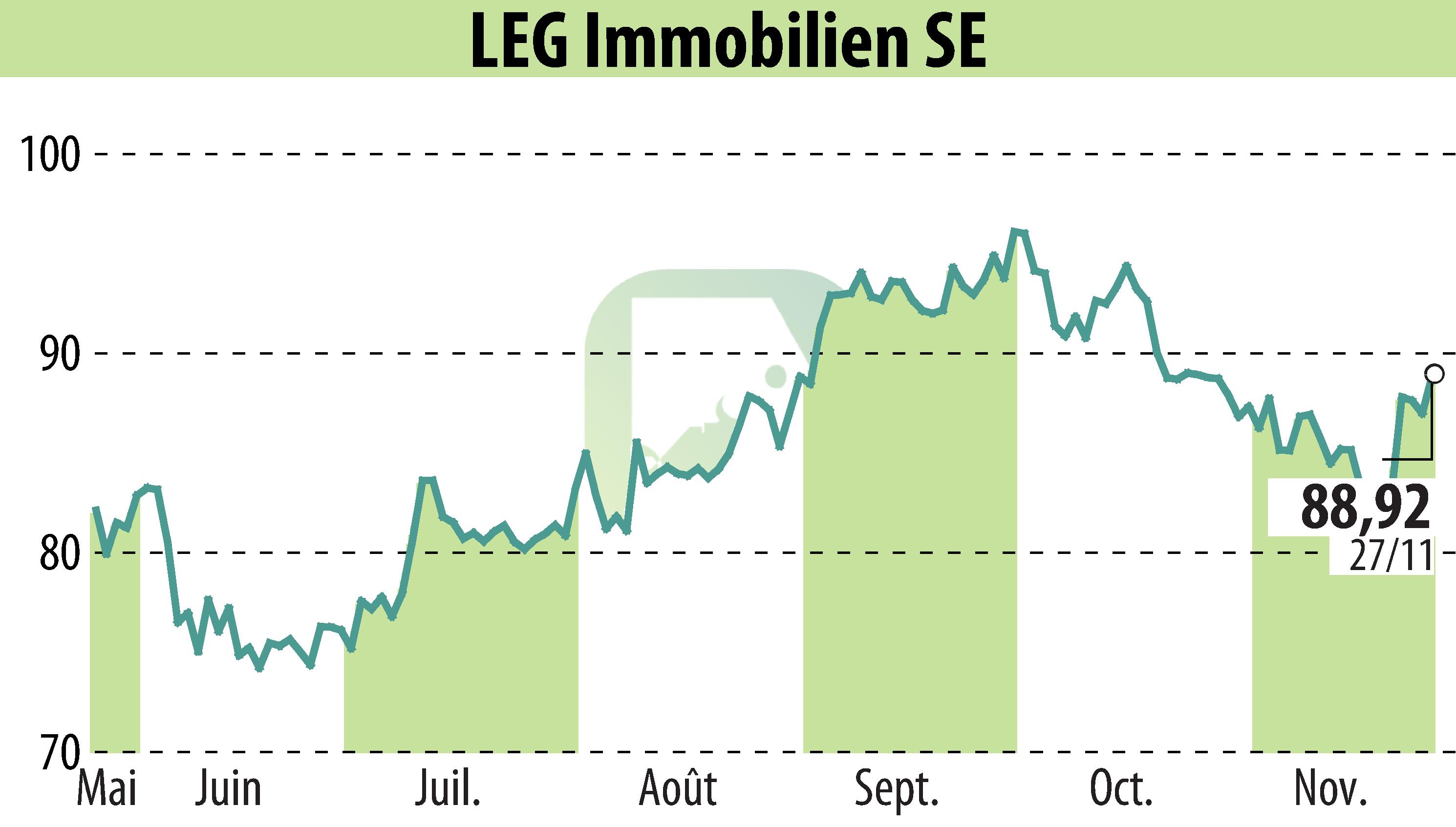

on LEG Immobilien AG (isin : DE000LEG1110)

LEG Immobilien SE Enhances Convertible Bonds with €200 Million Tap Issue

On November 28, 2024, LEG Immobilien SE announced the launch of a €200 million tap issue for its convertible bonds due 2030. This expansion aims to support refinancing and corporate activities. The new bonds, issued by LEG Properties B.V., a subsidiary guaranteed by LEG, will align with the terms of the company's existing €500 million bonds from September 2024. The bond issue was approved by the Management and Supervisory Boards of LEG Immobilien.

The tap issue is targeted at institutional investors outside the US through private placements, with settlement expected around December 5, 2024. Additionally, the bonds are projected to be traded alongside the original bonds on Frankfurt's Open Market. The issuance benefits from the Joint Global Coordinators waiving a previous 90-day lock-up period. The company has committed to a new 90-day lock-up agreement.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LEG Immobilien AG news