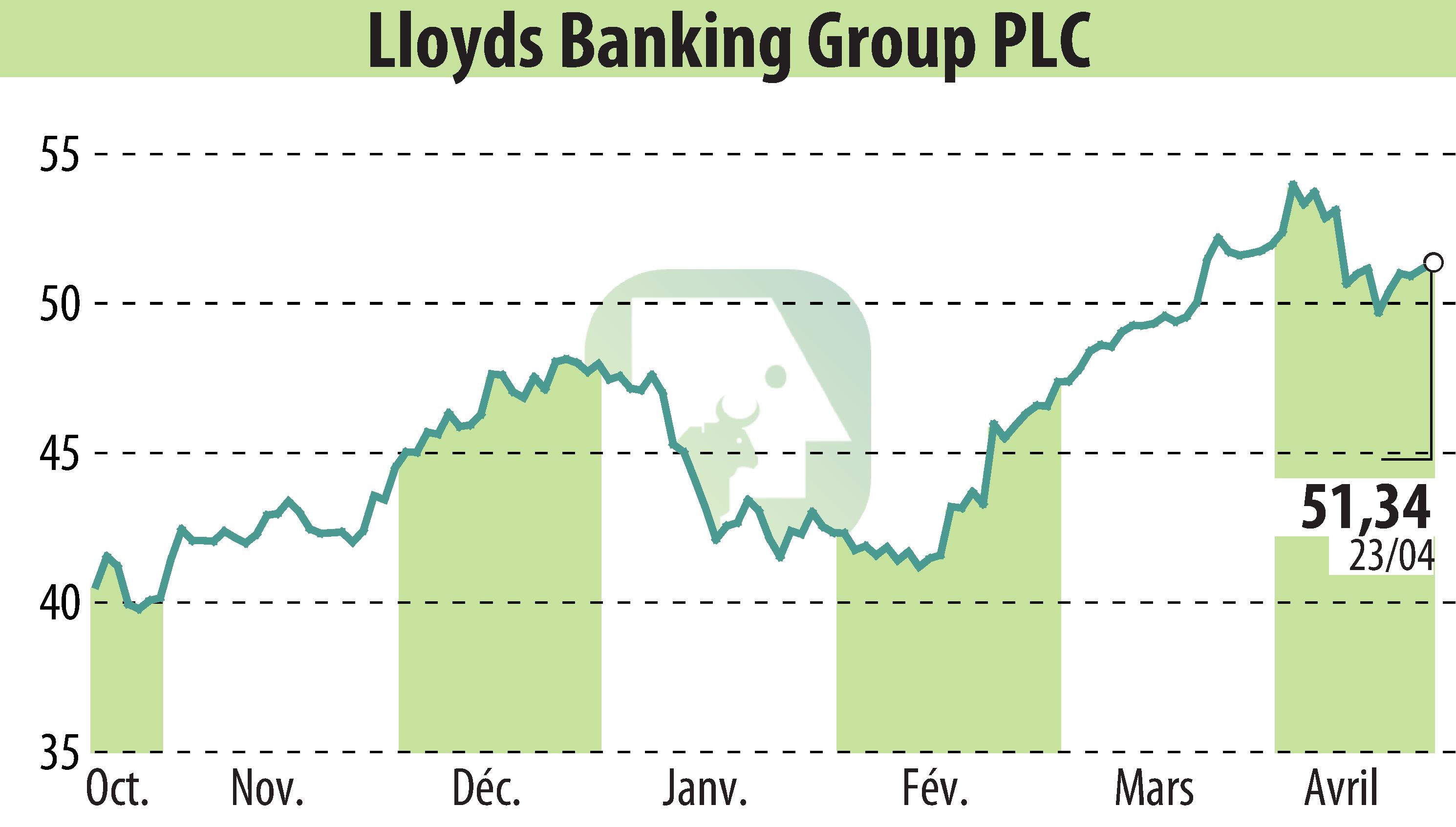

on Lloyds Banking Group (isin : GB0008706128)

Lloyds Banking Group Reports Q1 2024 Financial Results

Lloyds Banking Group PLC announced its financial results for the first quarter ending March 31, 2024. The group reported a statutory profit after tax of £1.2 billion, marking a decrease from £1.6 billion in the same period the previous year. The profit decline was tempered by a reduction in impairment charges, although net income fell by 9% year-on-year and operating costs rose by 11%.

Despite a decrease in underlying net interest income which dropped 10% to £3.2 billion, attributed to a lower banking net interest margin of 2.95%, the Group achieved a rise in other incomes by 7% at £1.3 billion, linked to recovery in customer activity. The capital position remains strong, with a CET1 ratio of 13.9%.

The Group confirmed its financial guidance for 2024, expecting a banking net interest margin of over 290 basis points and a return on tangible equity of around 13%. Lloyds also anticipates maintaining operating costs around £9.3 billion, notwithstanding additional expenses from regulatory charges.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Lloyds Banking Group news