on Kingstone Companies, Inc (NASDAQ:KINS)

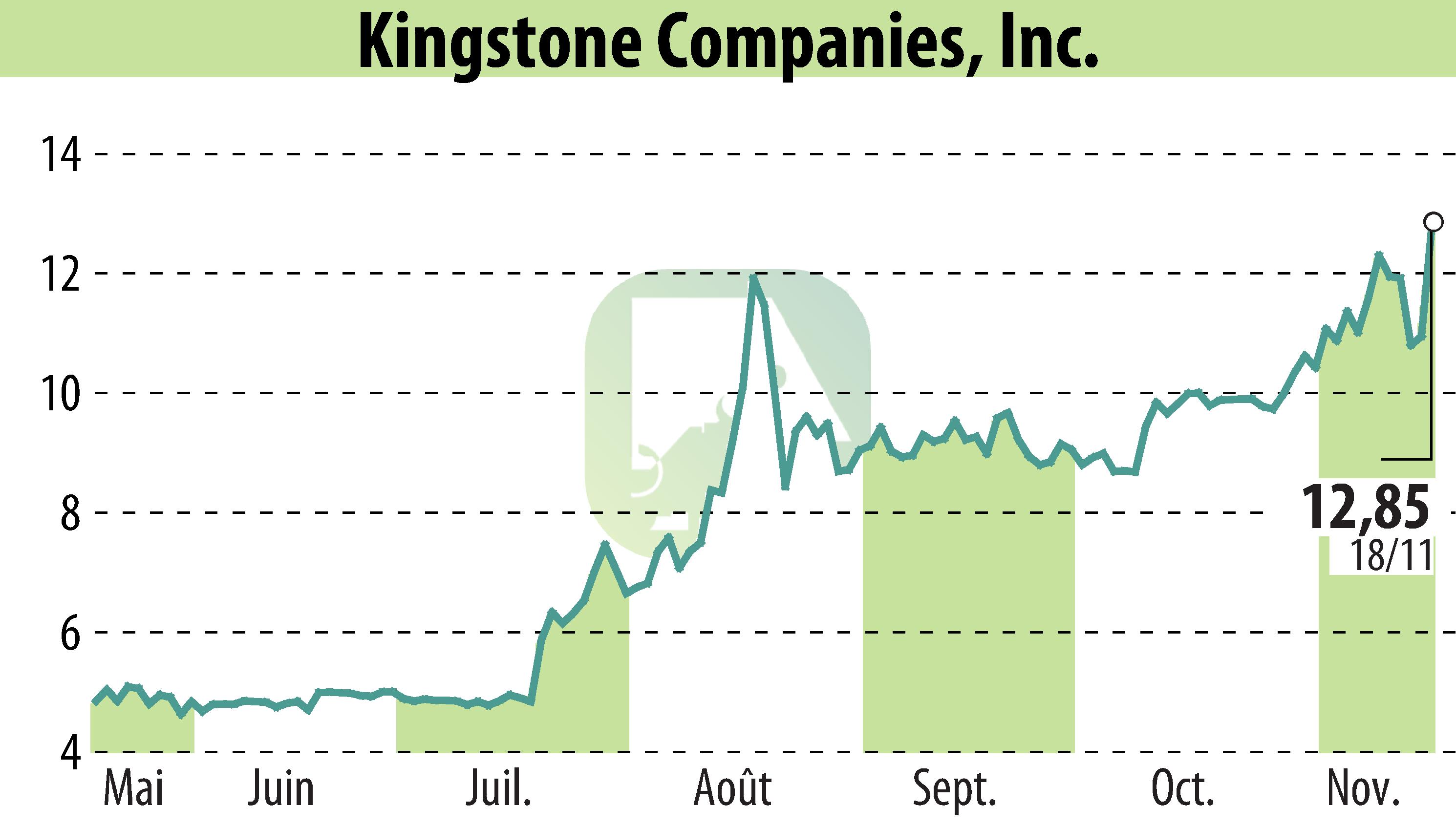

Kingstone Companies Projects Strong Financial Growth for 2024 and 2025

Kingstone Companies, Inc., a regional property and casualty insurance holding company, has released a letter from CEO Meryl Golden, detailing its financial guidance for 2024 and 2025. The third quarter of 2024 marked a milestone for Kingstone, with record profitability and growth, resulting in heightened financial expectations.

For the upcoming years, Kingstone anticipates a substantial increase in net income per share. In 2024, the basic earnings are projected between $1.40 to $1.70, rising to $1.60 to $2.00 in 2025. Meanwhile, diluted earnings per share are expected to follow a similar upward trajectory. Direct premiums written for the core business are expected to grow by 25% to 35% in 2024 and 15% to 25% in 2025.

The Company has also managed to reduce its debt by $10 million in the third quarter of 2024, cutting down its future financial obligations. This move has favorably impacted projected earnings per share. Kingstone remains committed to maintaining transparent communications with its shareholders while addressing potential risks and uncertainties that may affect future outcomes.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Kingstone Companies, Inc news