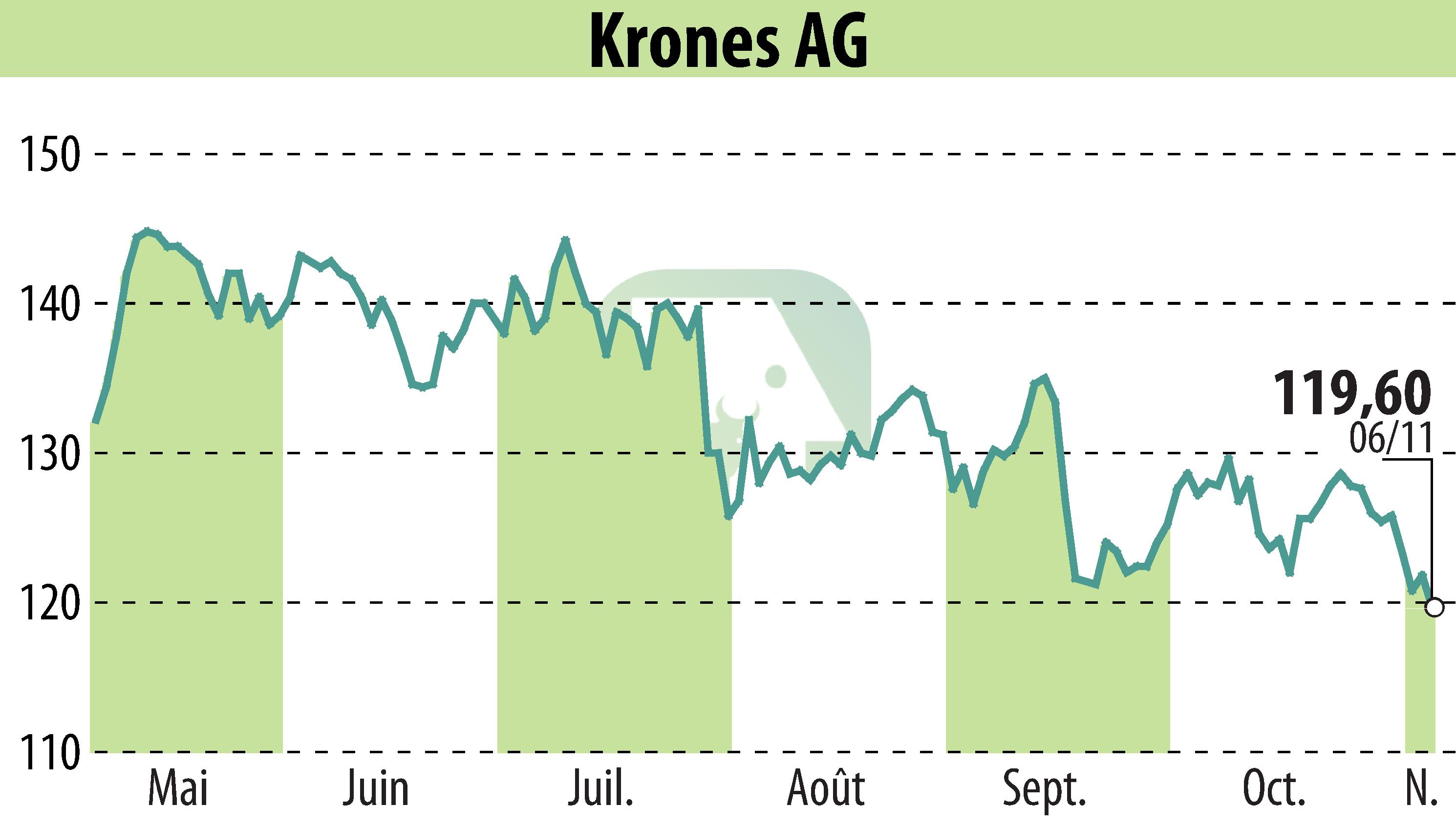

on Krones AG (ETR:KRN)

Krones AG Confirms Robust Performance Amid Global Uncertainties

Krones AG has continued on a profitable growth trajectory in Q3 2025, bolstered by a 6.2% rise in order intake to €1,374.3 million compared to the previous quarter. The company's revenue also saw a year-on-year increase of 4.7%, reaching €1,380.9 million, while the first nine months of 2025 marked a 6.0% revenue growth. Despite macroeconomic challenges, Krones remains resilient, attributed to its resilient market position and steady customer investment.

Profitability improved in the third quarter with an EBITDA of €142.2 million and a margin increase to 10.3%. The ROCE also saw an uplift, reaching 19.5% for the first nine months. Krones forecasts revenue growth of 7% to 9%, an EBITDA margin of 10.2% to 10.8%, and ROCE between 18% and 20% for the full year 2025.

Krones' solid financial footing is underscored by a €361.2 million net cash position. The firm remains vigilant to global economic uncertainties, including geopolitical risks and supply chain challenges, influencing short-term investment decisions.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Krones AG news