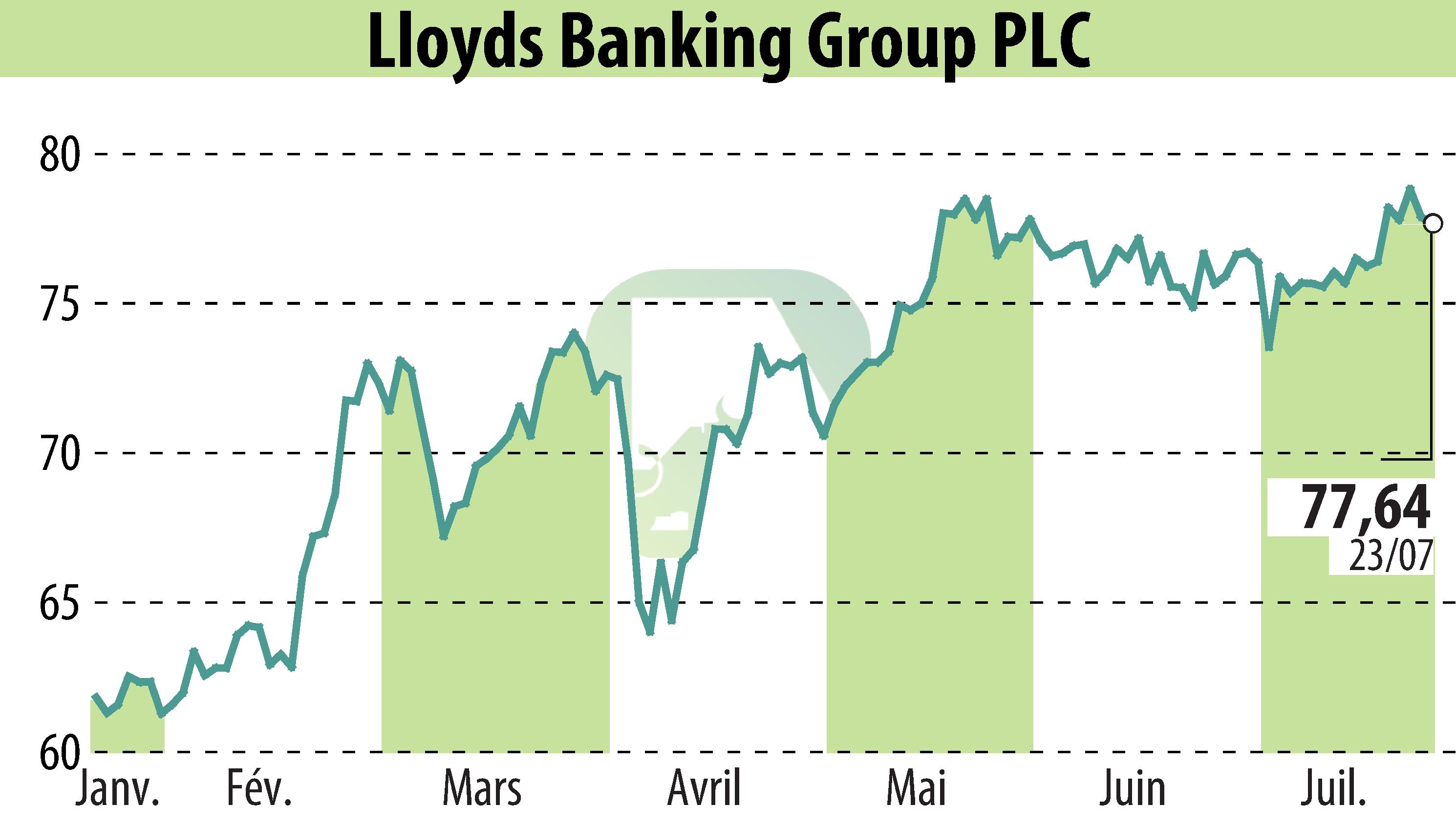

on Lloyds Banking Group (isin : GB0008706128)

Lloyds Banking Group Reports Strong 2025 Half-Year Results

Lloyds Banking Group has announced its half-year results for 2025, showing a sustained strength in financial performance driven by income growth and robust asset quality. The bank reported a 15% increase in interim ordinary dividend, reflecting strong capital generation.

The Group achieved a statutory profit after tax of £2.5 billion, with net income up 6% from the previous year. Underlying net interest income rose by 5% to £6.7 billion, attributed to a banking net interest margin of 3.04% and higher interest-earning assets.

The Group saw growth in both lending and deposits, with customer loans rising by £11.9 billion and deposits by £11.2 billion. Strategic initiatives generated over £1 billion in additional revenues, with expectations of reaching £1.5 billion by 2026.

Operating costs increased by 4% due to inflation and strategic investments. Despite this, asset quality remained robust with an impairment charge of £442 million. The bank reaffirmed its 2025 guidance and maintained its 2026 outlook.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Lloyds Banking Group news