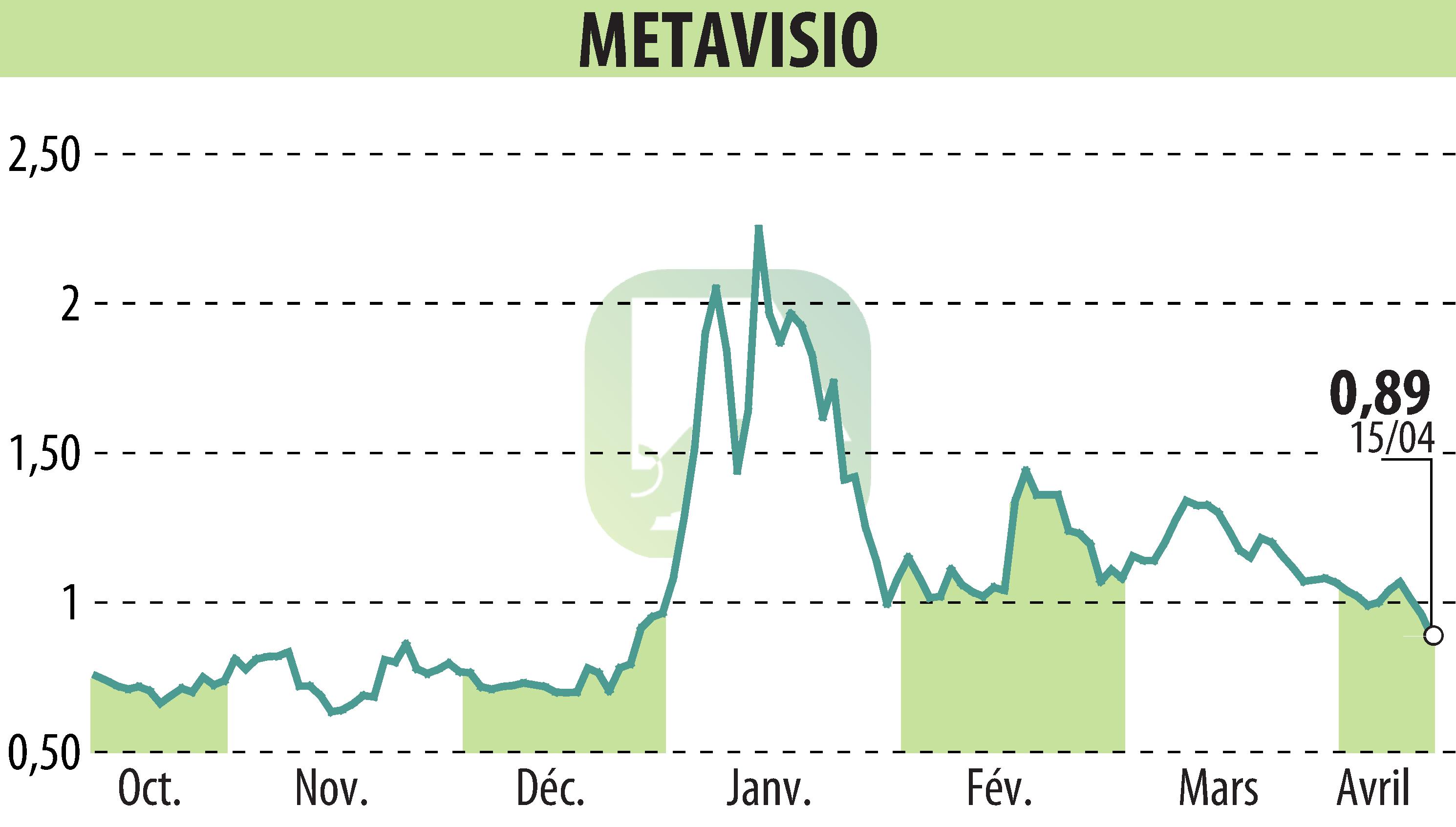

on METAVISIO (EPA:ALTHO)

METAVISIO-THOMSON Computing announces a 45% reduction in its convertible debt

METAVISIO-THOMSON Computing, a French player in the IT sector, has managed to reduce its convertible debt by 45%, bringing it to 3.9 million euros as of April 16, 2024. This reduction, compared to the debt of 7 .09 million euros recorded at the end of 2022, marks an important pivot in its financial consolidation strategy. This operation also reduces the dilutive risk for the company.

This reimbursement is a strategic approach designed to strengthen the financial bases of the group and guarantee sustainable growth. By reducing its debt burden, METAVISIO-THOMSON Computing improves its flexibility and reduces its exposure to market fluctuations, which is crucial in the current economic context.

The reduction in debt has a positive impact on financial charges and marks a move towards an optimized capital structure. This revised financial strategy should allow the company to increase its turnover, with a goal of exceeding 100 million euros. It also reinforces the company's commitment to its shareholders and illustrates its ability to manage its financial commitments while aiming for expansion.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all METAVISIO news