on INDUS Holding AG (isin : DE0006200108)

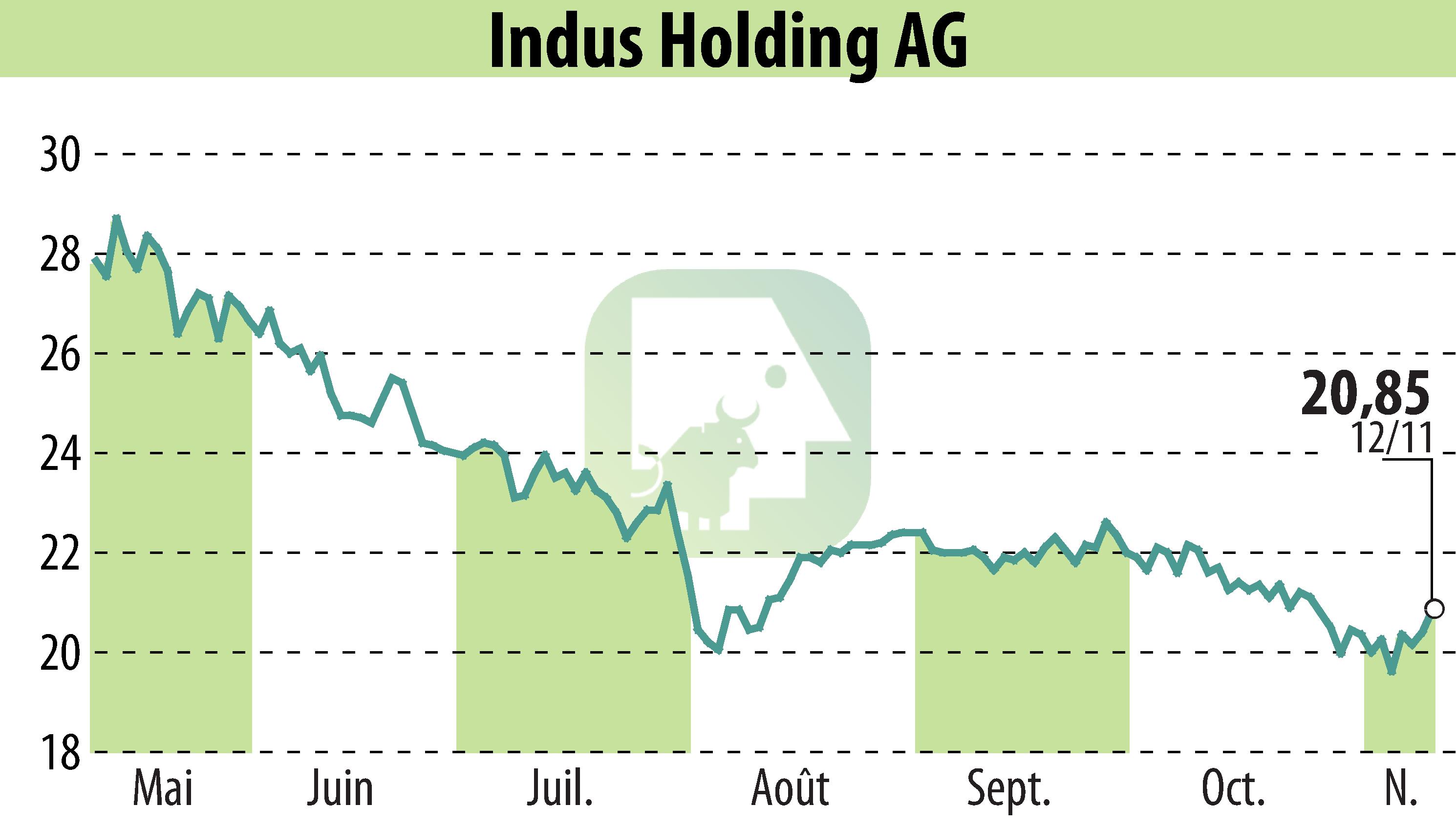

INDUS Holding AG Announces Q3 Results and Share Buyback

INDUS Holding AG reported its final Q3 results, revealing a slight sales drop by 3.6% to €443 million amidst a challenging macroeconomic environment. Notably, the EBIT remained stable at €31.8 million, with a 7.2% margin but saw a 22% decrease when adjusted for impairments. Personnel costs rose marginally by 0.6% despite a 1.6% reduction in staff. Material costs increased by 1.4%, attributed to a higher cost ratio.

The company announced its second share buyback offer, set for November 12-25, 2024, targeting 0.7 million shares at €21.65 each. Additionally, INDUS plans further open market acquisitions, potentially increasing treasury shares to 7.4%. This strategy aims to optimize capital due to perceived undervaluation.

The company's FY24 free cash flow is projected to exceed €110 million, despite geopolitical challenges. Management anticipates a moderate 5.4% sales growth for FY25, fueled by improvement in macroeconomic conditions and strategic M&A activities.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INDUS Holding AG news