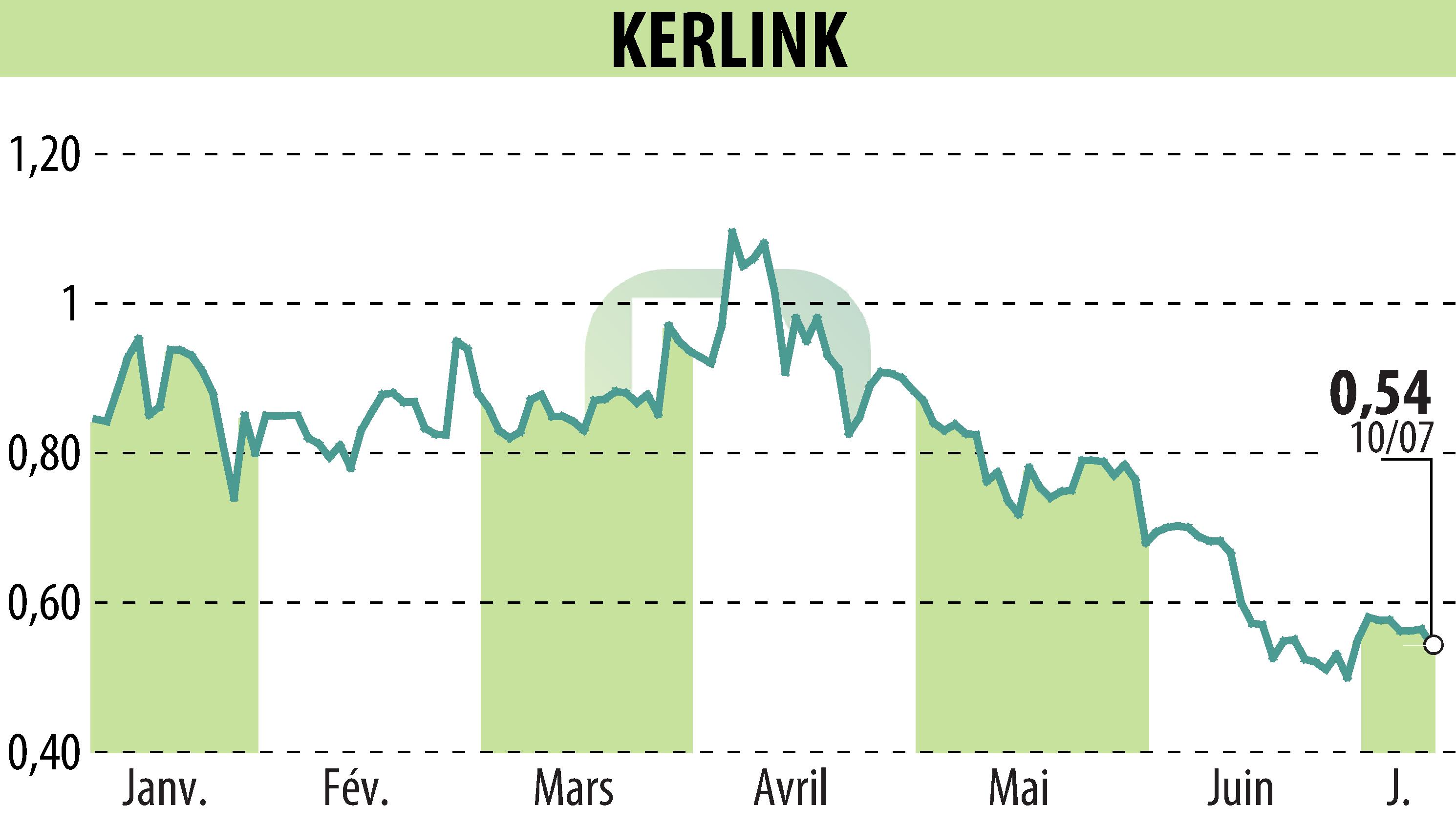

on KERLINK (EPA:ALKLK)

Kerlink Reports 6% Revenue Decline Amid Wait-and-See Market

Kerlink, a French network and IoT solutions provider, announced a 6% drop in H1 2024 revenue to €6.2m compared to €6.6m in H1 2023. The decline is attributed mainly to the termination of two Network as a Service (NaaS) contracts due to economic difficulties faced by clients.

Despite the revenue fall, sales of network infrastructure equipment rose by 5%, reaching €4.8m. This increase offsets a 29% dip in services revenue, which fell to €1.5m. Kerlink attributed this shift to integrating value-added solutions into infrastructure products, favoring equipment sales.

The group's cash position improved from €4m at the end of December 2023 to €5.3m by the end of June 2024, thanks to measures implemented last year. Although Kerlink remains optimistic about future prospects, it revised its 2024 financial goals due to current market uncertainties.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KERLINK news