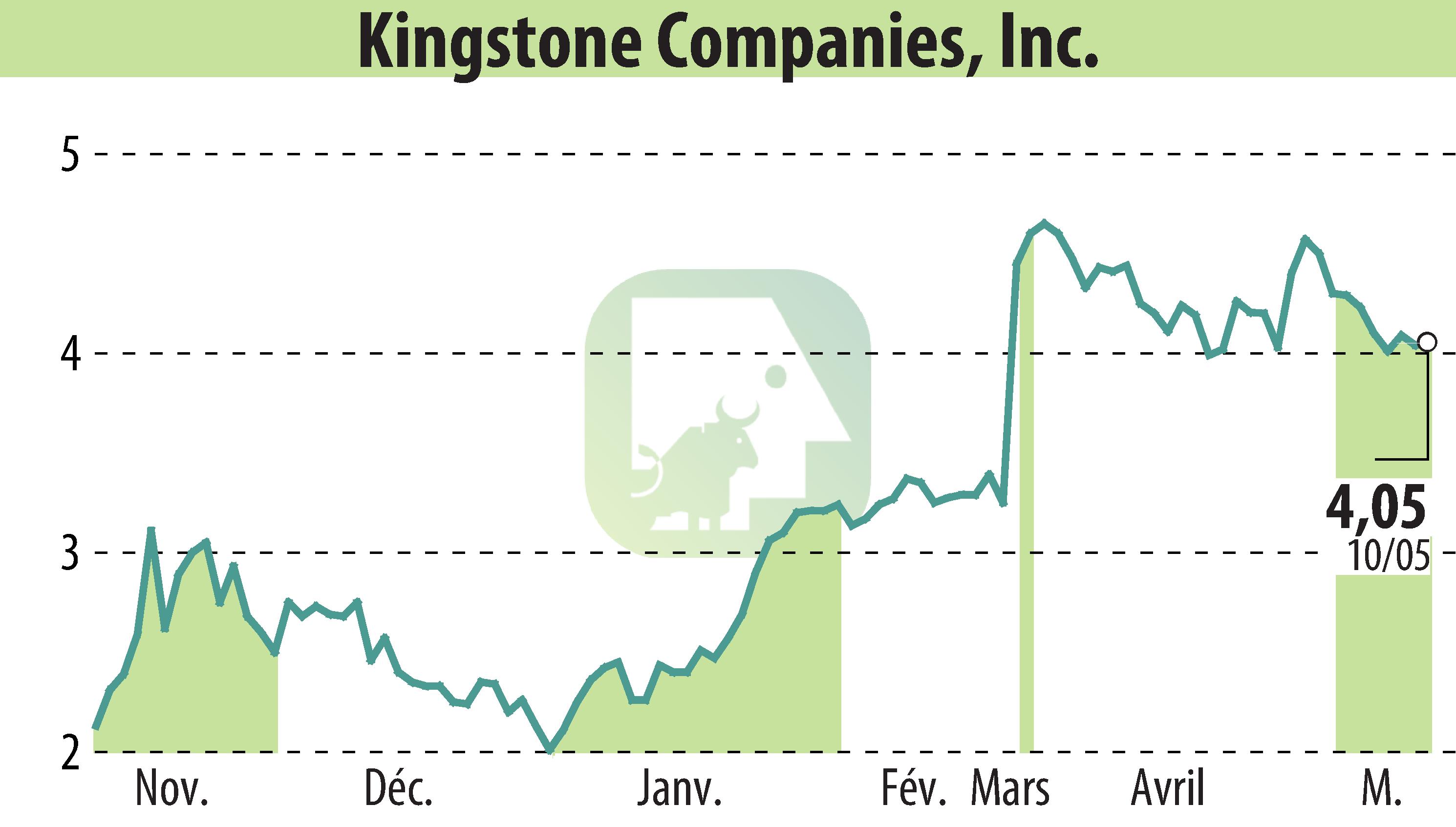

on Kingstone Companies, Inc (NASDAQ:KINS)

Kingstone Companies, Inc. Reports Strong Q1 2024 Performance with Substantial Gains in Profitability and Premium Growth

Kingstone Companies, Inc. (Nasdaq: KINS) today announced significant improvements in its Q1 2024 financial results. The company achieved a notable growth in core business premiums and recorded the highest first quarter profitability in seven years. For Q1 2024, Kingstone reported a net income of $1,427 thousand, contrasting sharply with a net loss of $5,055 thousand during the same period in 2023.

With an impressive decline in the combined ratio from 123.3% to 93.3%, Kingstone effectively reversed previous losses, aided by milder weather conditions reducing catastrophe losses. Direct premiums written for core business surged by 12.5%, amounting to $46,587 thousand, due to various strategic adjustments including price increments and broader underwriting endeavors.

These positive developments prompted Kingstone to raise its full-year 2024 guidance. The projected growth for core business direct premiums written is now set between 16.0% to 20.0%, up from the earlier forecast of 12.0% to 16.0%. Similarly, expectations for net income per share have been adjusted upwards to range from $0.75 to $1.10.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news