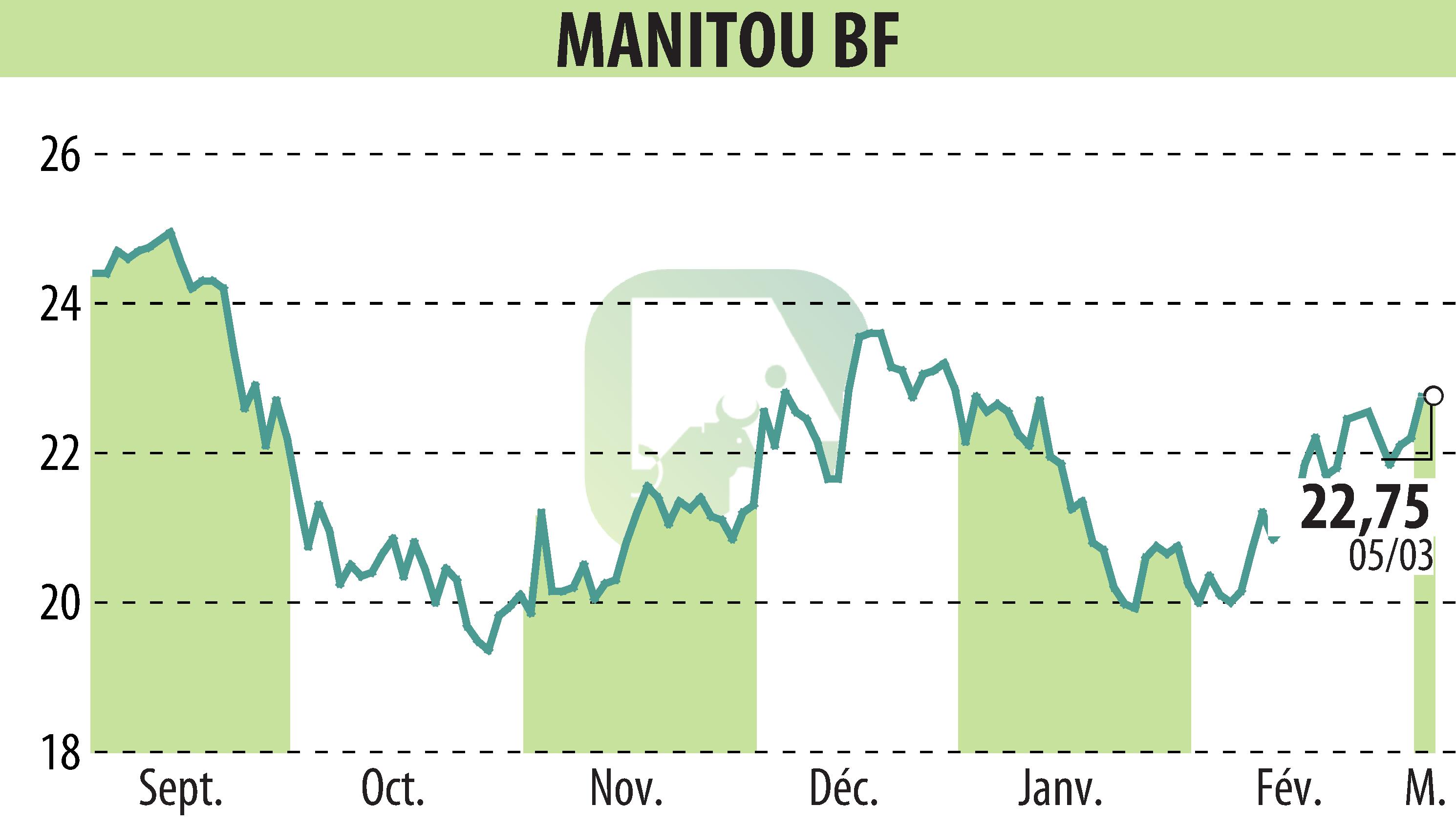

on MANITOU (EPA:MTU)

MANITOU Posts Record Financial Performance in 2023

MANITOU, the machinery manufacturer, announced a remarkable financial performance for 2023, marking a record year. The company reported net sales of €2,871 million, a 22% increase from the previous year. This growth is also reflected in the recurring operating income which reached €211.6 million, comparing favorably to €84.6 million in 2022. Additionally, net income saw a substantial rise, recording at €143.4 million up from €54.7 million in the preceding year.

The company's EBITDA also showed significant improvement, standing at €260 million, doubling the previous year's figure. Despite increased net debt, which was noted at €389 million, the financial outcomes demonstrate a year of strong commercial development and marked profitability growth.

Michel Denis, CEO, attributed 2023's success to strategic responses initiated in 2022 to counteract inflation and supply-chain tensions, yielding improved industrial efficiency. Furthermore, MANITOU foresees a stable revenue in 2024, albeit experiencing different market dynamics across regions. The expectation for recurring operating profit for 2024 is optimistically set to be over 6.5% of revenues.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MANITOU news