on MBB Industries AG (ETR:MBB)

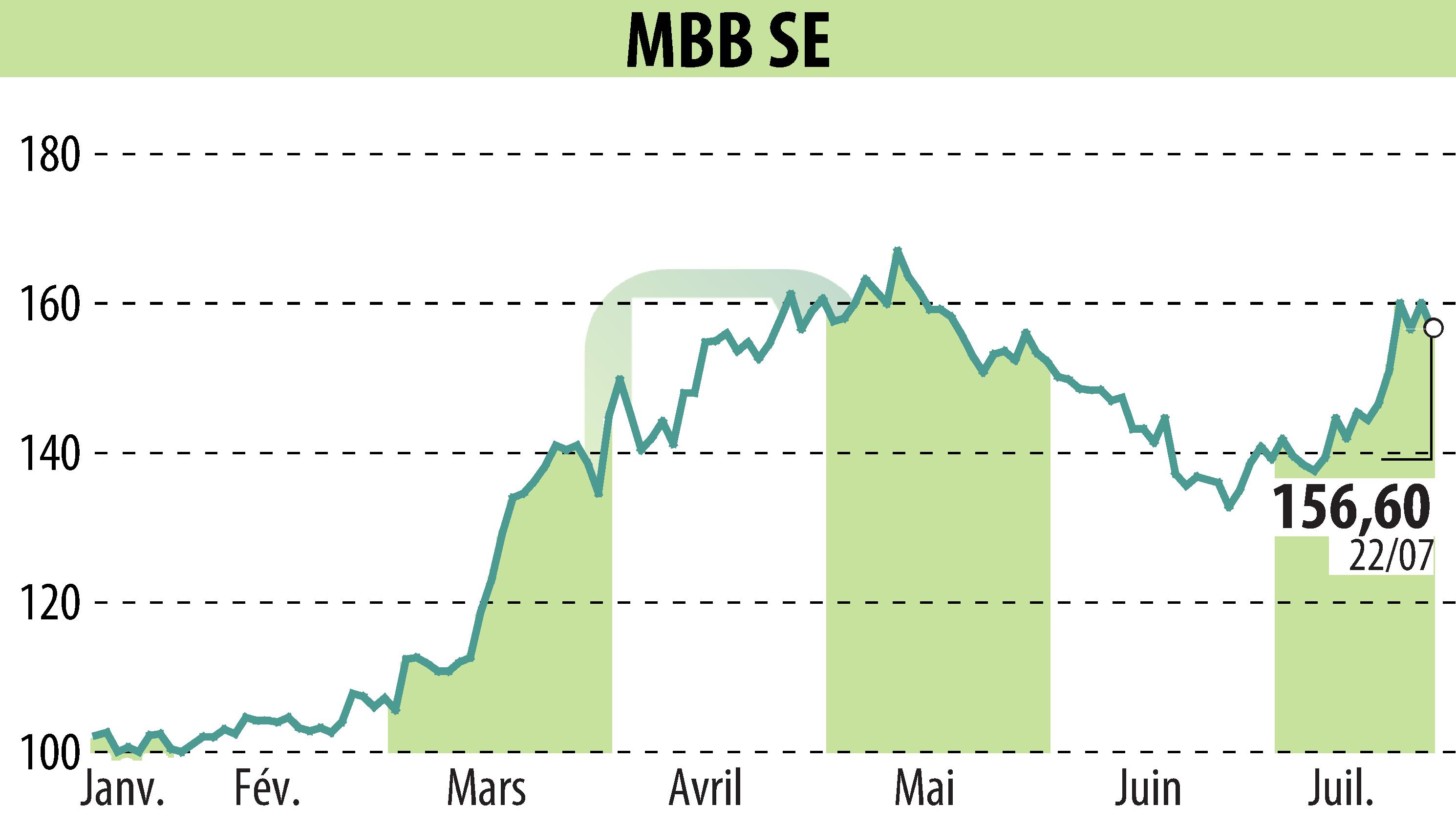

MBB SE Receives "Buy" Rating Following Strong Half-Year Performance

MBB SE has been classified as a "Buy" by Quirin Privatbank's Kapitalmarktgeschäft, as per their latest research update. The recent figures for the first half of 2025 exhibit strong performance, prompting an increase in the fiscal year guidance. MBB SE reported a 16.8% revenue increase, reaching EUR 545.5 million, and an adjusted EBITDA surge of 36.8% to EUR 76.4 million, enhancing the EBITDA margin to 14.1%.

The second quarter alone saw an impressive 40.3% growth in adjusted EBITDA, driven by subsidiaries Friedrich Vorwerk and DTS. Friedrich Vorwerk, in particular, doubled its EBITDA to EUR 54.5 million with a revenue rise of 56% to EUR 303 million. Accordingly, Friedrich Vorwerk has adjusted its revenue and EBITDA margin forecasts upwards, anticipating revenues between EUR 610-650 million.

Concluding the second quarter, MBB SE's net liquidity stood at EUR 457.4 million, with the holding company accounting for EUR 292.0 million. The research concludes with a revised target price of EUR 246.50, a reflection of Friedrich Vorwerk's stock performance. MBB's revenue forecast for the year positions the company at the upper end of its EUR 1.0 to EUR 1.1 billion range with an EBITDA margin expectation between 11% and 14%.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MBB Industries AG news