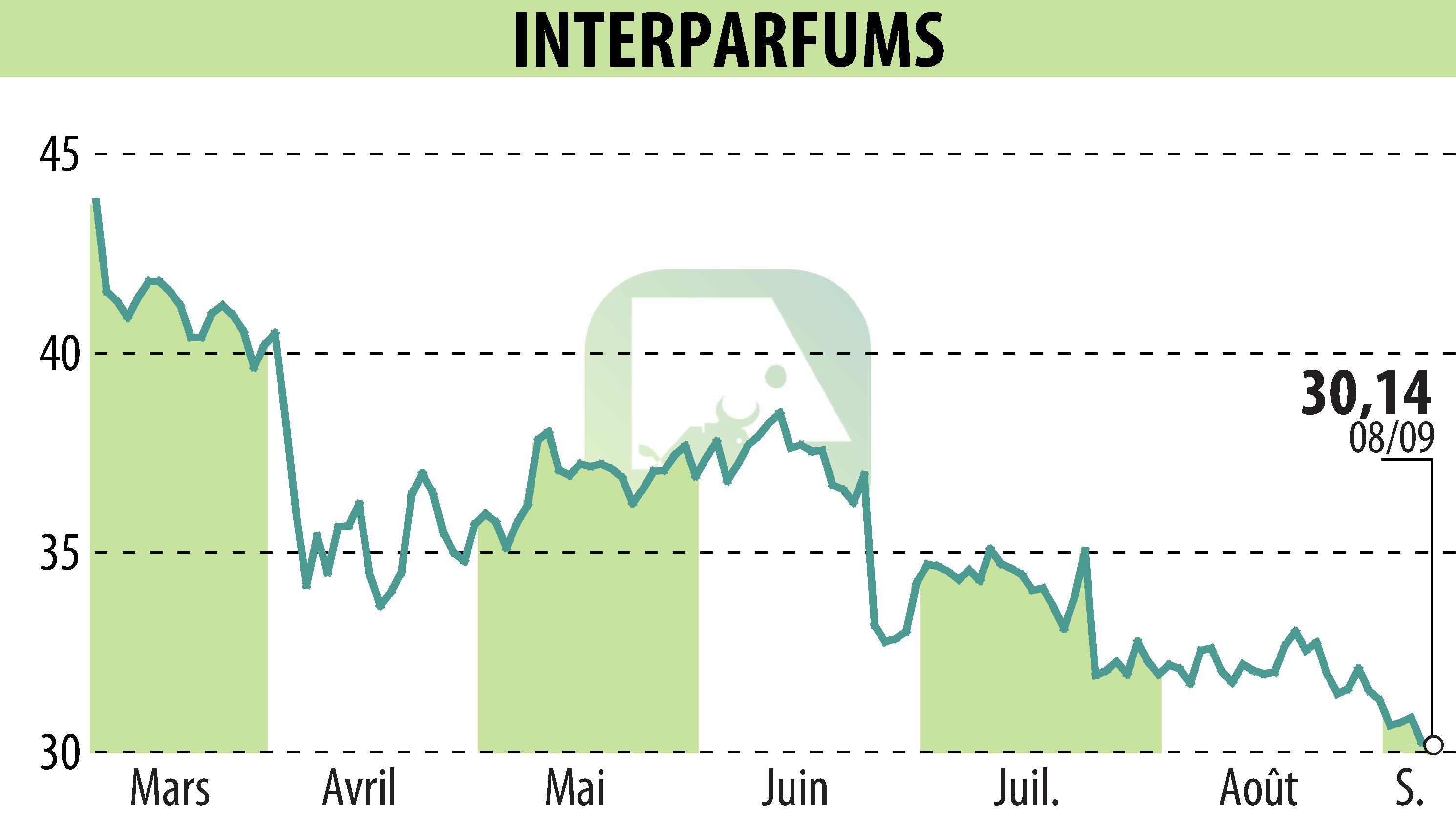

on INTER PARFUMS (EPA:ITP)

Inter Parfums Delivers Robust H1 2025 Performance

Inter Parfums demonstrated solid financial performance in the first half of 2025, with sales amounting to €446.9 million, marking a 6% increase from H1 2024. Despite geopolitical challenges, the company's operating margin reached 23.2%, up from 21.9% the previous year. The net margin remained stable at 16.4%, slightly below the 16.5% recorded in 2024.

The company's strong results were bolstered by a 20% growth in U.S. subsidiary sales and a favorable trend in gross margin, which increased by 60 basis points. Marketing expenses remained controlled, supporting the improvement in profitability. However, the euro/dollar exchange rate fluctuations posed some challenges.

Notably, the acquisition of Annick Goutal trademarks and additional real estate assets impacted cash flow, prompting new loans totaling €50 million. Despite this, shareholders' equity remains solid at nearly €680 million. The company plans a retail price increase due to U.S. import tariffs. Looking ahead, Inter Parfums' strategy includes major brand launches, supporting its growth outlook.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INTER PARFUMS news