on Manz AG (isin : DE000A0JQ5U3)

Manz AG to Divest Battery Cell Production Equipment Business Amid Market Challenges

Manz AG announced its decision to sell its battery cell production equipment business with approval from its supervisory board. This move is a strategic response to changes in the European battery cell market, driven by the need for significant investment and a weak short- to medium-term market outlook. The transaction, expected in early 2025, includes manufacturing systems, individual machines, and around EUR 70 million in unchanged IPCEI funding until 2028.

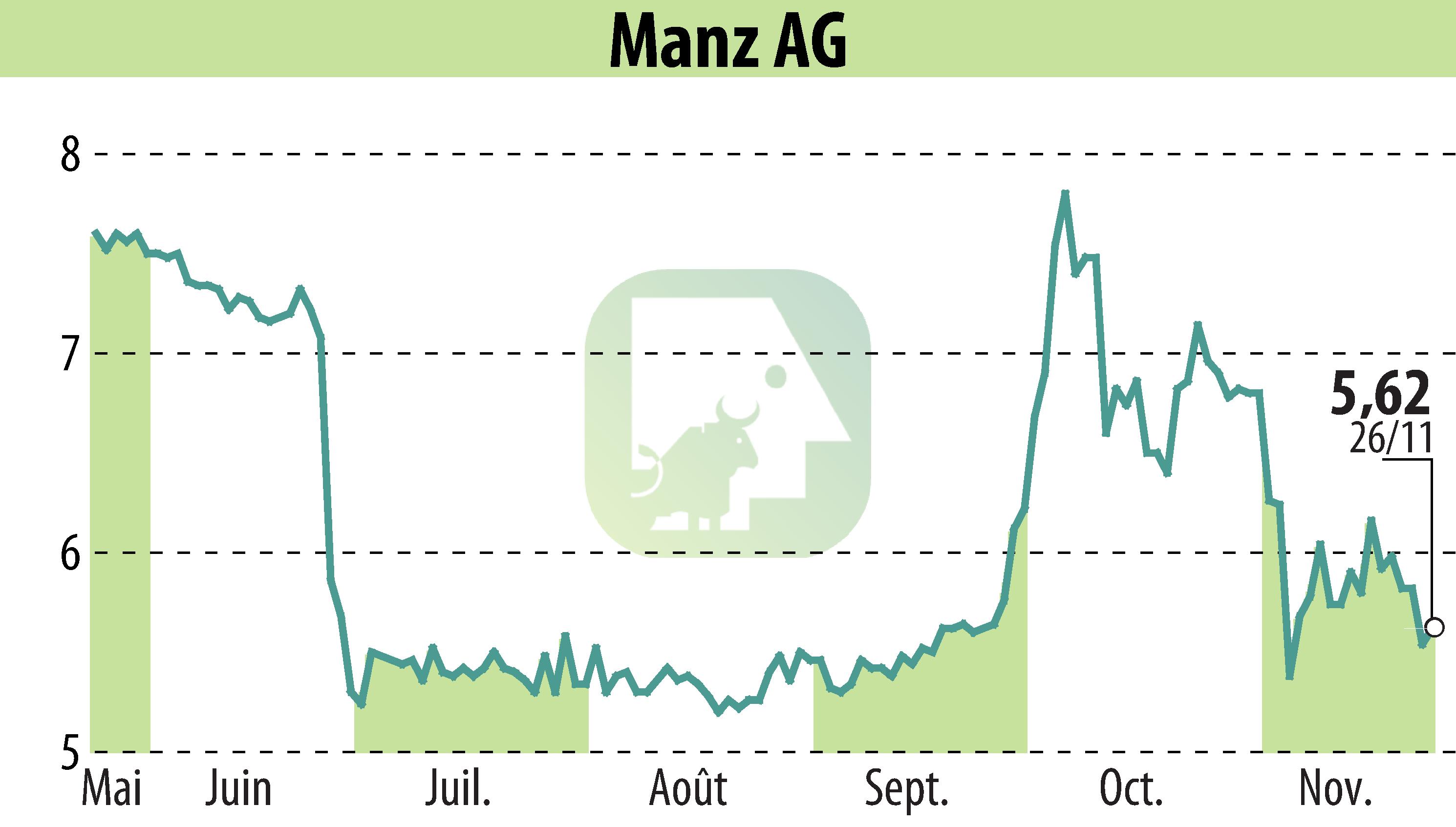

Confronted by declining demand and lower than anticipated order intake in 2024, Manz AG anticipates its fiscal year revenues between EUR 170-180 million, a significant decrease from EUR 249.2 million in 2023. EBITDA and EBIT are projected at EUR -20 to -25 million and EUR -30 to -35 million, respectively, excluding one-off impairment losses. The company's revenue for the first nine months of 2024 was EUR 133.7 million, with significant declines in earnings attributed to its Mobility & Battery Solutions segment.

Additionally, the Management Board is extending its efficiency program announced in July 2024, aiming for cost savings through personnel reductions, expense cuts, and process optimizations in the coming years.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Manz AG news