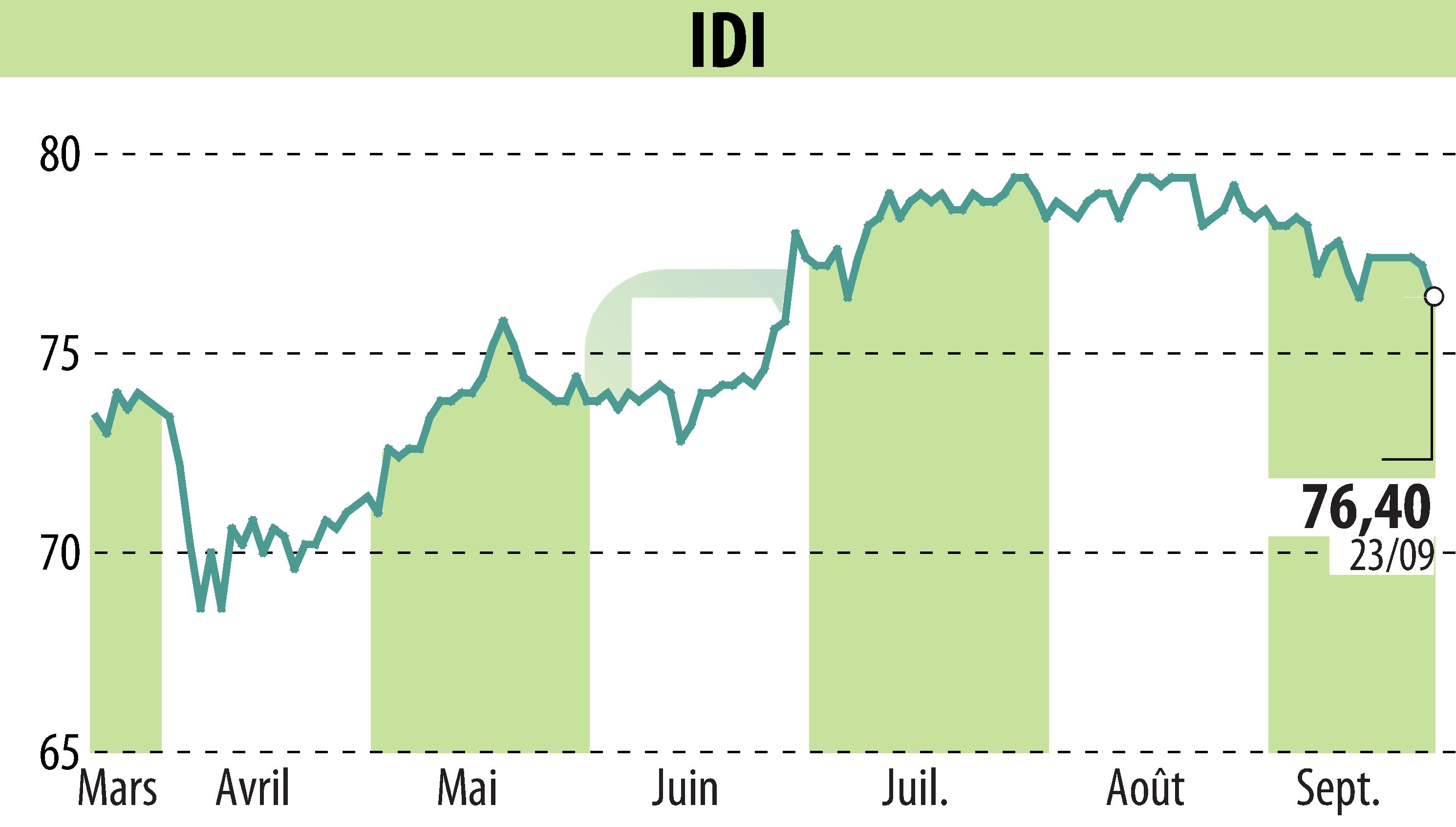

on IDI (EPA:IDIP)

IDI's 2025 half-year results up

The IDI Group posted positive performance in the first half of 2025 despite a complex economic environment. The company saw its Net Asset Value (NAV) per share increase by 1.95%, reaching €91.57. Consolidated shareholders' equity amounted to €697 million. This growth illustrates the resilience and relevance of IDI's business model.

Since the beginning of the year, IDI has carried out six strategic transactions, including acquisitions and disposals, to diversify its assets. Among these, the acquisition of a majority stake in Forsk, a network planning software publisher, underscores the international focus of its investments.

The group is strengthening its teams, notably with the arrival of Sébastien Chaigne as Operating Partner, to support a rapidly expanding portfolio. In addition, a renewed commitment to ESG illustrates its commitment to transparency and positive impact.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all IDI news