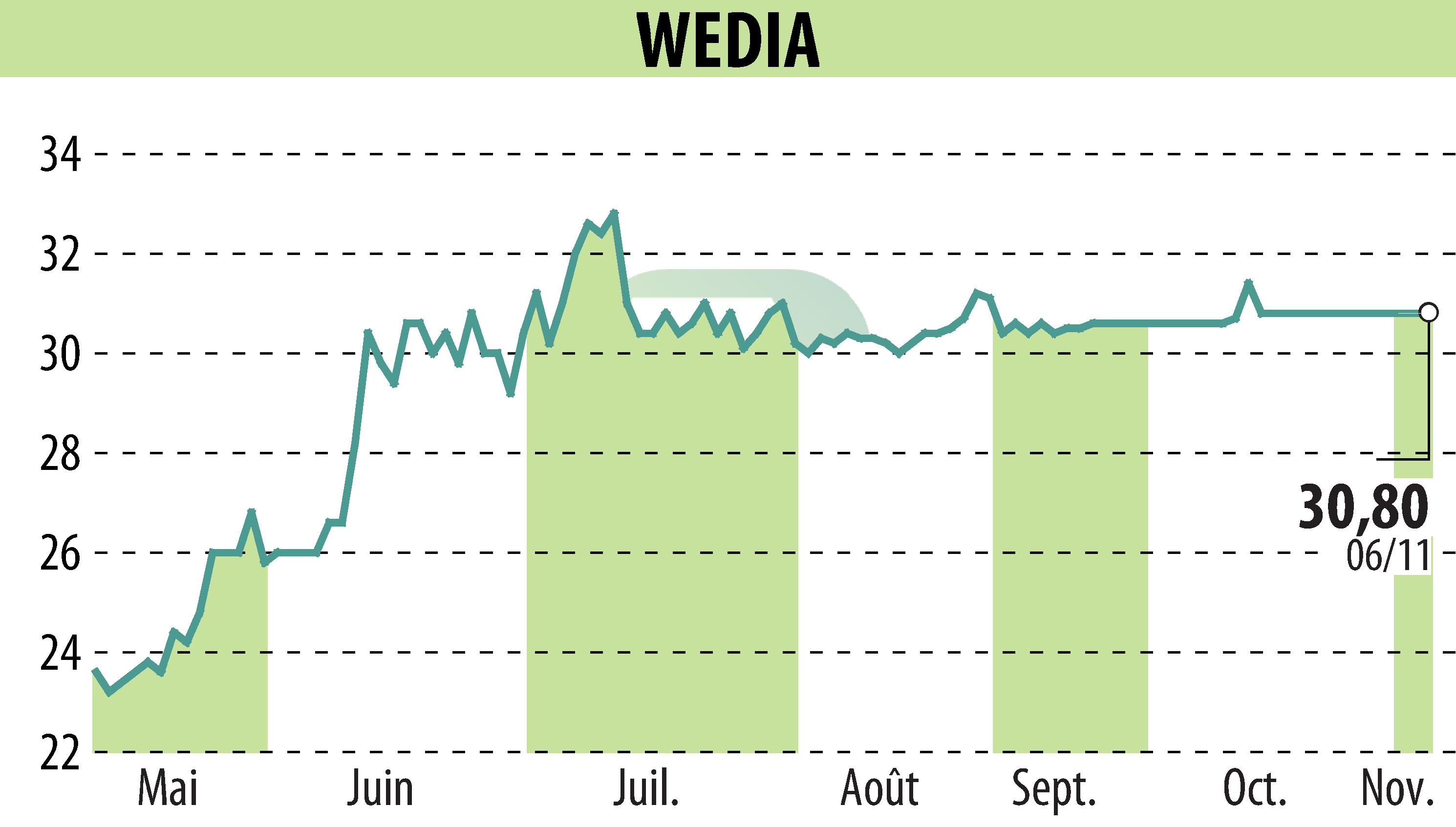

on WEDIA (EPA:ALWED)

Mandatory Withdrawal of Wedia Following the Takeover Bid of Mercure SAS

Mercure SAS launched a simplified public tender offer on Wedia, which ran from October 15 to November 6, 2024. The initiator now holds 98.14% of the voting rights. The mandatory delisting from the Euronext Growth market will take place on December 4, 2024. The planned compensation is 31.75 euros per Wedia share, net of all costs, for the 14,272 shares still held by minority shareholders. Bryan, Garnier & Co, representing Mercure, is handling the transaction. The funds will be available from CIC Market Solutions.

Shares not claimed after ten years will be transferred to the Caisse des Dépôts. The process complies with AMF regulations. The public notice was published in a legal announcements journal. The withdrawal schedule is published by Euronext. Legal and financial documents are available on the Wedia and AMF websites.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WEDIA news