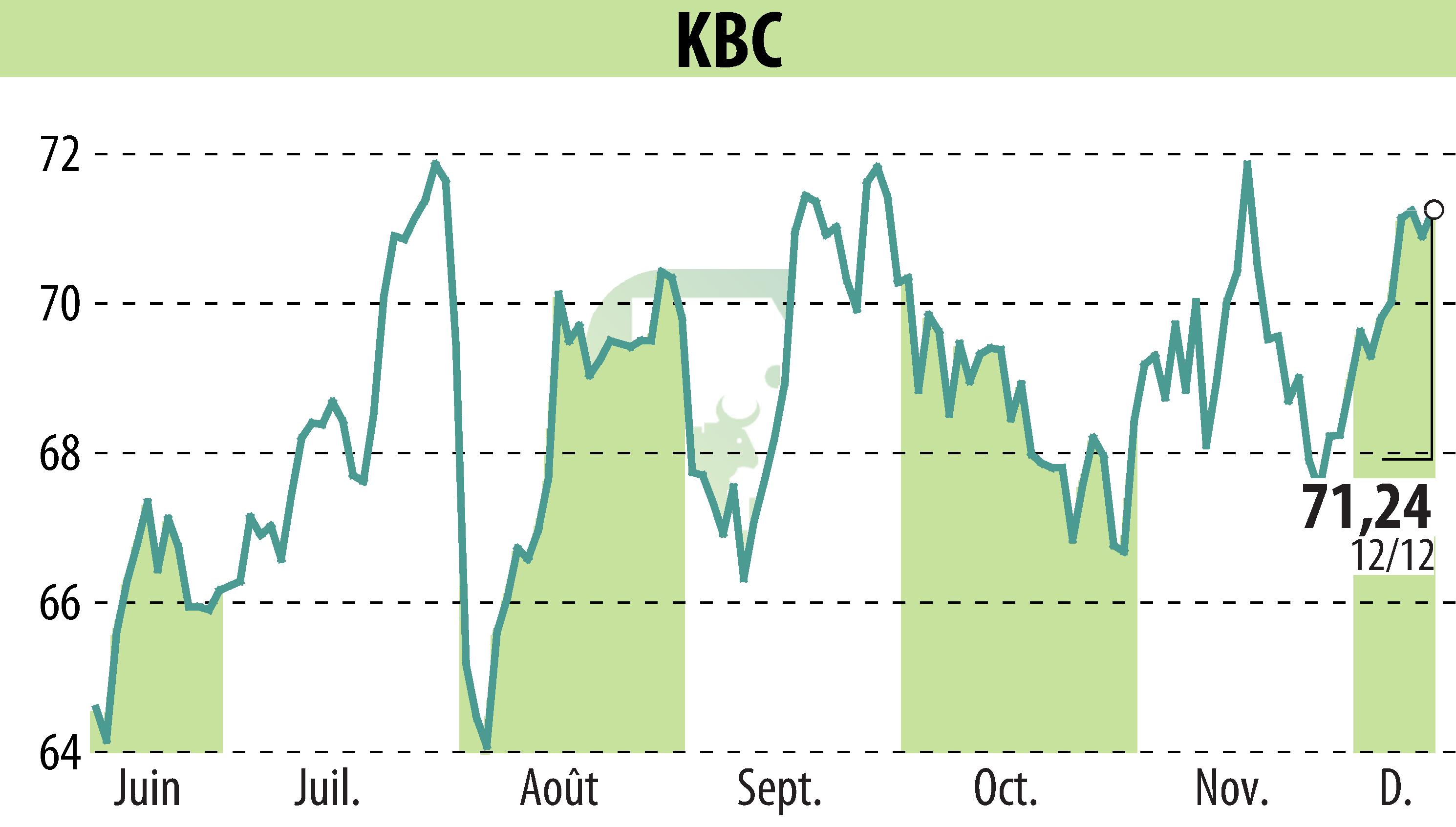

on KBC (EBR:KBC)

KBC capital exceeds ECB minimum requirements

The European Central Bank has communicated its new minimum capital requirements to KBC for 2024. The ECB has maintained the Pillar 2 requirement (P2R) at 1.86% and the Pillar 2 guidance (P2G) at 1.25% of risk-weighted assets. This results in an overall CET1 requirement of 10.88% for KBC Group.

The components of this requirement include a Pillar 1 requirement of 4.50%, an adjusted P2R of 1.09%, a capital conservation buffer of 2.50%, and a buffer for other systemically important institutions of 1.50%. This requirement also includes future changes to the cyclical and systemic capital buffers.

At the end of the third quarter of 2024, KBC Group's CET1 ratio reached 15.2%, well above the requirements set, underlining the financial robustness of the institution.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KBC news