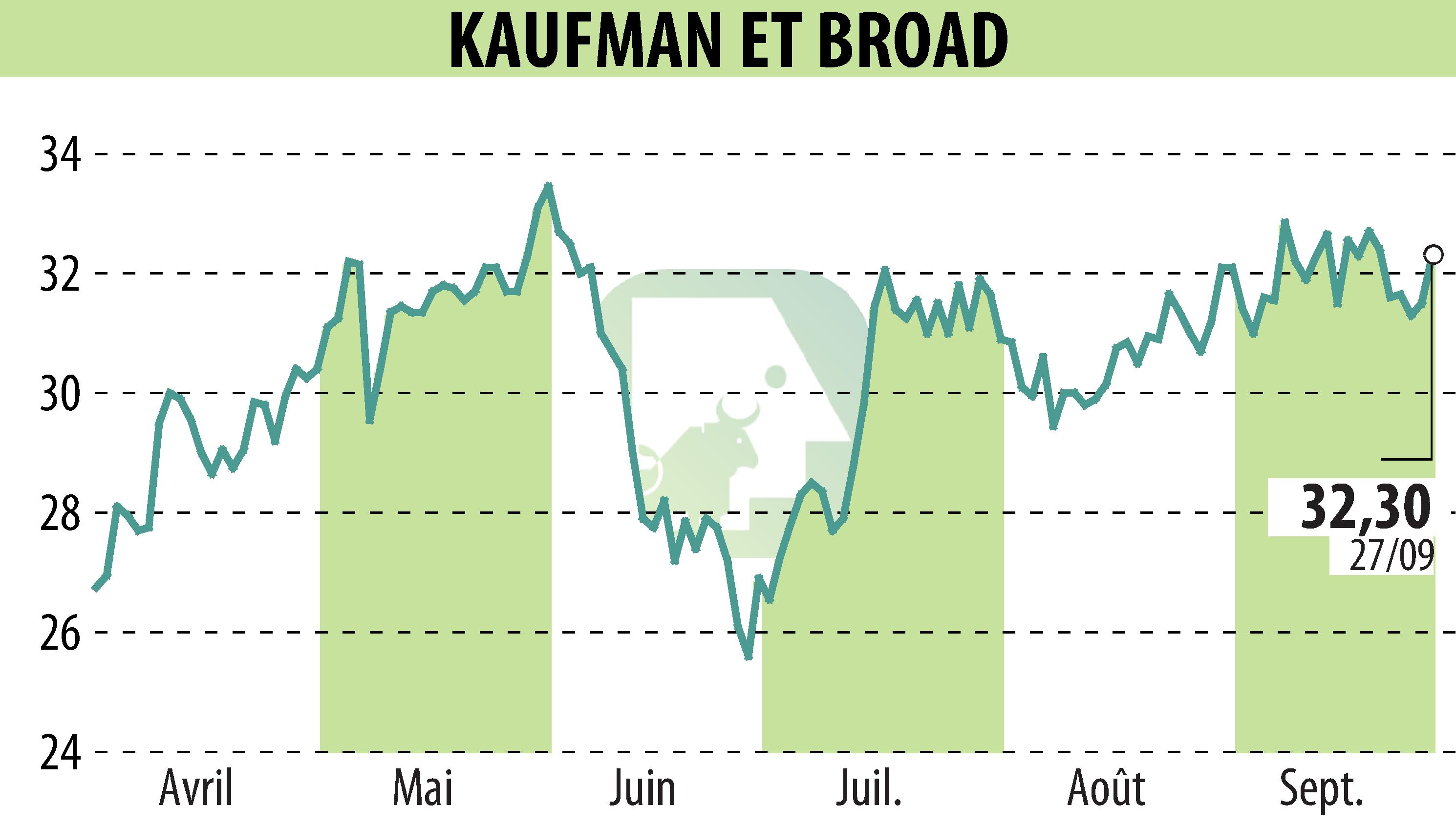

on KAUFMAN & BROAD (EPA:KOF)

Kaufman & Broad SA: First Nine Months Financial Results for 2024

Kaufman & Broad SA has reported its financial results for the first nine months of 2024. The company noted strong operating performance despite a challenging market, with a backlog of €2.6 billion and net cash of €381.5 million. Guidance for the 2024 financial year has been confirmed.

Total reservations for the period reached €804.5 million, including €777.9 million from housing across 3,433 units and €21.0 million from commercial property. The take-up rate for housing was 3.6 months.

Key financial data shows revenue at €701.2 million, a gross margin of €146.2 million, and EBIT of €53.5 million. Attributable net income was €31.1 million, and the financial capacity reached €685.5 million.

The company has maintained a strong financial structure, benefiting from a robust net cash position. Fitch Ratings confirmed Kaufman & Broad's 'BBB-' rating with a stable outlook, reflecting the company’s financial resilience.

The housing segment saw an 8.0% increase in value terms and a 5.8% rise in volume terms compared to the same period in 2023. The commercial property segment reported lower net bookings at €21.0 million. The company plans to launch 37 new housing programs in the fourth quarter of 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KAUFMAN & BROAD news