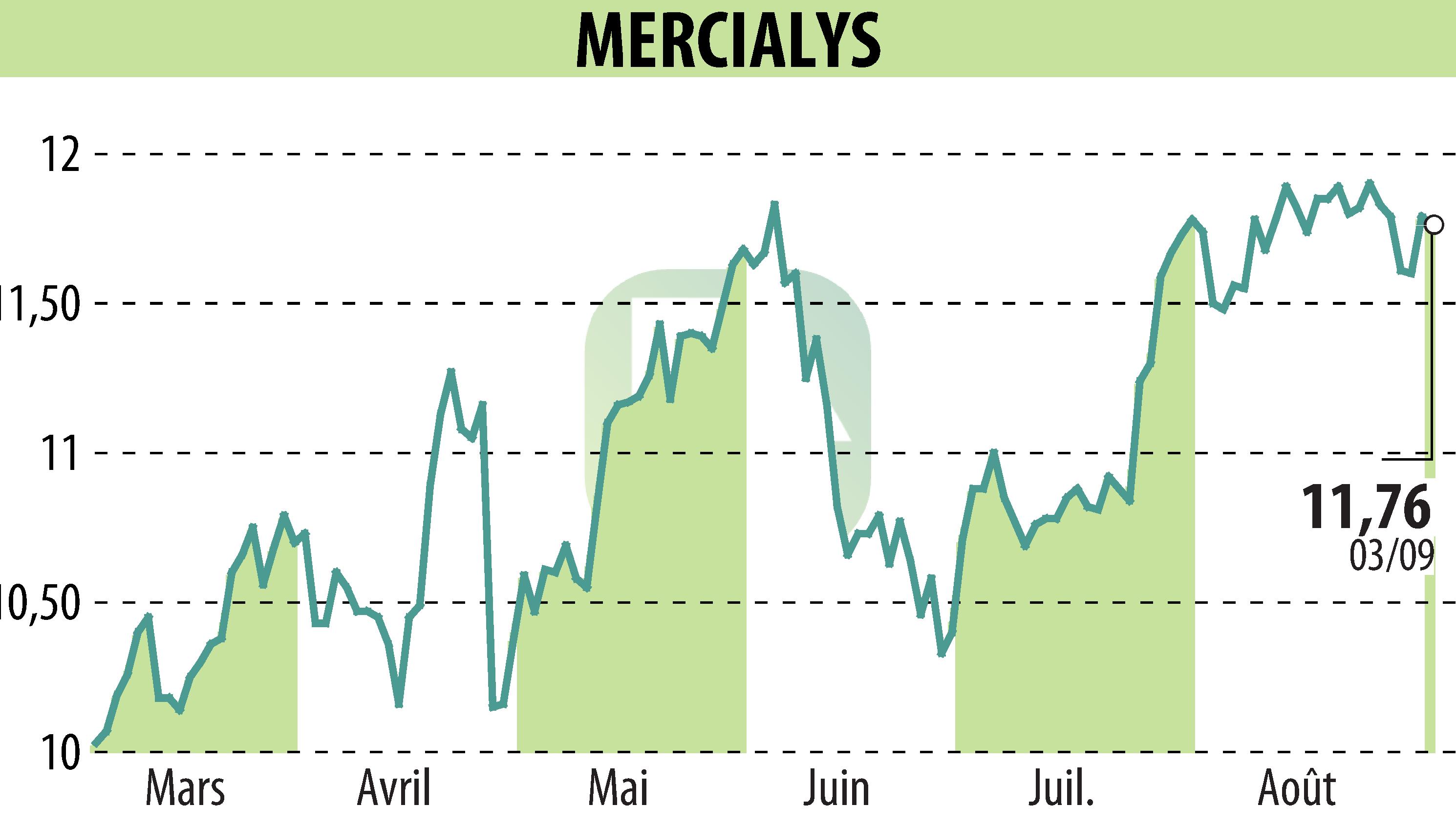

on MERCIALYS (EPA:MERY)

Mercialys Successfully Issues €300 Million Bond with 7-Year Maturity

Mercialys, a leading French REIT focused on accessible retail, has successfully placed a €300 million bond with a 7-year maturity and a 4.0% coupon. The bond, issued with a 165 basis points spread, saw significant investor interest, being 7.3 times oversubscribed.

The proceeds will support Mercialys' general needs and allow the company to exercise its make-whole call option for early redemption of a €200 million bond maturing in July 2027 with a 4.625% coupon. These moves are expected to extend the average maturity of Mercialys' debt and strengthen liquidity, which stood at 3.3 years as of June 2024.

Mercialys holds a BBB rating with a stable outlook from Standard & Poor's. The issue was coordinated by BNP Paribas and Crédit Agricole CIB, with CIC, La Banque Postale, Natixis, and Société Générale also acting as bookrunners.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MERCIALYS news