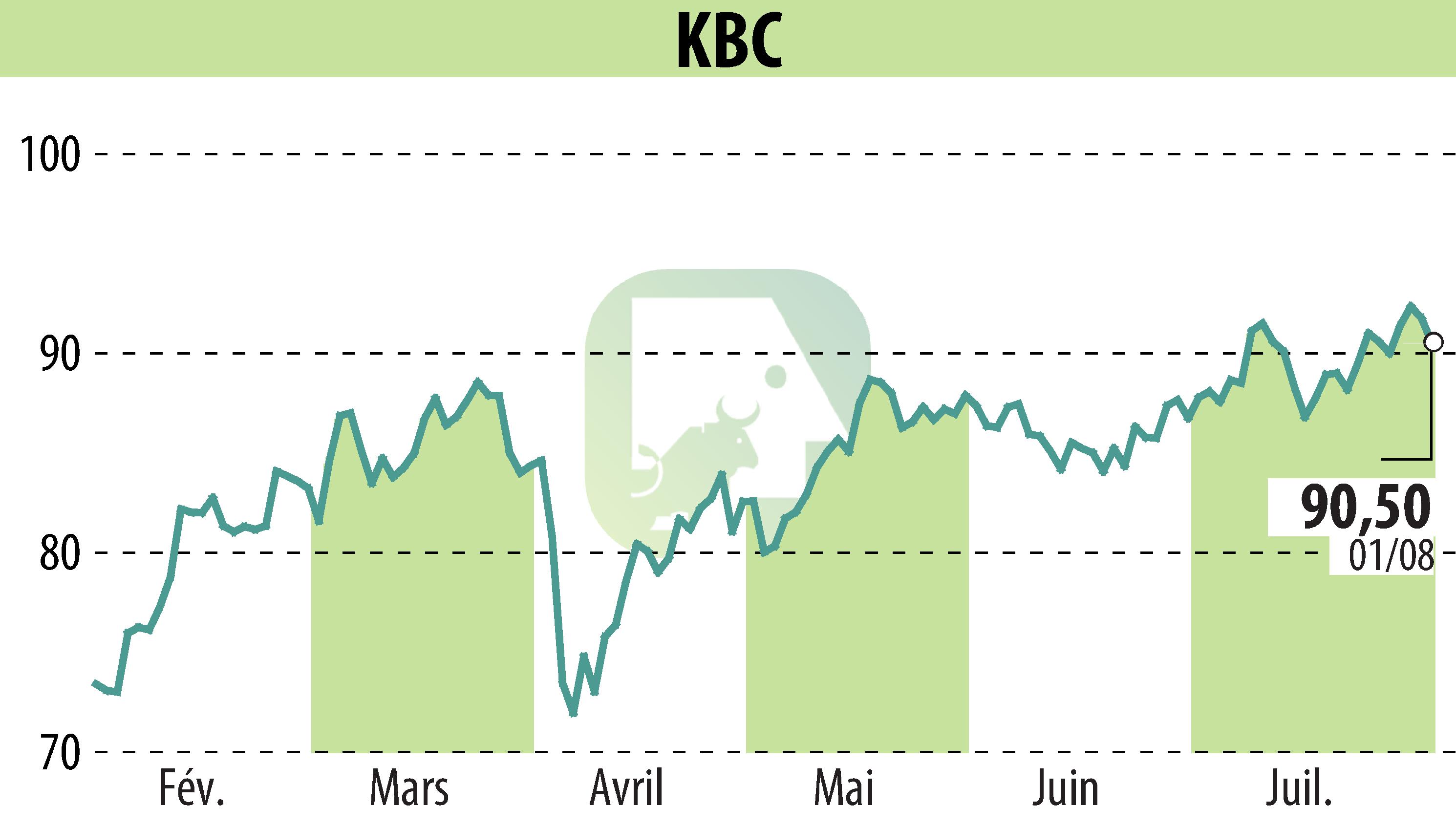

on KBC (EBR:KBC)

KBC Remains Well-Capitalised in 2025 EBA Stress Test

On August 1, 2025, KBC announced the outcome of the European Banking Authority's (EBA) 2025 EU-wide stress test. The results show that KBC remains robustly capitalised under varying economic scenarios. Under the base scenario, KBC's Common Equity Tier-1 (CET1) ratio is expected to increase from 14.56% at the end of 2024 to 17.22% by the end of 2027. In contrast, the adverse scenario predicts a decrease to 11.82%, still outperforming previous outcomes.

Johan Thijs, CEO of KBC Group, reiterates that these results reinforce their strong fundamentals, emphasizing KBC’s secure liquidity and solvency levels. The stress test, developed in collaboration with the ECB and ESRB, spans a three-year horizon without forecasting profits, but rather evaluating prudential capabilities under stress.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KBC news