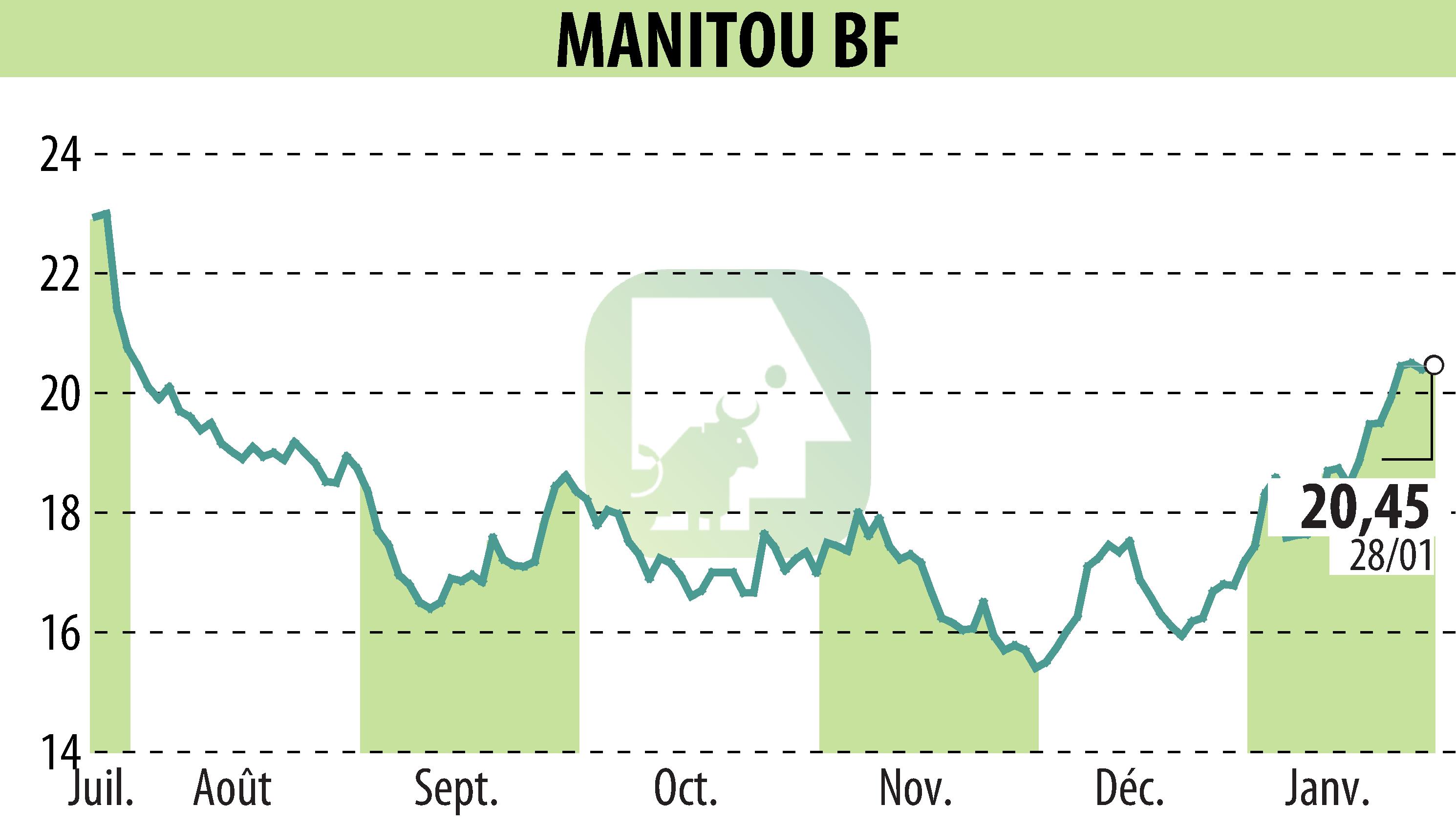

on MANITOU (EPA:MTU)

Manitou Announces Q4 2024 Revenue Decline

Manitou Group reported a significant decline in revenues for the fourth quarter of 2024, with sales dropping to €657 million, a 19% decrease compared to the same period in 2023. The year's cumulative sales also fell by 7% to €2,657 million. This decrease was notably pronounced in Northern Europe, including Germany and the Nordic countries.

Despite the downturn, the group observed an increase in order intake, surpassing last year's figures, indicating a partial market recovery. The order intake for Q4 2024 reached €532 million, up from €269 million in Q4 2023. However, the order book at the year's end reduced significantly to €1,083 million from €2,275 million the previous year.

The Product Division faced a sharper decline, with a 22% quarterly decrease, while the Services & Solutions Division remained relatively stable. Looking ahead, Manitou anticipates stable revenue for 2025, contingent on the broader economic and geopolitical landscapes.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MANITOU news