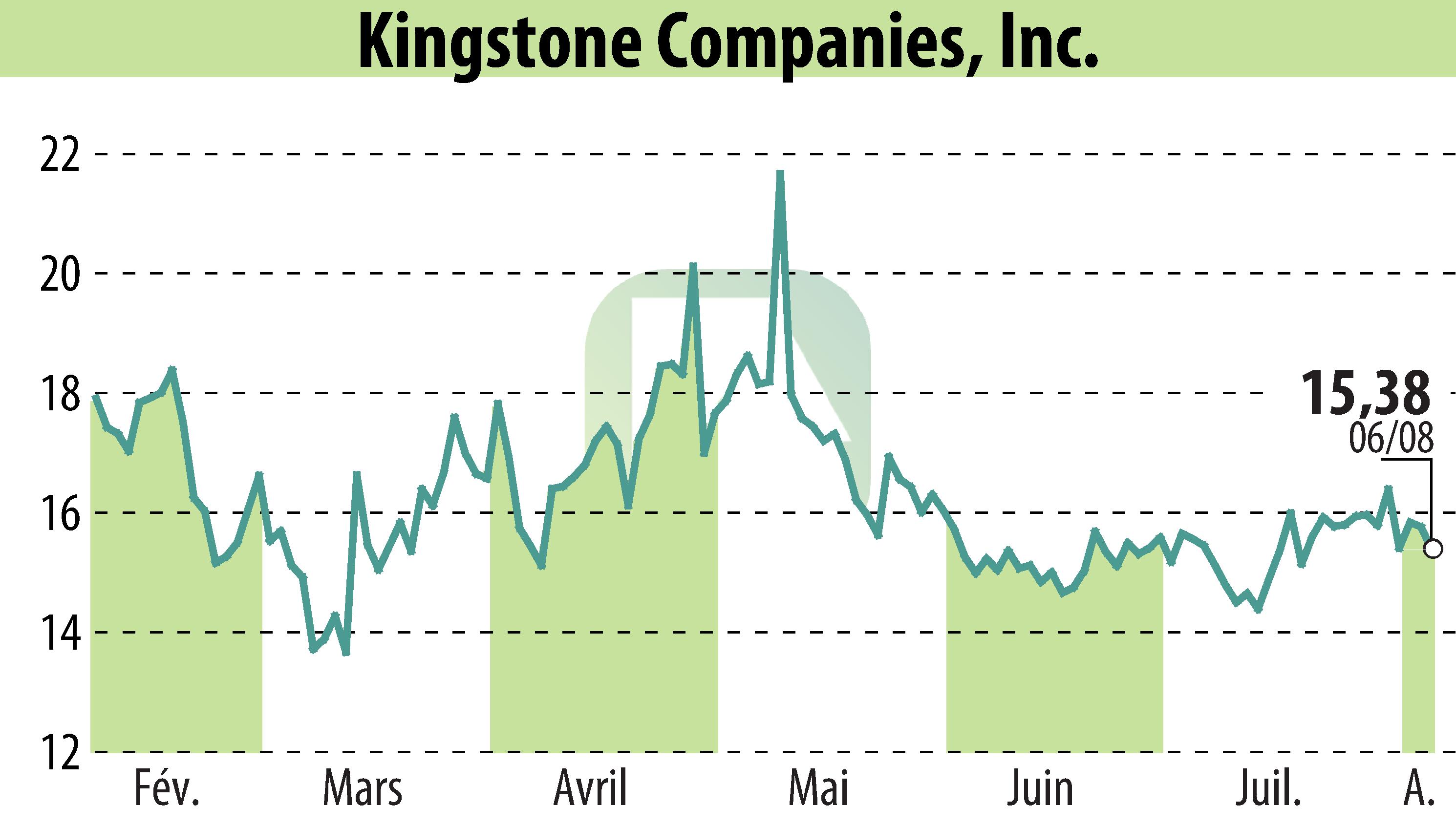

on Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Companies Reports Record Q2 2025 Financial Results

Kingstone Companies, Inc. has announced its highest quarterly net income in history, recording $11.3 million for Q2 2025. The company, focusing on property and casualty insurance, has also raised its 2025 EPS guidance and set a five-year goal to achieve $500 million in premiums. This reflects a notable 150% increase from the previous year, leading to a 50.8% annualized return on equity.

The direct premiums written by Kingstone rose by 16.6% from the previous year, reaching $59.8 million. The net combined ratio improved significantly, dropping by 6.7 points to 71.5%, driven by effective risk management and strategic underwriting of non-weather water risks. Additionally, the reduction in the quota share has boosted net earned premiums by over 52% compared to Q2 2024.

CEO Meryl Golden highlighted the company's strategic focus on catastrophe-exposed properties and plans for geographic diversification. This approach aims to mitigate risk and improve financial stability while targeting expansion in New York and other states. Kingstone anticipates record results for the full year 2025, leveraging favorable market conditions.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news