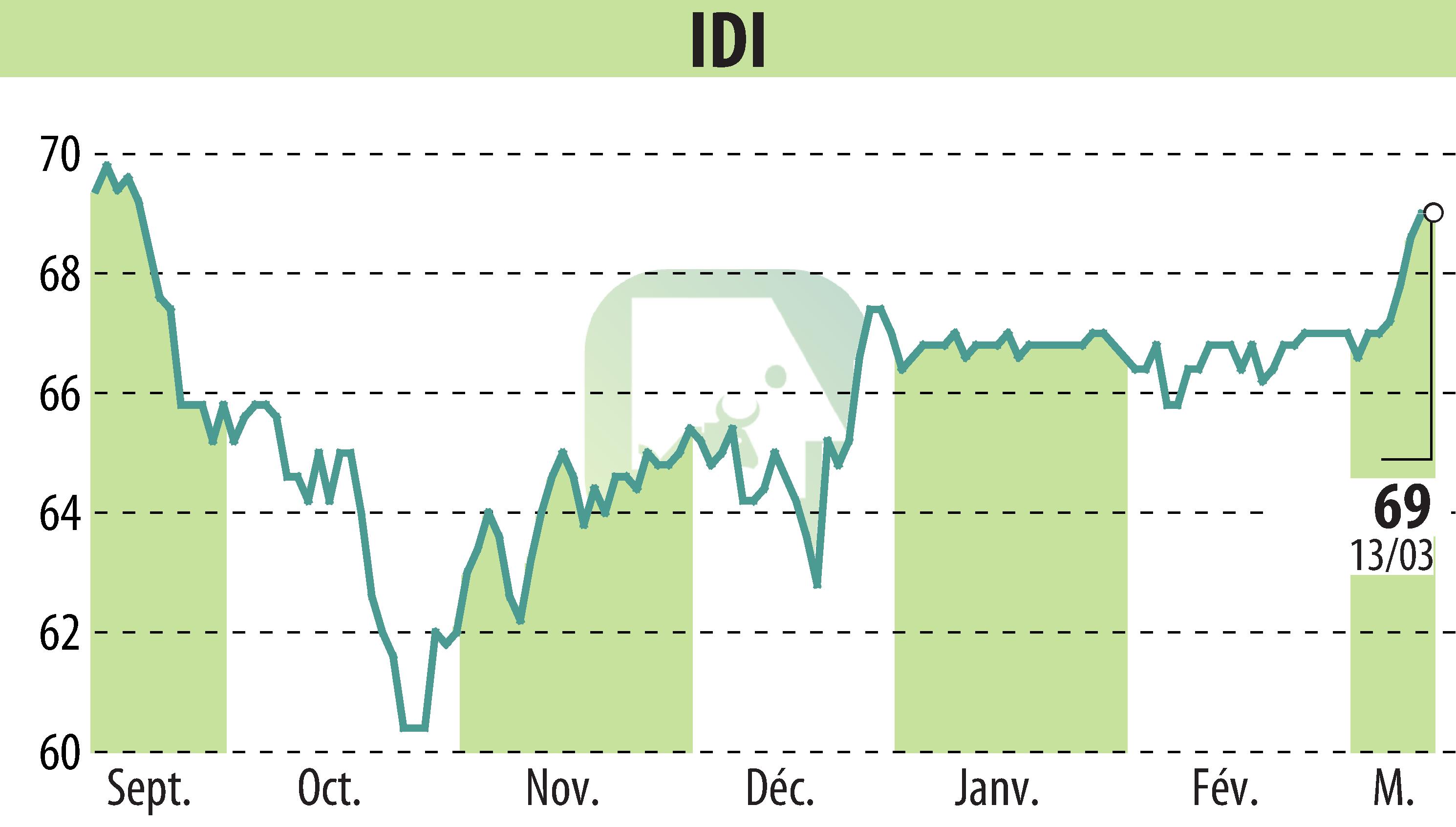

on IDI (EPA:IDIP)

IDI announces sustained growth in 2023 with an NAV of 732.4 million euros

The IDI group, specializing in private equity, revealed excellent annual results for the year 2023. The net revalued assets (NAV) amounted to 732.4 million euros as of December 31, 2023, affirming a growth of 11.4% compared to the previous year. The NAV per share thus reached €96.86.

2023 was marked by intense activity, with 21 transactions carried out, including acquisitions, disposals and external growth. This dynamic reflects the effectiveness of the group's strategy aimed at transforming SMEs into European mid-sized companies. Among these operations, we note notable sales such as that of Flex Composite Group to Michelin.

The group also announces a dividend of 5 euros per share for 2023, with a 10% increase in the ordinary dividend compared to the previous year. This distribution proposal underlines IDI's desire to offer an attractive return to its shareholders.

IDI also highlights its substantial investment capacity of 382.6 million euros which, reinforced by various credits and overdraft facilities, will equip the group to seize new investment opportunities. The strategy applied so far and the results obtained position IDI optimistically for the year 2024.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all IDI news