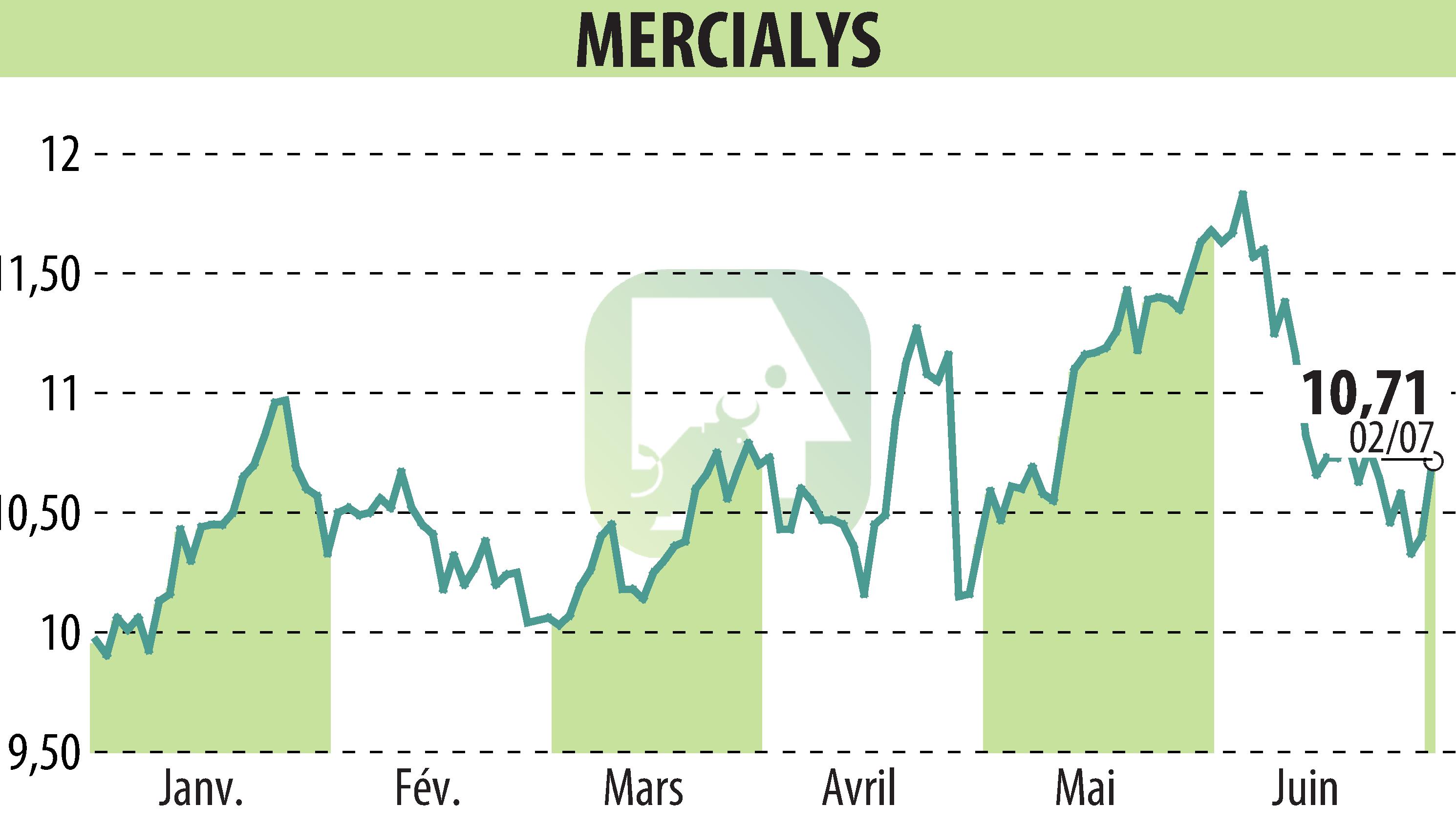

on MERCIALYS (EPA:MERY)

Mercialys sells 4 hypermarkets for €117.5 million

Mercialys announced the sale of 4 hypermarkets for €117.5 million to a club deal made up of Foncière Magellan, MTV Capital and Ciméa Patrimoine. These assets were 51% held by Mercialys, the remainder belonging to BNP Paribas REIM France. The operation also includes the transfer of two accessory lots in full ownership.

This transaction will make it possible to improve the debt ratio (Loan To Value) which would increase to 38.3%, compared to 38.9% at the end of 2023. It is part of Mercialys' asset rotation strategy and allows to anticipate the transition of five Casino stores in Corsica under the Auchan brand.

Post-sale, Mercialys' food exposure will be distributed as follows: Intermarché at 5.3%, Auchan at 5.0%, Carrefour at 2.0%, Monoprix at 1.6%, Casino#HyperFrais at 1.1 %, Aldi at 0.2% and Lidl at 0.1%. The transaction strengthens Mercialys' financial situation, giving it the means to pursue its growth strategy.

In this transaction, Mercialys and BNP Paribas REIM France were advised by JLL and the Wargny Katz study, while Bretlim Fortuny and the Office du Dôme study assisted the buyer.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MERCIALYS news