on Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Companies, Inc. Announces Record Profitability and Growth

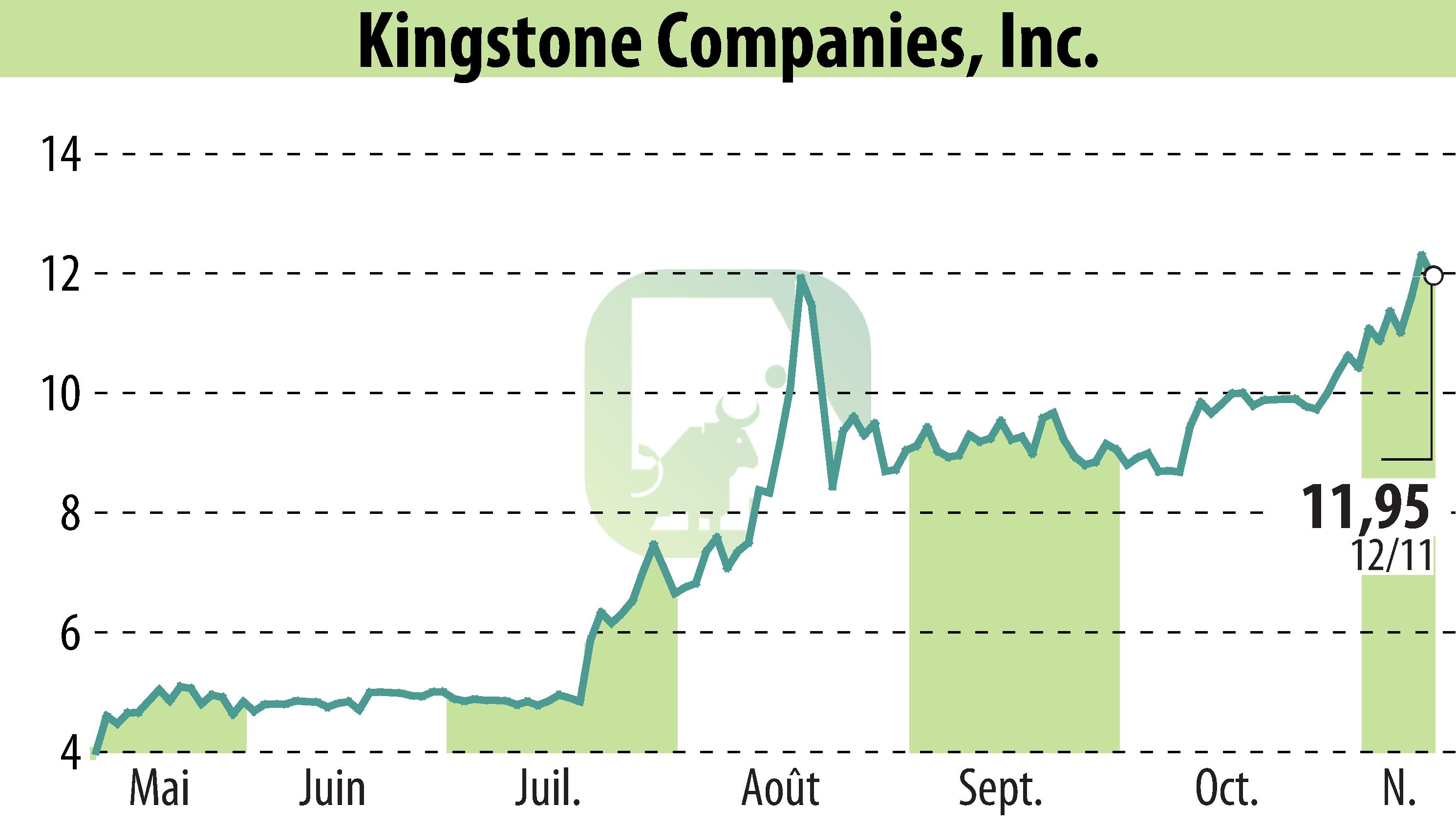

Kingstone Companies, Inc. reported significant growth and profitability for the third quarter of 2024. A Northeast regional property and casualty insurance holding company, Kingstone saw its direct premiums written for core business rise by 39.4% compared to last year. Overall, direct premiums increased by 28.1%. These advancements led to a net income of $6.98 million, reversing a loss of $3.54 million in the prior year.

The net combined ratio improved by 38.2 percentage points to 72.0%, attributed to lower claim frequency, reduced non-core business, and strong underwriting. Severe weather impact was minimal, contributing only 1.7% to the loss ratio, while favorable reserve development offset this effect.

CEO Meryl Golden emphasized strategic growth and raised guidance for 2024 and 2025. The company aims for continued shareholder value and long-term success, adjusting the combined ratio and net income expectations positively for both years.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news