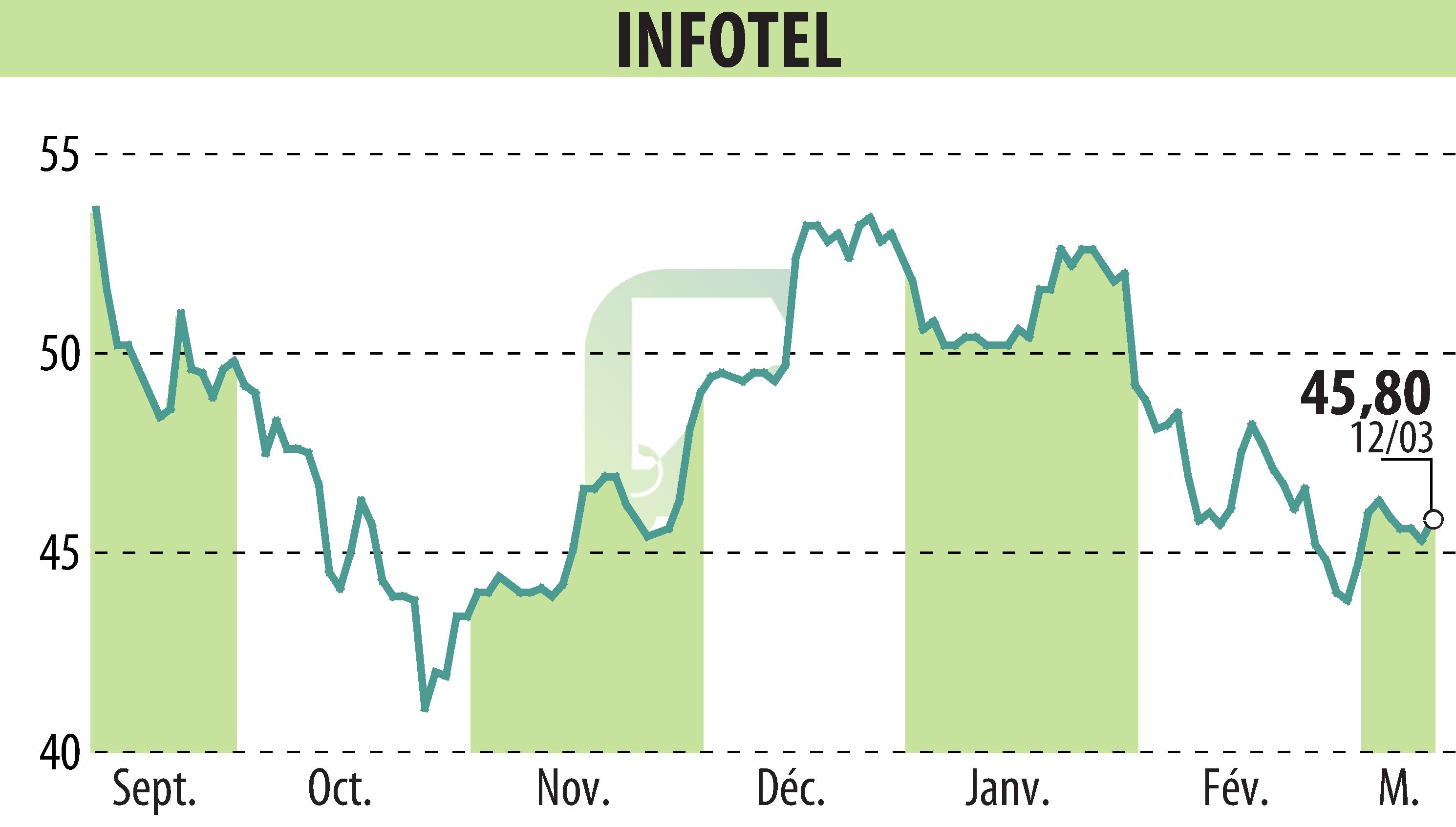

on INFOTEL (EPA:INF)

Infotel Announces Steady Growth in 2023 Full-Year Results

Infotel reported a revenue increase of 2.4% in 2023, with consolidated revenue hitting €307.5 million, according to its audited financial statements. The company showed resilience amid a sluggish economic environment, particularly in the banking sector. A part of this growth is attributed to its services sector, which grew by 2.1%, and a significant 9.6% increase in software revenue, highlighted by the Orlando suite's 50% revenue growth.

Despite a less buoyant market, Infotel maintained a low inter-contract rate and managed to grow its workforce while keeping the employee departure rate at a market-leading 12%. The company's strategic investments, including international expansion and investments in artificial intelligence, demonstrate its commitment to sustaining growth. However, these investments led to a dip in operating profitability, with a current operating income of €27.5 million, reflecting a 7.7% decrease compared with 2022.

Infotel proposed a dividend of €2 per share, reflecting confidence in its financial stability and future prospects. The company maintains a robust balance sheet with increased shareholders’ equity and no financial debt. Looking ahead, Infotel anticipates a recovery in the latter half of 2024, aiming for a revenue target of €380 million by 2026, with more than a 10% current operating margin.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INFOTEL news