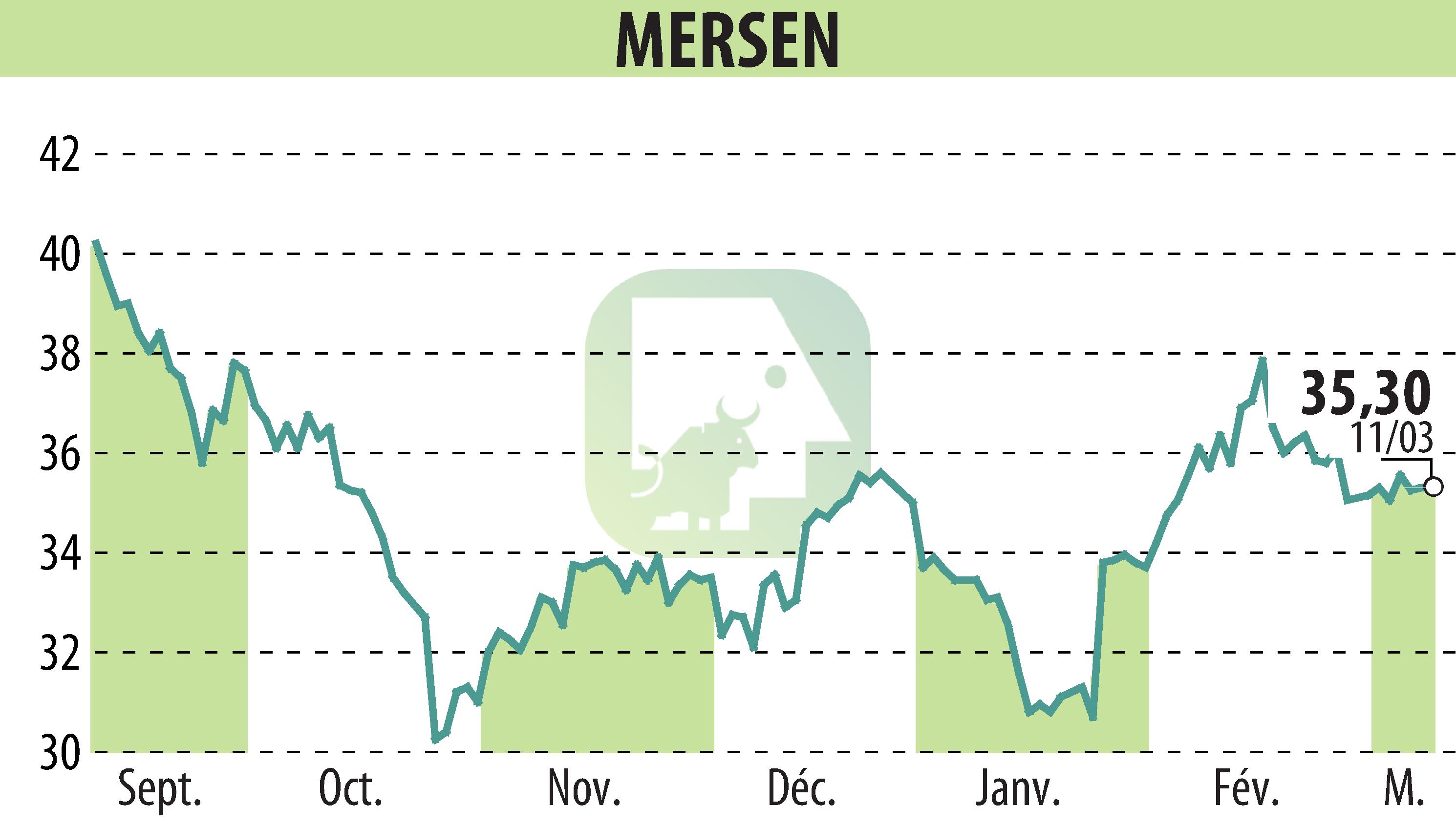

on MERSEN (EPA:MRN)

Mersen Reports Strong Growth in 2023, Exceeding Financial Targets

Mersen, a global leader in electrical power and advanced materials, reported a significant growth for the year ending December 31, 2023. The company recorded an organic sales growth of 13%, with an operating cash flow increase and a 20% rise in net income attributable to Mersen shareholders, reaching €82 million. The Return on Capital Employed (ROCE) also saw an uptick to 13.0% from 12.5% in the previous year, alongside a solid financial structure with a leverage of 1.09x.

CEO Luc Themelin highlighted the achievement of surpassing the year’s objectives in sales and operating margin, attributing the success to the momentum in growth markets, notably the SiC semiconductor and electric vehicle sectors. The company also made strides in its non-financial performance, reducing CO2 emissions intensity by 26% from 2022 and increasing the proportion of women in engineering and managerial positions to over 26%. Furthermore, 75% of Mersen's sales were within the new EU Green Taxonomy eligibility.

For 2024, Mersen sets its sight on attaining around 5% organic sales growth with an operating margin before non-recurring items of approximately 11%. This ambition is supported by a significant capital expenditure plan focused on growth initiatives while maintaining cost discipline. Themelin expressed gratitude towards the employees for their dedication and is confident in their ability to continue on the company's strategic path.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MERSEN news